Helping thousands of financial institutions to turn findings into fixes

Transform Your Complaint Management Process

See patterns you're missing. Fix issues before regulators find them. Complaint Ntelligence uses AI trained on thousands of real financial institution scenarios to automatically identify regulatory risks and generate resolution plans—so you can focus on prevention, not paperwork.

Smart Complaint Classification

Separate regulatory issues from customer service issues with complaint tracking software that uses advanced pattern recognition to classify complaints by product, issue type, and regulatory impact and then prioritize high-risk issues. From Reg E and UDAAP to FRCA, the solution is trained to identify specific violations.

Streamlined Complaint Workflows

Route complaints to the right teams based on regulatory requirements identified by Complaint Ntelligence. Users can create custom action items and assign tasks to appropriate team members for resolution using configurable workflows. The system maintains full audit trails throughout the process, ensuring you're always exam-ready.

Purpose-Built for Financial Services

Trained exclusively on financial services regulations and thousands of actual financial institution scenarios with oversight from regulatory attorneys and compliance officers. Complaint Ntelligence’s regulatory classification is 90%+ accurate.

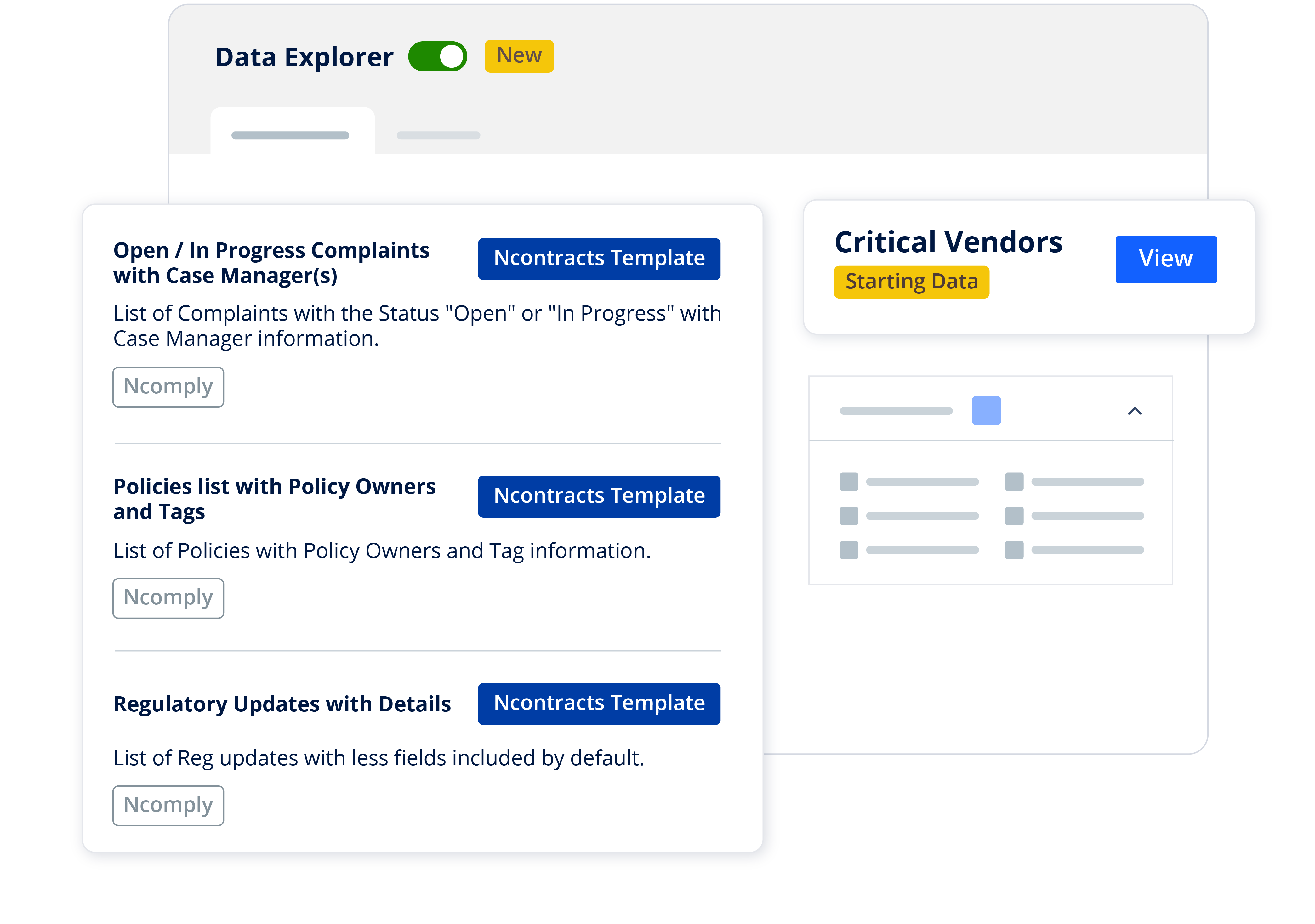

Ncomply Integration

Seamless embedded into the Ncomply compliance management platform. No separate logins or data silos. All your compliance information is in one place.

Comprehensive Documentation & Reporting

Automatically capture every analysis, regulatory decision, and complaint classification. Generate defensible reports that highlight your structured, compliant approach to complaint management.

Exam Readiness

Maintain comprehensive audit trails with automated documentation of every action, decision, and communication. Generate CFPB, UDAAP, and fair lending reports instantly, showing examiners your proactive approach to complaint management.

Trend Detection and Pattern Analysis

Go beyond basic tracking with advanced analytics that spot emerging patterns across complaints to uncover systemic issues and prevent future issues – whether it’s causing consumer harm or customer churn. Transform raw complaint data into strategic intelligence for proactive improvements.

