Risk and Compliance Management Software for Banks

Built for banks, Ncontracts connects enterprise risk, compliance, vendor oversight, business continuity ¾ and more ¾ in one platform. Gain visibility across products and departments, simplify processes, and stay ahead of risk with tools that make your bank smarter and more resilient.

Financial Risk Management Solutions — by Bankers, for Bankers

Navigate shifting markets, emerging tech, and evolving regulations with ease. Ncontracts risk management software for banking offers tools that work together to empower banks to make faster, smarter, risk-based decisions.

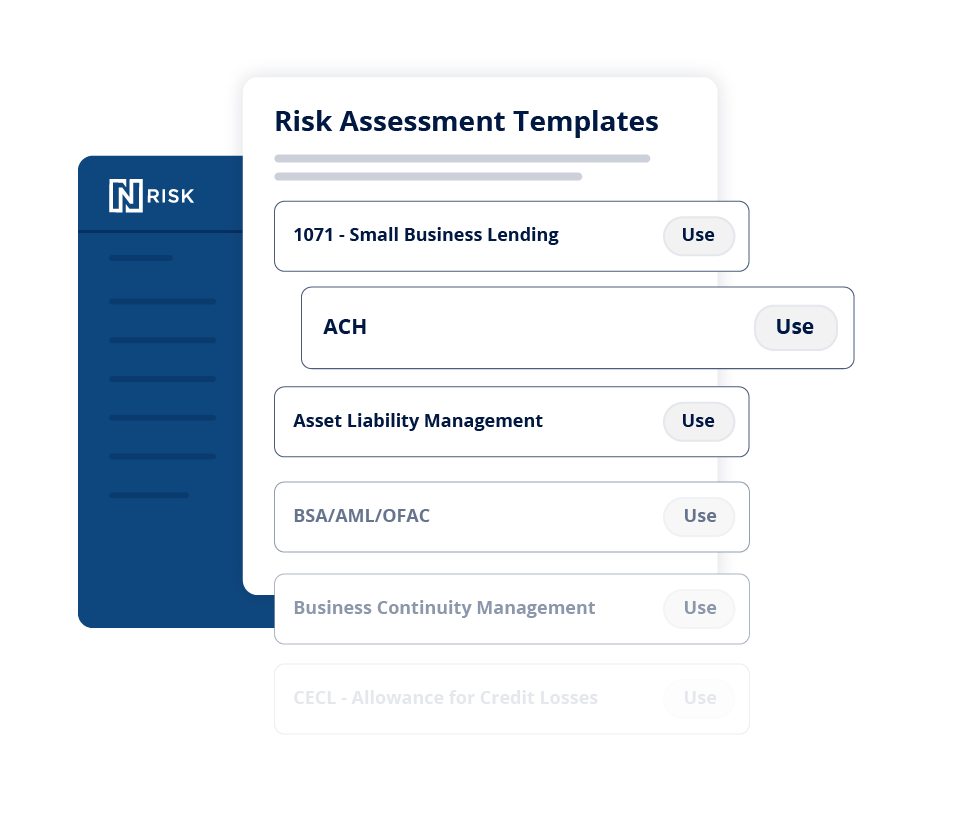

Get a real-time, bank-wide view of risk

Ready to ditch fragmented reports and manual processes? Move beyond siloed risk management with scalable cloud-based enterprise risk management software for banks. Gain a holistic view of risk with real-time insights and expert-built controls. Collaborate across departments with customizable risk assessments, ratings, and reports. Proactively manage and mitigate risk to keep your bank aligned, agile, and ready for what’s next.

