Complete CRA Compliance Software for Transmittal & Analytics

The only Community Reinvestment Act (CRA) solution you’ll ever need. Seamlessly handle transmittal, geocoding, mapping, and community development tracking with expert analyst support for maximum efficiency and exam confidence.

Trusted by more banks than any other CRA Solution

Comprehensive CRA Management Software for Banks and Financial Services

Everything you need to manage CRA compliance with confidence, efficiency, and clarity in one CRA solution.

CRA Transmittal & Filing

Format applications and loans in compliance with regulatory requirements. Software accepts CRA LAR data, loan files, and deposit files in multiple formats including Excel, CSV, and fixed width files.

Advanced Geocoding & Mapping

Visualize your loans, deposits, and facilities on interactive maps with overlays for counties, census tracts, and demographic data. Filter views to focus on specific assessment areas or loan types. Batch, single-search, or integrated LOS geocoding using GPS-quality street data and interactive mapping capabilities.

Interactive Dashboards & Reporting

Access easy-to-understand dashboards, tables, charts, and maps that clearly show your CRA risk exposure across all assessment areas. Generate comprehensive reports with just one click for examination preparation.

Built-In Error Detection

Ensure accurate filings with built-in error detection and compliance formatting. Test loan applications against rule sets within your LOS and capture data to produce clean transmittal files.

Geospatial Mapping & Visualization

Visualize your loans, deposits, and facilities on interactive maps with overlays for counties, census tracts, and demographic data. Filter views to focus on specific assessment areas or loan types.

LMI and MMCT Tract Analysis

Evaluate service to Low-to-Moderate Income by race, ethnicity, and gender.

Assessment Area Analysis

Verify configurations and analyze loan/deposit activity inside and outside assessment areas to accurately track performance.

In/Out Ratio Monitoring

Track lending performance ratios across all loan types and geographic areas with color-coded risk identification

Community Development Tracking

Log and manage community development loans, services, donations, and investments with geocoding, interactive filtering.

Expert Guidance

Annual meetings with a CRA lending analytics expert to probe deeper and uncover additional insights.

Peer Benchmarking

Compare your institution's performance against relevant peer data to give regulators context and gain insights into market position.