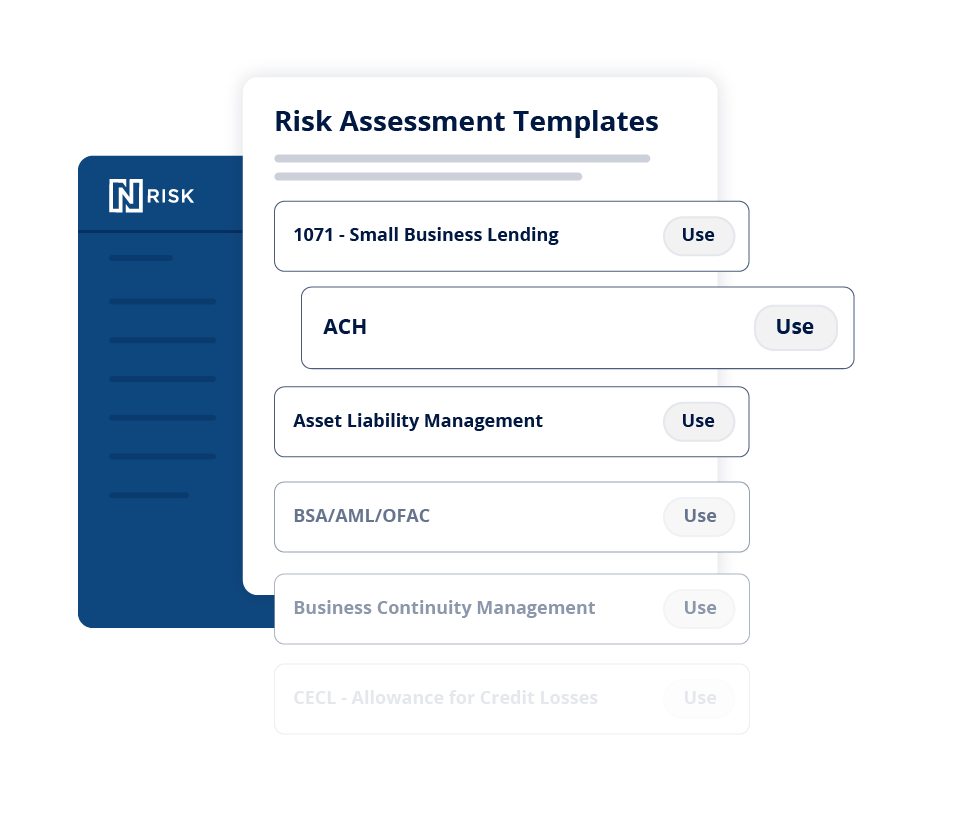

Get a real-time, bank-wide view of risk

Ready to ditch fragmented reports and manual processes? Move beyond siloed risk management with scalable cloud-based enterprise risk management software for banks. Gain a holistic view of risk with real-time insights and expert-built controls. Collaborate across departments with customizable risk assessments, ratings, and reports. Proactively manage and mitigate risk to keep your bank aligned, agile, and ready for what’s next.

