Trusted by thousands of financial institutions to simplify lending compliance

Fair Lending Regression Analysis Made Simple

Fair lending exams hinge on the numbers — but running complex statistical tests shouldn’t require a data scientist. Identify disparities, get action plans, defend your decisions, and stay ahead of examiner questions with automated, AI-powered regression analysis.

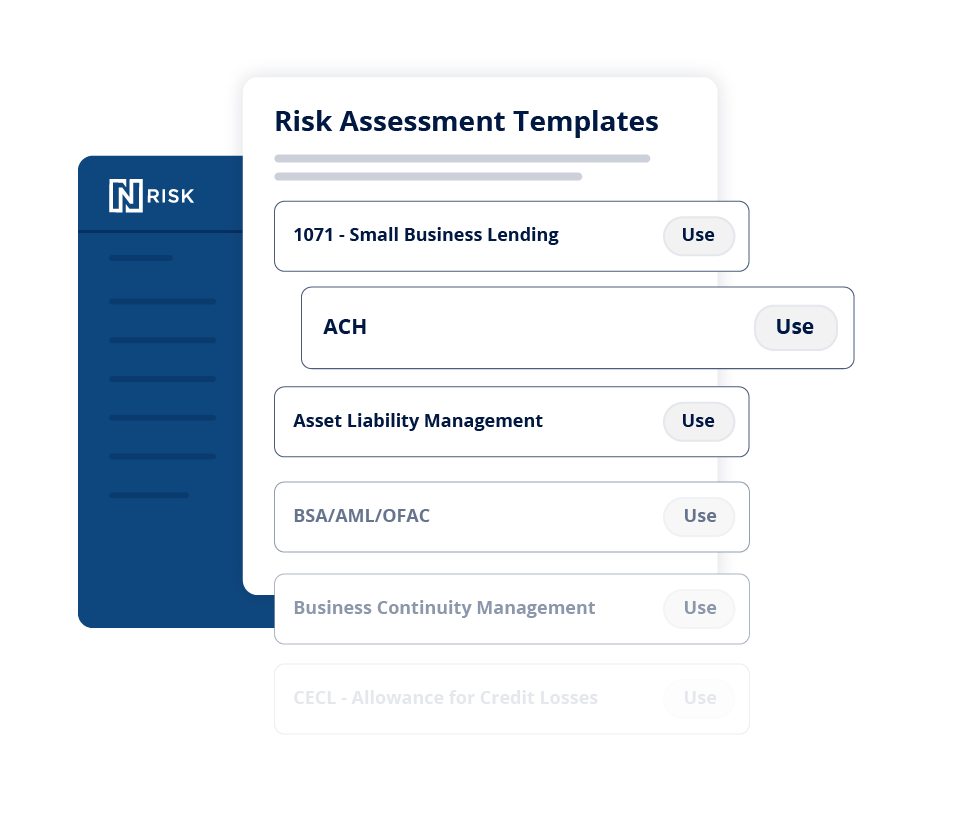

Get a real-time, bank-wide view of risk

Ready to ditch fragmented reports and manual processes? Move beyond siloed risk management with scalable cloud-based enterprise risk management software for banks. Gain a holistic view of risk with real-time insights and expert-built controls. Collaborate across departments with customizable risk assessments, ratings, and reports. Proactively manage and mitigate risk to keep your bank aligned, agile, and ready for what’s next.