Tailored to You

Advanced Analytics

Cloud-Based Access

Easy Reporting

API Integrations

Responsive Customer Support

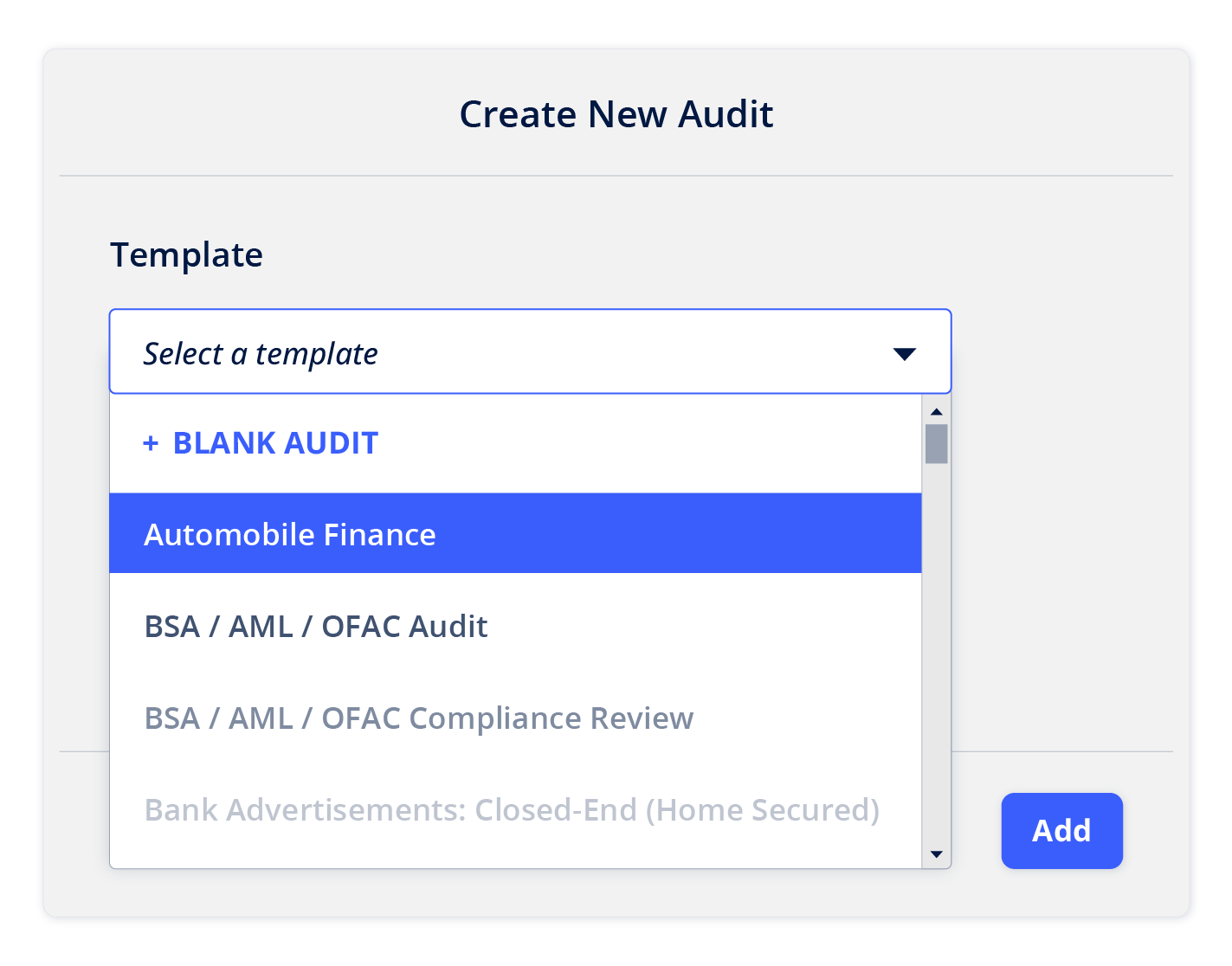

CRA transmittal & filing

Format applications and loans in compliance with regulatory requirements. Software accepts CRA LAR data, loan files, and deposit files in multiple formats including Excel, CSV, and fixed width files.

Built-in error detection

Ensure accurate filings with built-in error detection and compliance formatting. Test loan applications against rule sets within your LOS and capture data to produce clean transmittal files.

Assessment area analysis

Verify configurations and analyze loan/deposit activity inside and outside assessment areas to accurately track performance.

Advanced geocoding & mapping

Visualize your loans, deposits, and facilities on interactive maps with overlays for counties, census tracts, and demographic data. Filter views to focus on specific assessment areas or loan types. Batch, single-search, or integrated LOS geocoding using GPS-quality street data and interactive mapping capabilities.