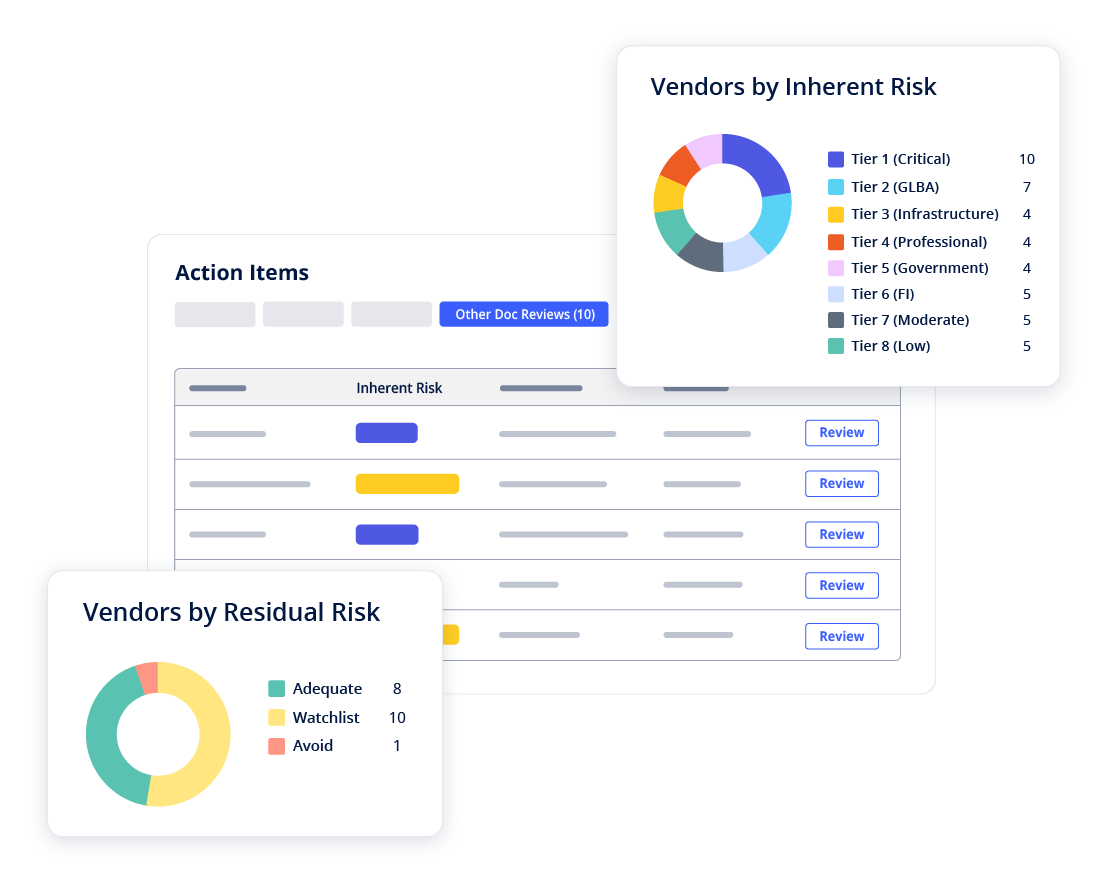

Manage third-party risk with confidence

Does your TPRM team need support? Centralize vendor data, automate due diligence processes, create customized vendor risk assessments, and manage contracts in one comprehensive third-party risk management solution. Easily track compliance, operational, cyber, and financial risks — and reduce internal workload with vendor services that analyze due diligence documents and support risk reviews — across all your bank’s third-party providers.