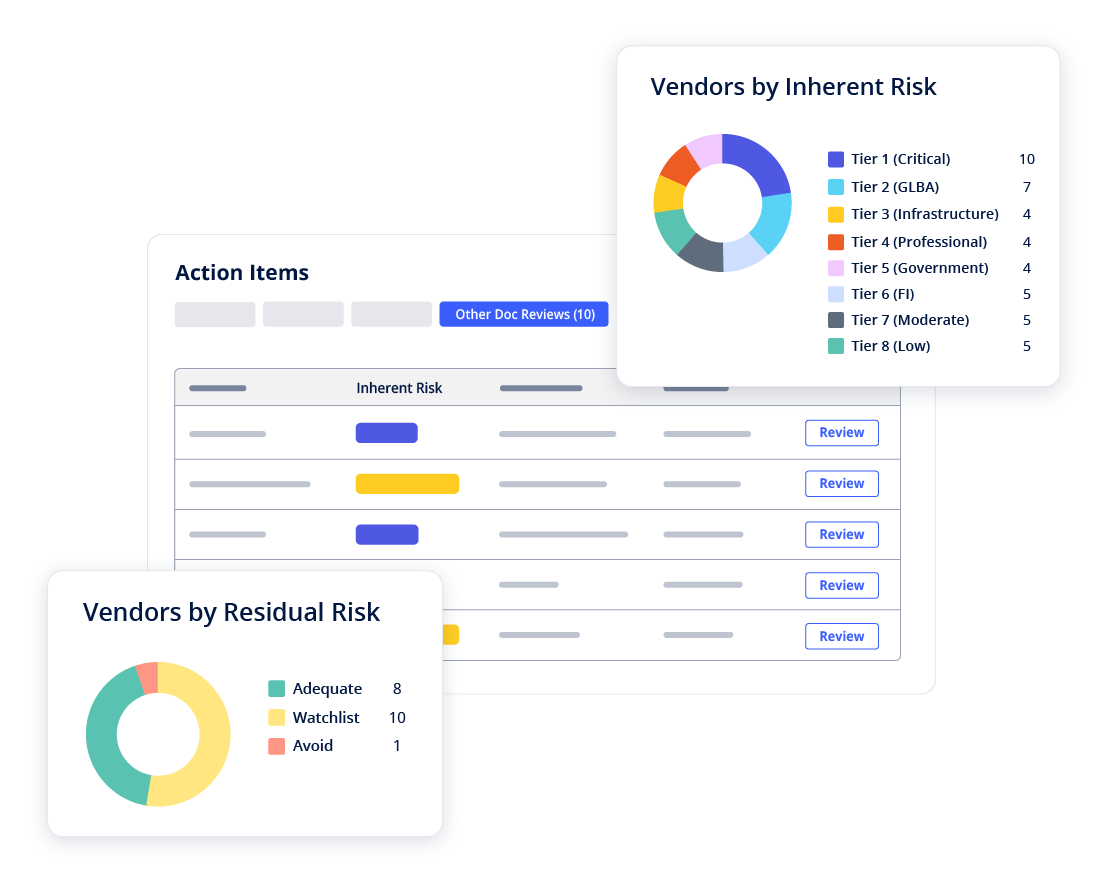

Manage third-party risk with confidence

Does your TPRM team need support? Centralize vendor data, automate due diligence processes, create customized vendor risk assessments, and manage contracts in one comprehensive third-party risk management solution. Easily track compliance, operational, cyber, and financial risks — and reduce internal workload with vendor services that analyze due diligence documents and support risk reviews — across all your bank’s third-party providers.