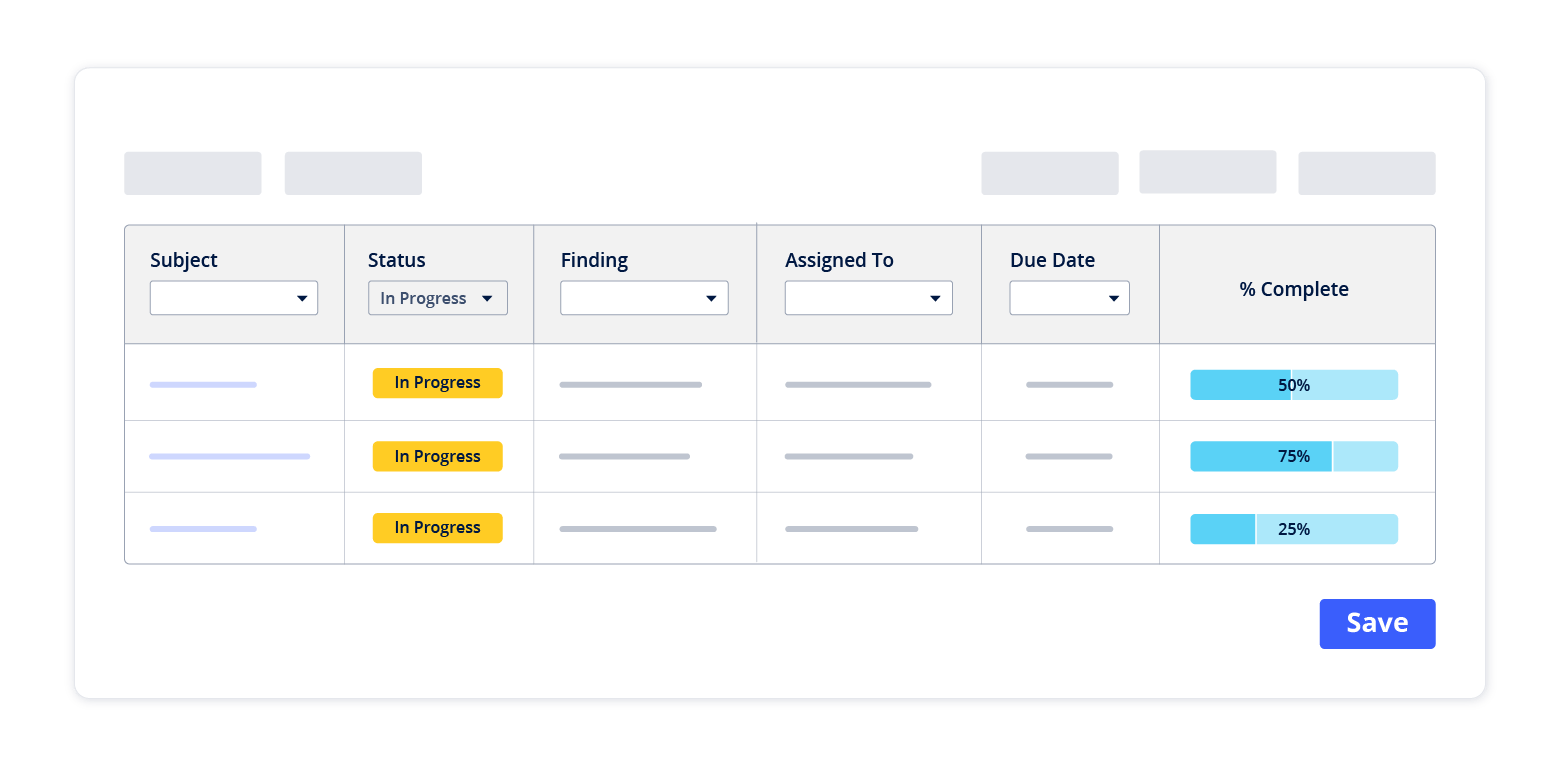

In/out ratio monitoring

Track lending performance ratios across all loan types and geographic areas with color-coded risk identification.

LMI and MMCT tract analysis

Evaluate service to Low-to-Moderate Income and Majority-Minority census tracts with proxy assignments for race, ethnicity, and gender.

Peer benchmarking

Compare your institution's performance against relevant peer data to give regulators context and gain insights into market position.

Community development tracking

Log and manage community development loans, services, donations, and investments with geocoding, interactive filtering.

Expert guidance

Quarterly meetings with a CRA lending analytics expert to probe deeper and uncover additional insights.