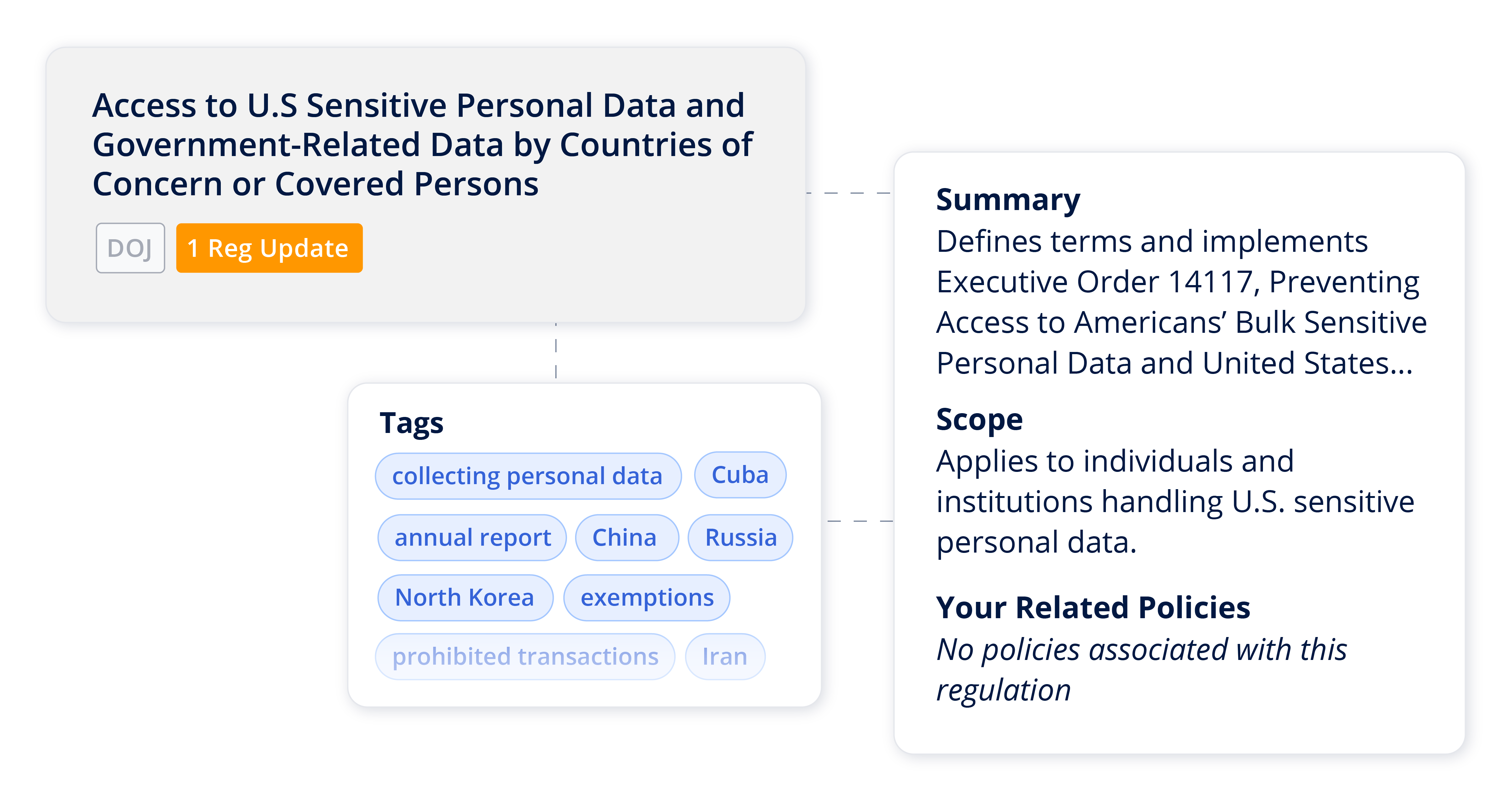

Simplify regulatory compliance

Struggling to keep up with complex and ever-evolving banking requirements? Stay exam-ready with a banking compliance software that takes the guesswork out of compliance. Empower your team to stay proactive with automated tools that manage policies, track complaints, and create examiner-ready reports — all in one platform. Access plain English explanations of state and federal banking regulations. Daily library updates aligned with your bank’s profile ensure you never miss relevant changes. Save time and reduce risk throughout your bank.