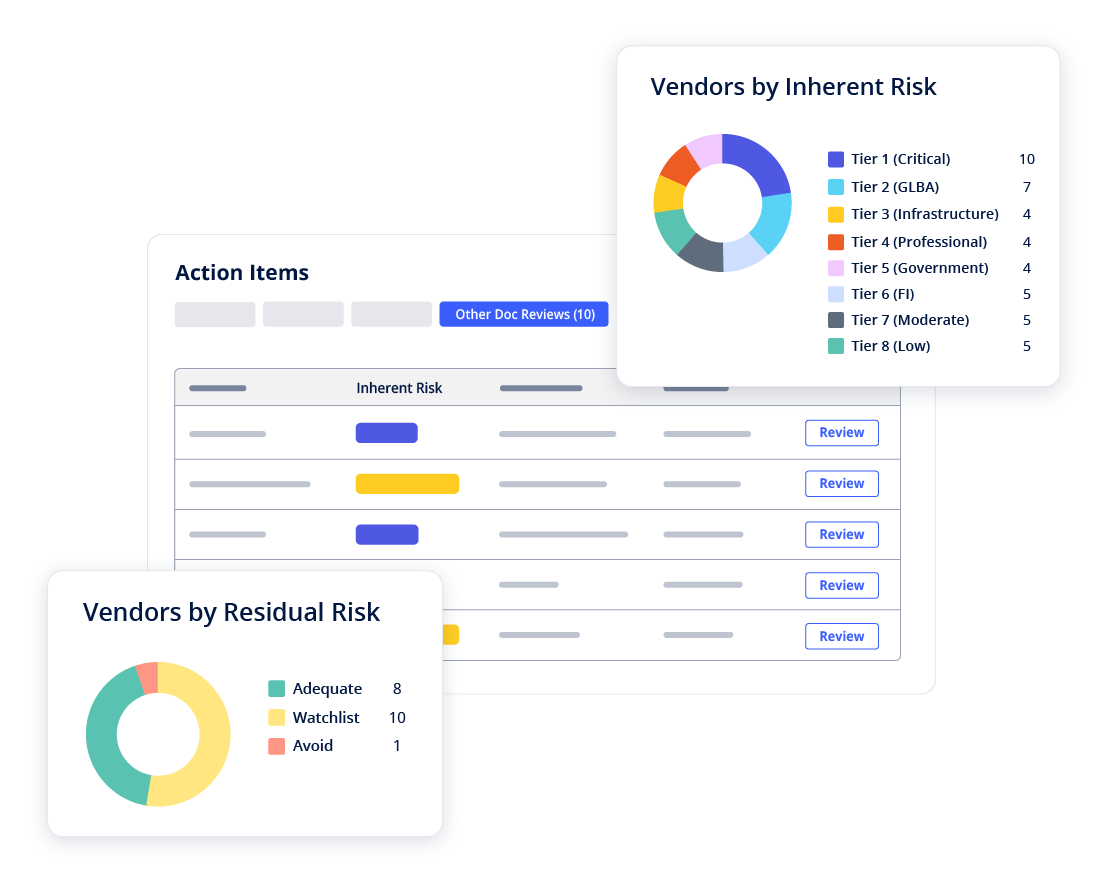

Manage third-party risk with confidence

Does your TPRM team need support? Centralize vendor data, automate due diligence processes, create customized vendor risk assessments, and manage contracts in one comprehensive third-party risk management solution. Easily track compliance, operational, cyber, and financial risks — and reduce internal workload with vendor services that analyze due diligence documents and support risk reviews — across all your bank’s third-party providers.