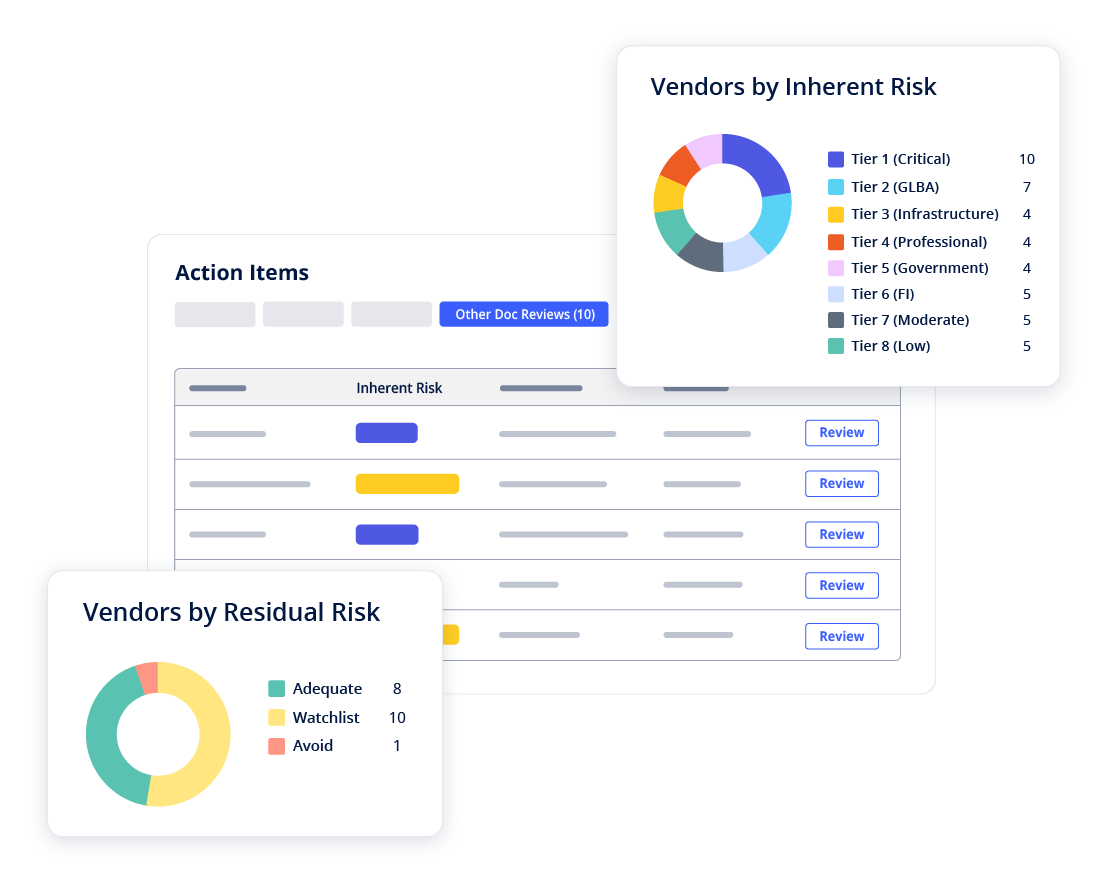

Interactive dashboards & reporting

Access easy-to-understand dashboards, tables, charts, and maps that clearly show your CRA risk exposure across all assessment areas. Generate comprehensive reports with just one click for examination preparation.

Geospatial mapping & visualization

Visualize your loans, deposits, and facilities on interactive maps with overlays for counties, census tracts, and demographic data. Filter views to focus on specific assessment areas or loan types.