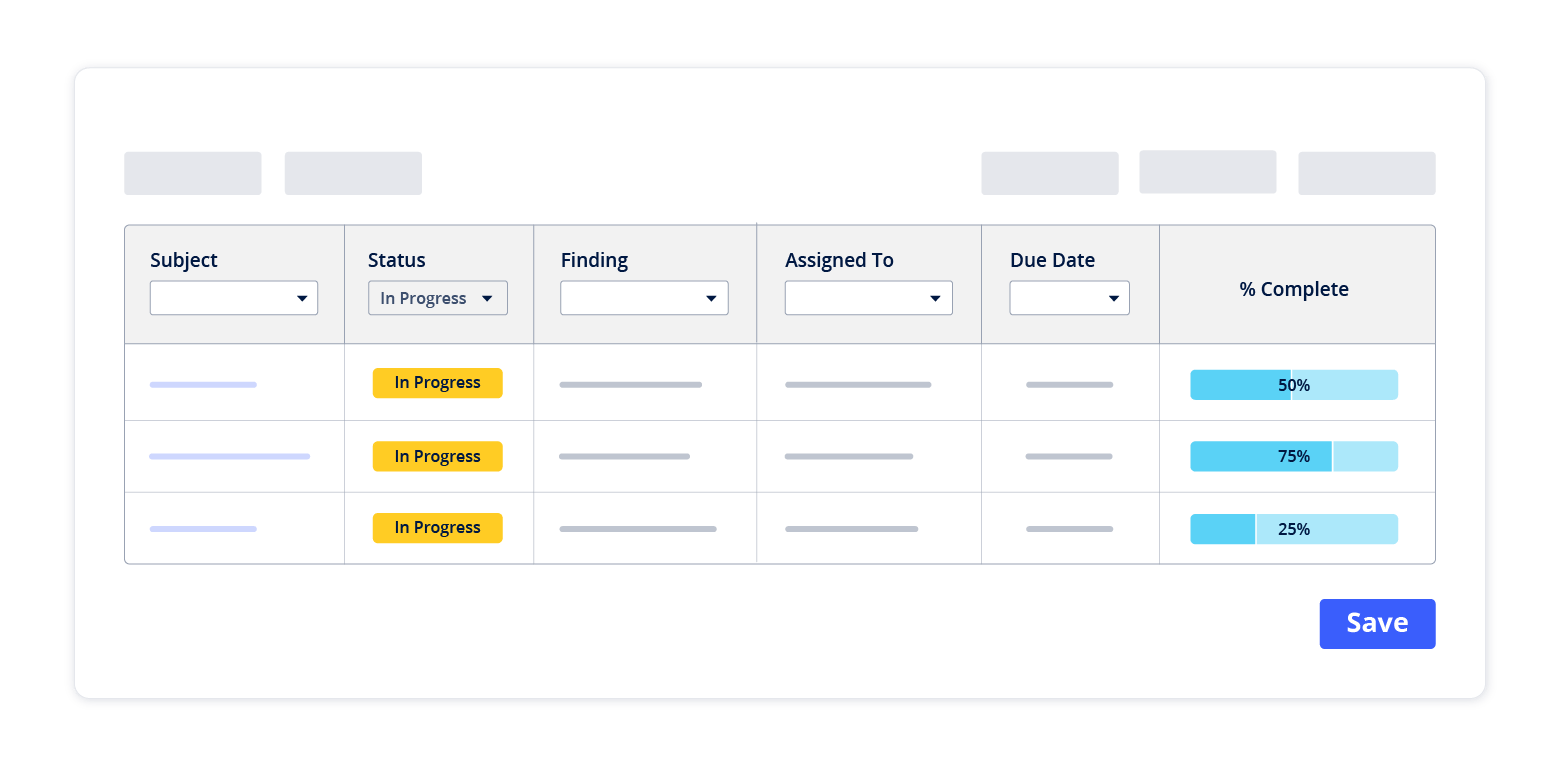

Track and address findings — fast

Ready to transform how you manage audit, exam and other findings? Confidently track, resolve, and document issues from internal audits, compliance reviews, and regulatory exams — all in one centralized platform. Gain real-time visibility into findings, automate task reminders, prioritize remediation, and maintain a complete audit trail. Go from issue to exam-ready reporting with tools that ensure nothing slips through the cracks.