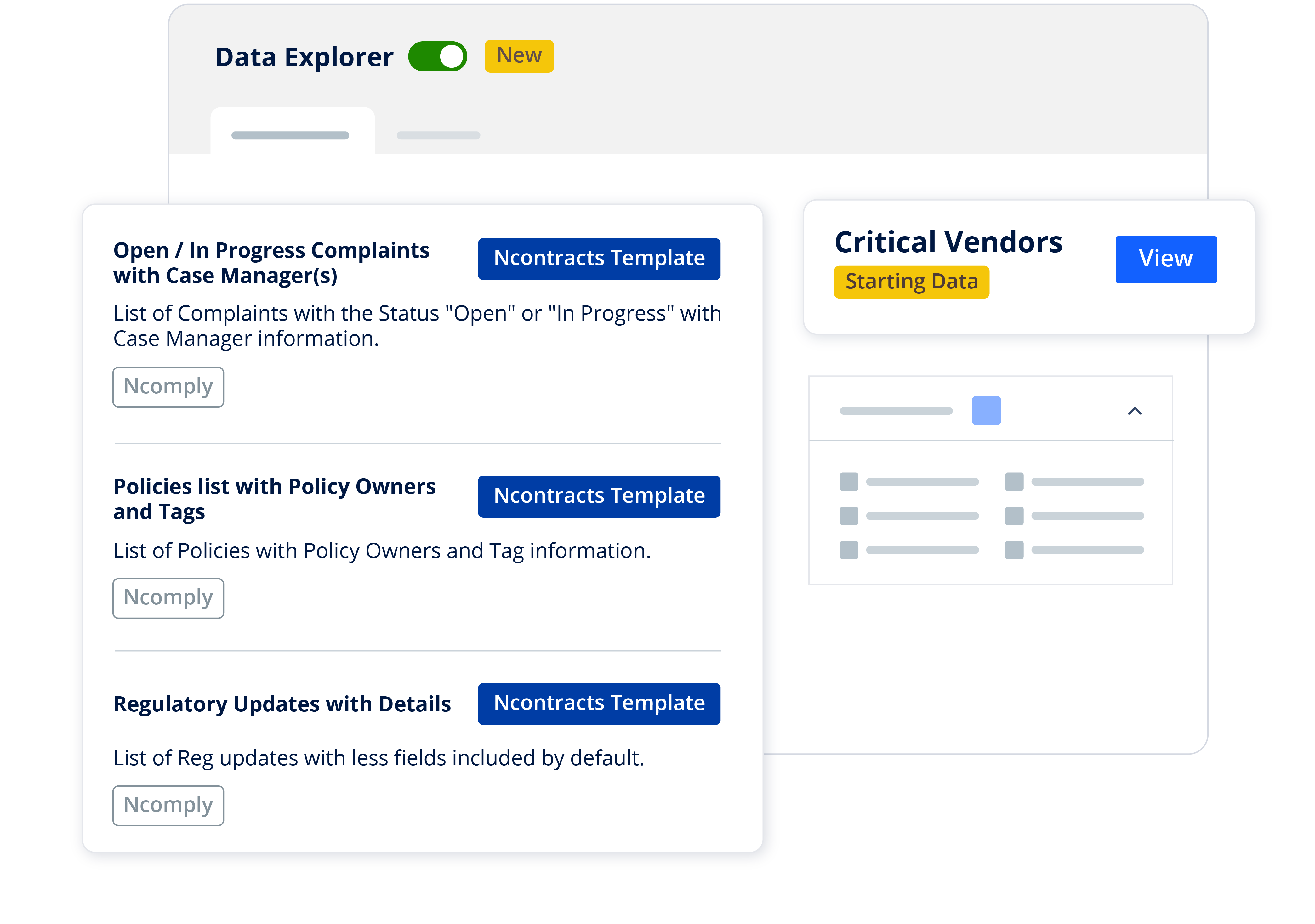

Simplify regulatory compliance

Struggling to keep up with complex and ever-evolving banking requirements? Stay exam-ready with a banking compliance software that takes the guesswork out of compliance. Empower your team to stay proactive with automated tools that manage policies, track complaints, and create examiner-ready reports — all in one platform. Access plain English explanations of state and federal banking regulations. Daily library updates aligned with your bank’s profile ensure you never miss relevant changes. Save time and reduce risk throughout your bank.

