Subscribe to the Nsight Blog

All Topics

Risk & Compliance

Product Insight

Banks

Lending Compliance

Credit Unions

Risk Management

Fair Lending

Nfairlending

Cluster: Risk Management

Compliance

Lending Compliance Management

Integrated Risk Blog

Nrisk

Regulatory Compliance Management

News & Updates

HMDA

Risk

Mortgage Lenders

Ncomply

Vendor Management

Business Resiliency

CRA

Lending Compliance Blog

Vendor

CFPB

Ncontinuity

Third-Party Vendor Management

Business Continuity

Cybersecurity

Fintech

NVendor

Strategic Planning

Ncyber

Ntransmittal

Audits & Findings

Company Culture

OCC

Regulatory Updates

Audit

Nverify

Regulatory Compliance

Exams

FDIC

Compliance Management

Findings

Nfindings

NCUA

Contract Management

Employee Intranet

Contract

FRB

Business Continuity Management

FFIEC

Findings Management

Ncontracts manager

Third-Party Vendors

Vendor Risk

Enterprise Risk Management

ABA Bank

Access Control

Audit Findings

Board Portal

Call Report

Due Diligence

Efficiency

Employee Engagement

Exam findings

FIEC

Inc. 5000

Internal Audit Management

Nboardportal

Verify

Wealth Management

As the Vice Chairman for Banking Supervision, Randal Quarles is an important voice for the Federal Reserve System and the banking industry. He has served on the Board since 2017, when he was appointed by President Trump.

As the Vice Chairman for Banking Supervision, Randal Quarles is an important voice for the Federal Reserve System and the banking industry. He has served on the Board since 2017, when he was appointed by President Trump. Another Federal Reserve Board member, Lael Brainard was appointed to the Board in 2014 by then-President Obama. She has had a long career in politics, serving since the mid-90s, always with a focus on finance.

Another Federal Reserve Board member, Lael Brainard was appointed to the Board in 2014 by then-President Obama. She has had a long career in politics, serving since the mid-90s, always with a focus on finance. Joseph Otting was appointed by President Trump and became the Comptroller of the Currency of the OCC in late 2017. Before joining the OCC, he had a long career leading banks. Most recently, he was the President of CIT Bank. As a former banker, he has made it very clear that he is a supporter of banks and understands the challenges faced.

Joseph Otting was appointed by President Trump and became the Comptroller of the Currency of the OCC in late 2017. Before joining the OCC, he had a long career leading banks. Most recently, he was the President of CIT Bank. As a former banker, he has made it very clear that he is a supporter of banks and understands the challenges faced. Another OCC leader, Grovetta Gardineer became the Senior Deputy Comptroller for Compliance and Community Affairs in 2016. She is also a

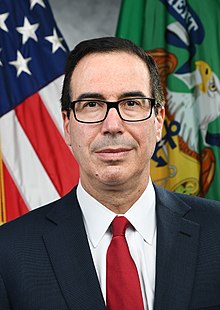

Another OCC leader, Grovetta Gardineer became the Senior Deputy Comptroller for Compliance and Community Affairs in 2016. She is also a  Steve Mnuchin is a former investment banker who was appointed by President Trump to be the Secretary of the Treasury in 2017. He is seen to be pro-corporation, as his policy initiatives have been primarily focused on tax reform and reducing the corporate tax rate. However, he is also involved in the CRA discussions.

Steve Mnuchin is a former investment banker who was appointed by President Trump to be the Secretary of the Treasury in 2017. He is seen to be pro-corporation, as his policy initiatives have been primarily focused on tax reform and reducing the corporate tax rate. However, he is also involved in the CRA discussions. Amid some controversy, Mick Mulvaney became the Acting Director of the CFPB in 2017. He is also currently serving as the Director of the Office of Management and Budget.

Amid some controversy, Mick Mulvaney became the Acting Director of the CFPB in 2017. He is also currently serving as the Director of the Office of Management and Budget.  Kathleen Kraninger is currently serving as an official in the Office of Management and Budget (OMB), overseeing budgets for seven departments including the Department of Housing and Urban Development, Department of Homeland Security, and Department of Justice. Kraninger was recently nominated to be the new Director of the CFPB by President Trump. Since her nomination, some controversy is swirling due to her potential involvement in the decision to implement the zero-tolerance policy at the border that split children from their parents.

Kathleen Kraninger is currently serving as an official in the Office of Management and Budget (OMB), overseeing budgets for seven departments including the Department of Housing and Urban Development, Department of Homeland Security, and Department of Justice. Kraninger was recently nominated to be the new Director of the CFPB by President Trump. Since her nomination, some controversy is swirling due to her potential involvement in the decision to implement the zero-tolerance policy at the border that split children from their parents. Rob Nichols is the President and CEO of the American Bankers Association (ABA), and one of the leading supporters of American bankers to Congress. He has served in this role at the ABA since 2015, and is seen as one of the most influential banking lobbyists in the country.

Rob Nichols is the President and CEO of the American Bankers Association (ABA), and one of the leading supporters of American bankers to Congress. He has served in this role at the ABA since 2015, and is seen as one of the most influential banking lobbyists in the country. There are plenty of excellent journalists who could have been included on this list, but in terms of recent impact,

There are plenty of excellent journalists who could have been included on this list, but in terms of recent impact,