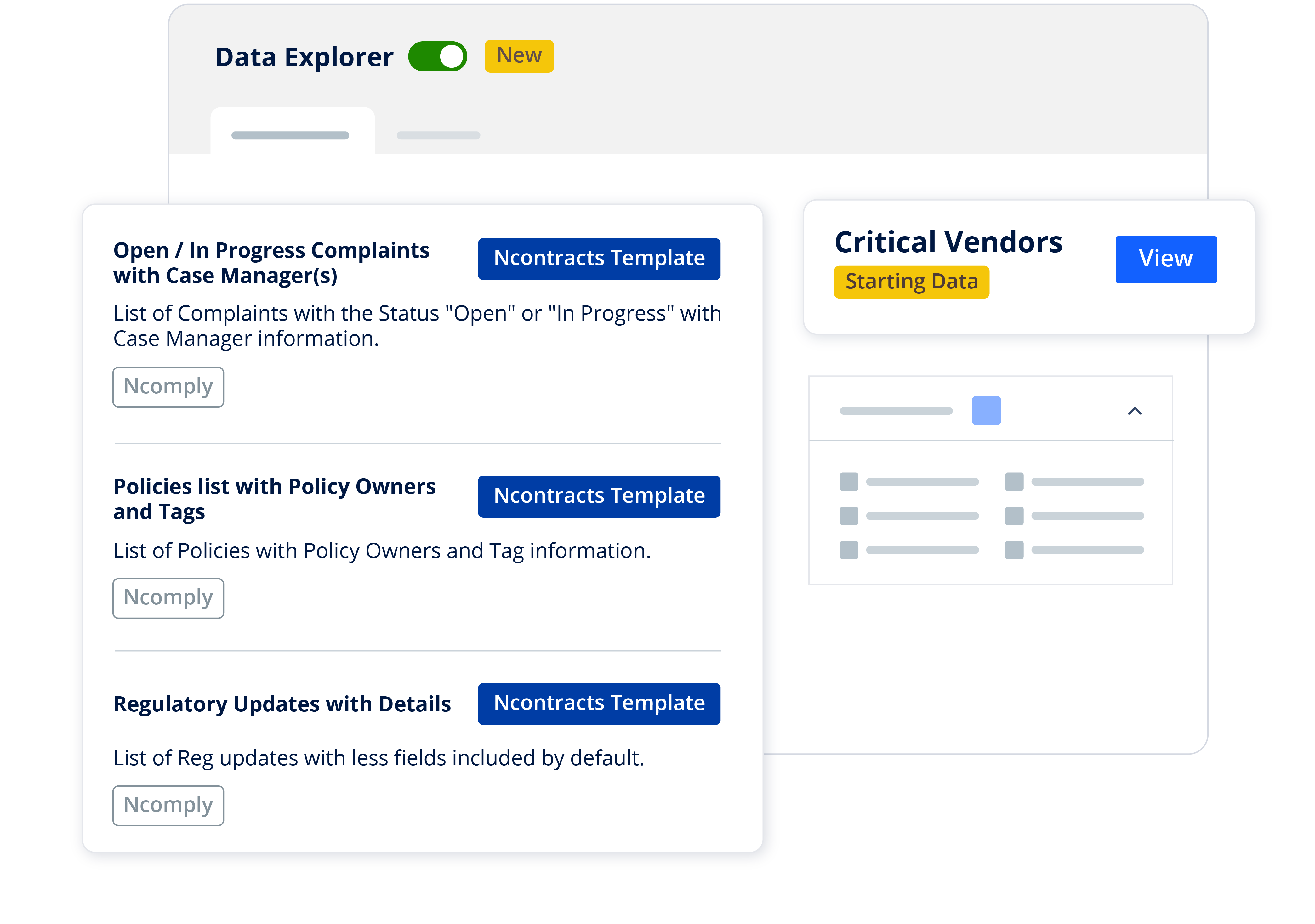

Simplify regulatory compliance

Struggling to keep up with complex and ever-evolving banking requirements? Stay exam-ready with a banking compliance software that takes the guesswork out of compliance. Empower your team to stay proactive with automated tools that manage policies, track complaints, and create examiner-ready reports — all in one platform. Access plain English explanations of state and federal banking regulations. Daily library updates aligned with your bank’s profile ensure you never miss relevant changes. Save time and reduce risk throughout your bank.