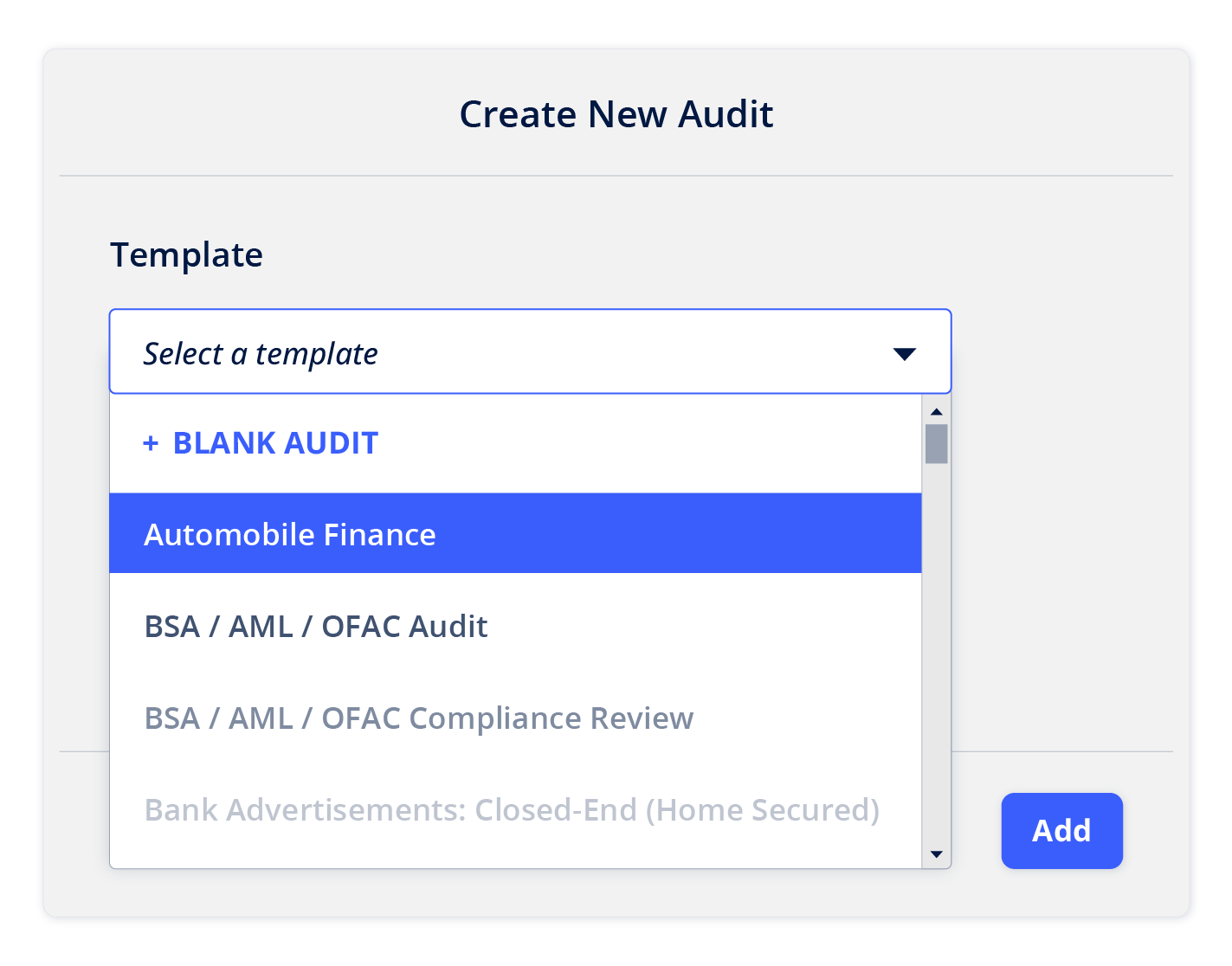

Improve productivity with advanced auditing

Is your bank maximizing your internal audit processes? Reduce your team’s manual efforts by consolidating audit planning, execution, and reporting in a single system. Customize audit templates, automate workflows, and integrate exam and audit findings management for holistic risk tracking and remediation. Discover operational redundancies and areas for improvement for a smoother, faster auditing process.

Complaint Tracking Software for Customer Retention & Compliance

Customer complaints tell you what’s broken. Complaint Ntelligence tells you how to fix it.

Regulatory Confidence

Meet CFPB, FDIC, OCC, and state requirements with built-in compliance workflows and automated reporting.

Customer Experience Excellence

Respond faster, resolve better, and turn frustrated customers into advocates.

Operational Efficiency

Reduce manual data entry, eliminate spreadsheet tracking, and free your team to focus on prompt, consistent resolution.

Proactive Risk Detection

Identify potential fair lending issues, UDAAP violations, and emerging risks through advanced pattern analysis.

Enterprise Integrations

Connect seamlessly with core banking systems and complaint data through robust APIs.

Frequently Asked Questions

Compliance Management Buyer’s Guide

Learn about the key components to look for in a compliance management solution. Plus, find out how you can reduce the amount of time your compliance team spends researching regulatory changes and updates.

"The Ncontracts Complaint Ntelligence module has significantly elevated our approach to complaint management. Its AI-powered features streamline complaint intake and analysis, helps to identify root causes and emerging risks, and ensures accurate regulatory categorization – providing confidence that nothing is overlooked. Its intuitive, user-friendly interface enables effective complaint handling even by staff without a compliance background. The module promotes operational efficiency, strengthens cross-functional collaboration, and reduces resolution times, making it a valuable tool for both frontline and oversight teams."

Sasha Furrier

VP, Div. Head of Compliance, 1st Source Bank

Why Complaint Management Matters

Learn how to develop an effective complaint management program that complies with regulatory requirements, improves risk management, and aids in exam preparation.

Managing Complaints to Achieve Better Results

Join Stephanie Lyon, Ncontract's VP of Compliance, to know more about complaint trends and best practices to strengthen your complaint management program.

Statements that May Signal a Complaint

If a consumer uses any of the following phrases, don’t dismiss it. You probably have a reportable customer complaint. Check our resource to manage complaints efficiently.