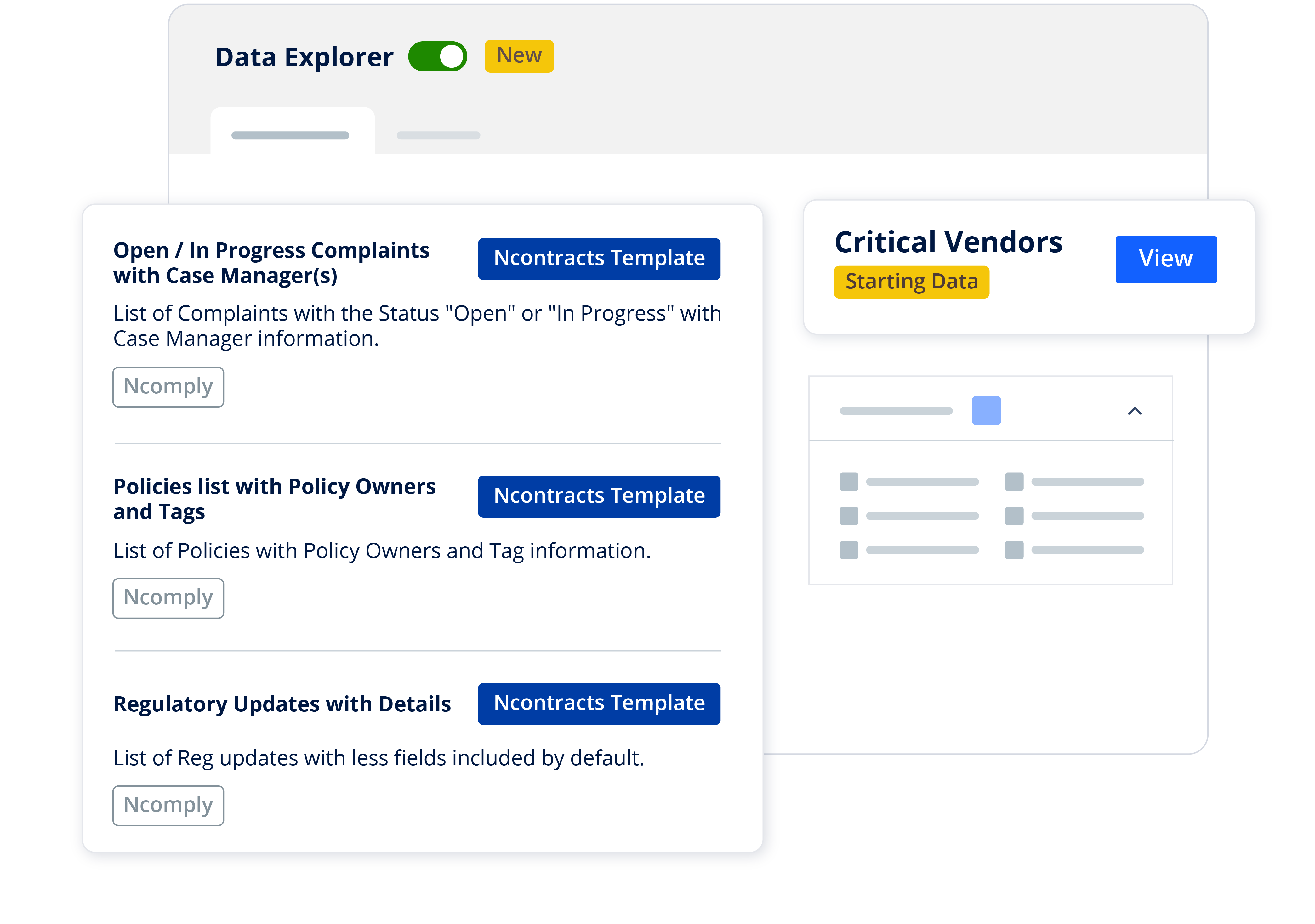

Build the Lending Compliance Solution You Need

Nlending is the flexible lending compliance platform that brings CRA, HMDA, Fair Lending, and more together in one integrated solution.

Customer Success Story

See how First Financial Bank simplified CRA compliance across 150+ branches—saving time, reducing errors, and strengthening examiner confidence with Ncontracts’ CRA Analytics.

“CRA Analytics is absolutely time-saving! There’s no way that a team of people could go through and review all the data that needs to be looked at without it.”

Heather Montgomery

First Financial Bank Community Development Analyst

“I like that I don’t have to look at everything ‘overall.’ I can break it down branch-by-branch.”

Erin Goodall

Valliance Bank Vice President and Director of Compliance

"We just completed our CRA exam. The reporting available in the lending module was so helpful. It helped us validate our assessment areas, match our lending with our peers, and show us where our loans are located. The reports helped the exam to be as efficient as possible for our bank and the examiner."

Chad Elledge

EVP & Chief Risk Officer at Texas Heritage National Bank

Frequently Asked Questions

How to Get CRA Community Development Credit

These 5 practical tips will help you identify potential Community Development activities.

Top Reasons for Bad CRA Compliance Exam Ratings

Being prepared to tell your bank's story is critical. Here are 5 common factors that may cause your CRA rating to be downgraded.

Everything You Need to Know about CRA Performance Context

What is "performance context"? What does it mean for my bank? How should I create it? Find the answer here.