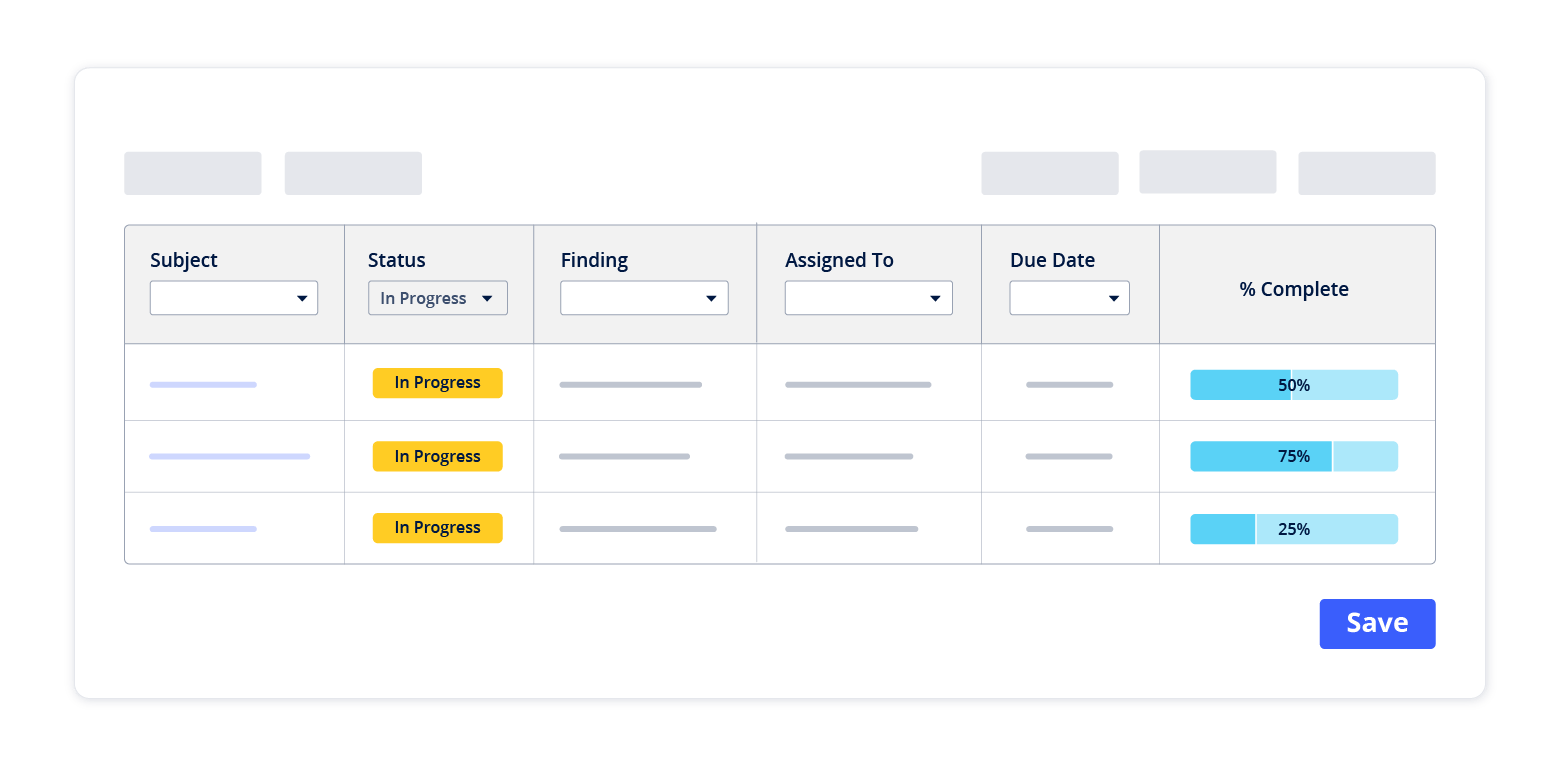

Track and address findings — fast

Ready to transform how you manage audit, exam and other findings? Confidently track, resolve, and document issues from internal audits, compliance reviews, and regulatory exams — all in one centralized platform. Gain real-time visibility into findings, automate task reminders, prioritize remediation, and maintain a complete audit trail. Go from issue to exam-ready reporting with tools that ensure nothing slips through the cracks.