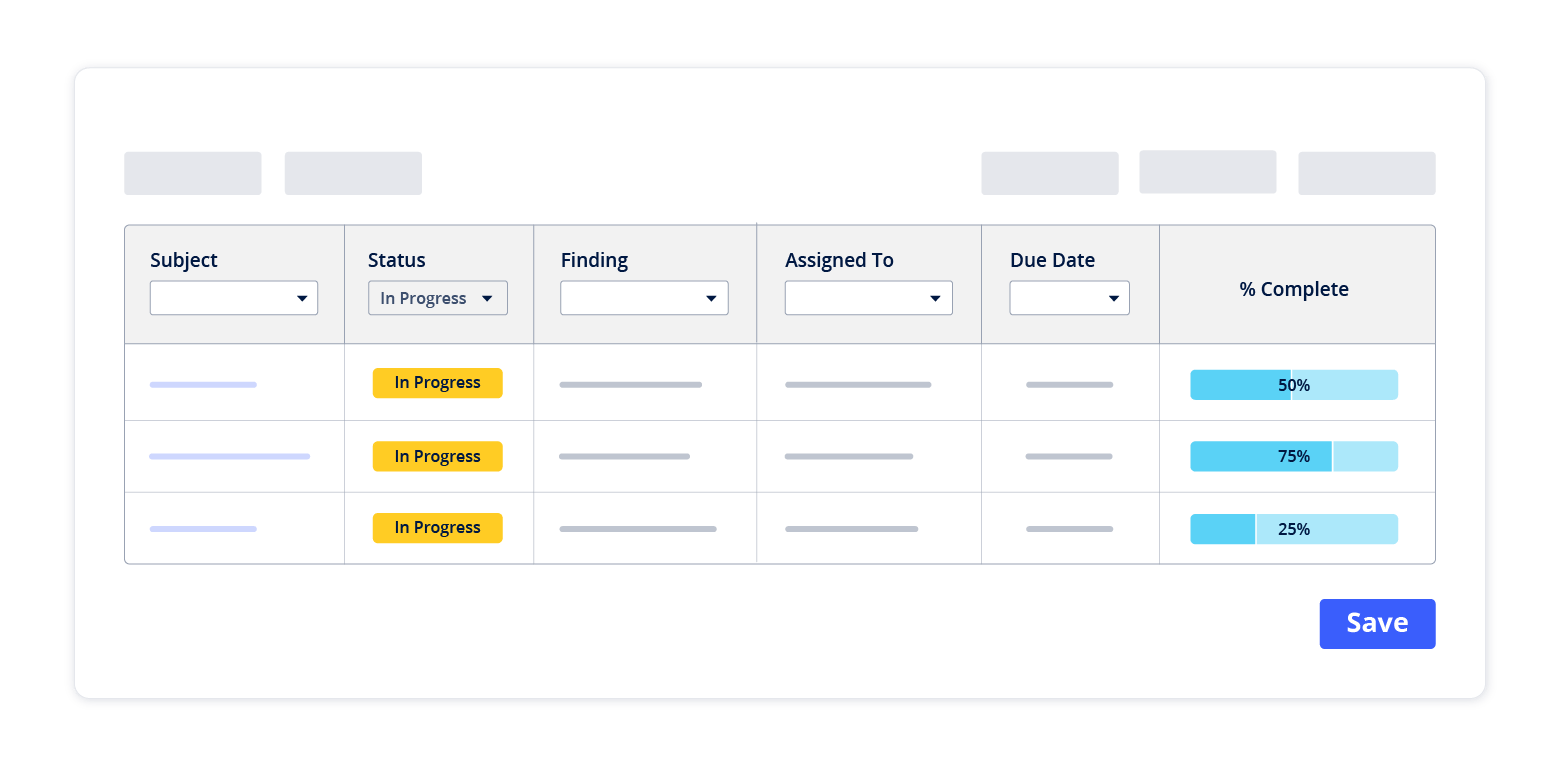

Track and address findings — fast

Ready to transform how you manage audit, exam and other findings? Confidently track, resolve, and document issues from internal audits, compliance reviews, and regulatory exams — all in one centralized platform. Gain real-time visibility into findings, automate task reminders, prioritize remediation, and maintain a complete audit trail. Go from issue to exam-ready reporting with tools that ensure nothing slips through the cracks.

Fair Lending Regression Analysis Software

Legacy tools require statistical expertise you don't have. Consultants take weeks you can't spare. Regression Ntelligence delivers the answers you need, when you need them.

Continuous Monitoring

Run unlimited analyses to catch issues early, test scenarios proactively, and maintain constant vigilance over lending patterns.

Regulatory Confidence

Generate 95% confidence reports that show the strength of your fair lending program.

Operational Efficiency

Eliminate consultant delays, reduce manual analysis, and empower your team to identify and fix issues independently.

Strategic Insights

Turn regression analysis from a compliance checkbox into strategic intelligence for product development and market expansion.

Frequently Asked Questions

Regression analysis is a statistical method that controls for legitimate credit factors to identify whether lending disparities exist across protected classes. It helps institutions demonstrate that lending decisions are based on creditworthiness, not prohibited factors, while identifying areas requiring corrective action.

Traditional regression requires statistical expertise and weeks of manual analysis or expensive consultants. AI-powered regression delivers instant results through a user-friendly interface, translates complex statistics into plain English, and enables unlimited analyses for continuous monitoring rather than periodic snapshots.

The system controls for all major credit factors including debt-to-income ratio, loan-to-value, credit score, payment history, employment stability, and other legitimate underwriting criteria. Custom factors can be configured based on your specific lending products and policies.

Analysis results are available in minutes, not weeks. You can run daily, weekly, or real-time analyses to catch emerging patterns immediately. This continuous monitoring approach identifies issues before they accumulate into regulatory findings.

No, it enhances and strengthens your existing program by providing sophisticated analytical capabilities. The tool supports your fair lending efforts with data-driven insights, but human oversight, policy decisions, and remediation strategies remain essential components of a comprehensive program.

That's exactly who Regression Ntelligence was designed for. The user-friendly interface requires no statistical background, and our expert support team provides guidance throughout implementation and ongoing use. We help you build regression capabilities from the ground up.

Fair lending regression analysis guide

Do you know what disparities in your lending data might mean? And can you prove it to examiners or the media? Download our guide to get the answers.

Is regression analysis right for your institution?

Use this 5-question check to gauge data readiness, volume, and risk—and see how it clarifies disparities.

Reducing compliance risk with regression analysis

Turn a “complex” model into a practical tool: watch the webinar to understand variables, pick the right data, and use results to mitigate risk and satisfy examiners.