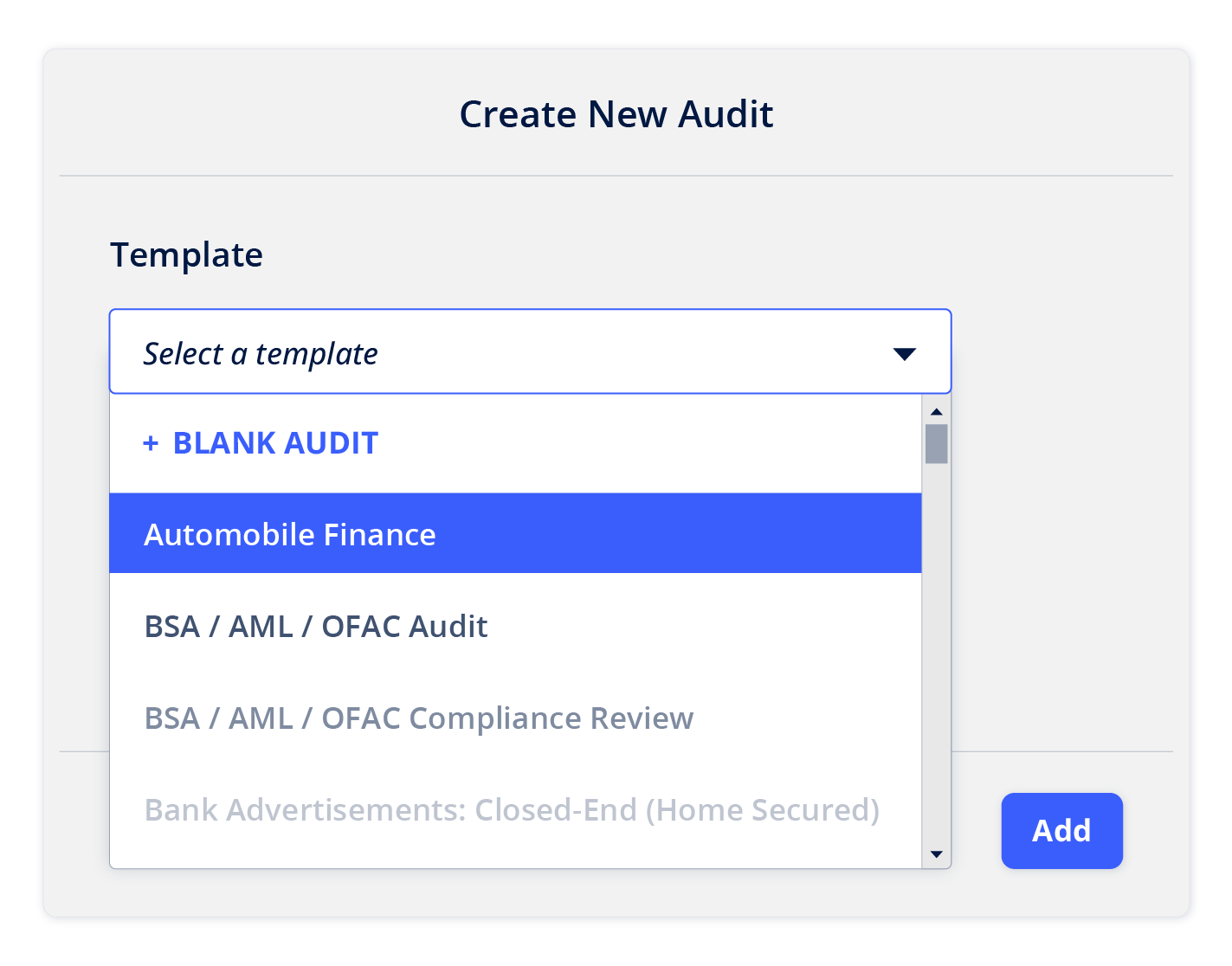

Improve productivity with advanced auditing

Is your bank maximizing your internal audit processes? Reduce your team’s manual efforts by consolidating audit planning, execution, and reporting in a single system. Customize audit templates, automate workflows, and integrate exam and audit findings management for holistic risk tracking and remediation. Discover operational redundancies and areas for improvement for a smoother, faster auditing process.

Integrated risk management solution built and maintained by former bank examiners, CROs, compliance officers, regulatory attorneys and other experienced bank staff.

Build a Better Team with Risk Management Software for Banks

Get all the financial risk management solutions you need under one roof. Spend less time managing risk and focus more on setting strategy with automated tools built for your bank’s needs — today and as you grow.

Customer Success Stories

“When we saw Nvendor and Ncontracts’ focus on banking regulation we were excited. The products were built specifically to meet regulatory guidelines and ease the burden we face as banking professionals.”

Lisa Maxwell

Vice President, Information Security/Vendor Manager, United Bank

“I was very surprised when I started working with Ncontracts about how quickly the support people called you back and emailed you back. I usually don’t have to wait more than a day before the solution is taken care of.”

Beth Seals

Enterprise Risk Manager, Bankers’ Bank of Kansas

“Having Ncontracts’ solutions has also been a big catalyst for us developing that program further.”

Sandy Swensen

Director of Teller Operations, First Dakota National Bank

Industry Insights and Expertise

Learn directly from our subject matter experts, who bring decades of combined experience in banking, compliance, and risk management. From regulatory updates to industry trends and product news—we’ve got it covered.

-2.jpg)

What Are Commercial Lending Regulations and Why Do They Matter in 2026?

.png)

How to Run a Successful BCP Tabletop Test: Exercises, Examples and Top Tips

.webp?width=1200&height=627&name=Bankers%20Bank%20of%20Kansas%20(1).webp)