This $25M Settlement Highlights UDAAP Risk and FDCPA Changes

This recent $5M Civil Money Penalty from the CFPB against a debt collector highlights the importance of compliant debt collection practices. Learn more!

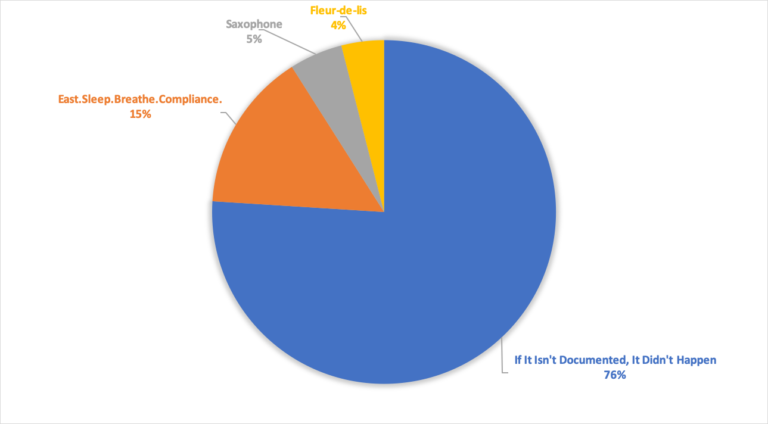

3 Elements of a Vendor Cyber Monitoring Program

An FI’s vendor management program is part of its enterprise risk management. Vendor management can’t be done in a vacuum.

Fair Lending Fireworks: 3 Trends in the Hottest Area of Compliance

In the spirit of July 4th, learn what's sparking fireworks in Fair Lending compliance. After the $1.75M consent order, this is news you'll want to know.

Frequently Asked Questions About Cyber Monitoring

Here are the most common questions we get asked about vendor cyber monitoring:

3 Lessons Learned from the ABA Regulatory Compliance Conference

In this post, you'll learn 3 essential insights gained from the ABA Regulatory Compliance Conference that every compliance pro needs to know!

Lessons Learned from Giving Away 1,100 T-Shirts at an ABA Conference

We handed out our full inventory of 1,100 free t-shirts at the ABA Compliance Conference earlier this month! Here's what we learned:

What to Do When You’re Worried About Your Vendor’s Finances

How do you know your vendor is in trouble and what can you do if it is? Read on to find out.

OCC: Operational Risk Remains Elevated

The only certainties in life are death and taxes, but I can think of one more thing: risk.

Due Diligence 101: Are On-Site Visits Required?

Let’s start with guidance on the subject. There is very little guidance requiring on-site due diligence. It’s peppered with words like “may” or...

Creating Value with A Culture of Risk Management

Many bankers think the concept of a “risk management culture” is thought exercise. It’s the kind of psychobabble that takes up time that could be dedicate

4 Key Risks Facing the Banking Industry, According to the OCC

As the banking industry has undergone major changes, the top risks have also evolved. Here are the four biggest risks facing banks today, from the OCC.

GAO Grades Regulatory Agencies on Risk Management Supervision

The board will consider whether there are specific factors Federal Reserve staff should consider when escalating supervisory concerns.

Wishing for More Regulatory Tailoring? You’ll Love Risk Management

In a world where bankers feel overwhelmed and disadvantaged by a seemingly one-size-fits-all regulatory environment, there remains one place where a fina

10 Tips to Make the Most of Your Next Banking Conference

Learn 10 best practices to help you make the most of your next banking industry event! These guidelines will ensure your next conferences is a success.

We Listen So You Don’t Have To: FDIC’s Crisis & Response Podcast

What went down during the financial and banking crises, and what did the FDIC learn from it? The FDIC has released a 7-part podcast.

Do Small Institutions Need Risk Management?

Risk management isn’t just for large institutions. The case can be made that it’s even more important for smaller FIs to address risk management.

Why Do I Need a HMDA and CRA Transmittal Tool?

Find out everything you need to know from A to Z about the HMDA and CRA transmittal and why you might need the software for your financial institute.

Community Bankers Association of Illinois Endorses Ncontracts Risk Management Solutions

CBAI member banks can rely on Ncontracts to be a trusted teammate to assist them with vendor and risk management

Embezzlement in La La Land: How a TV Studio Credit Union CEO Stole $40 Million Over 20 Years

Would you believe a story where the villain steals over $40 million from a FI that only had $21 million in assets? The truth is stranger than fiction.

Game of Thrones: Risk Assessing The Iron Bank

Game of Thrones has returned for its final season! In honor of the ending of this series, let’s identify the biggest risks facing The Iron Bank of Braavos.

Are You Making This Common Vendor Management Mistake Observed by the FDIC?

FIs aren’t doing enough to ensure their contracts with third-party vendors sufficiently address business continuity and incident response.

7 Most Confusing Areas of Compliance for Compliance Pros

Learn the essentials of 7 of the most complex areas of regulatory compliance - including UDAAP, Community Development, and REMAs...

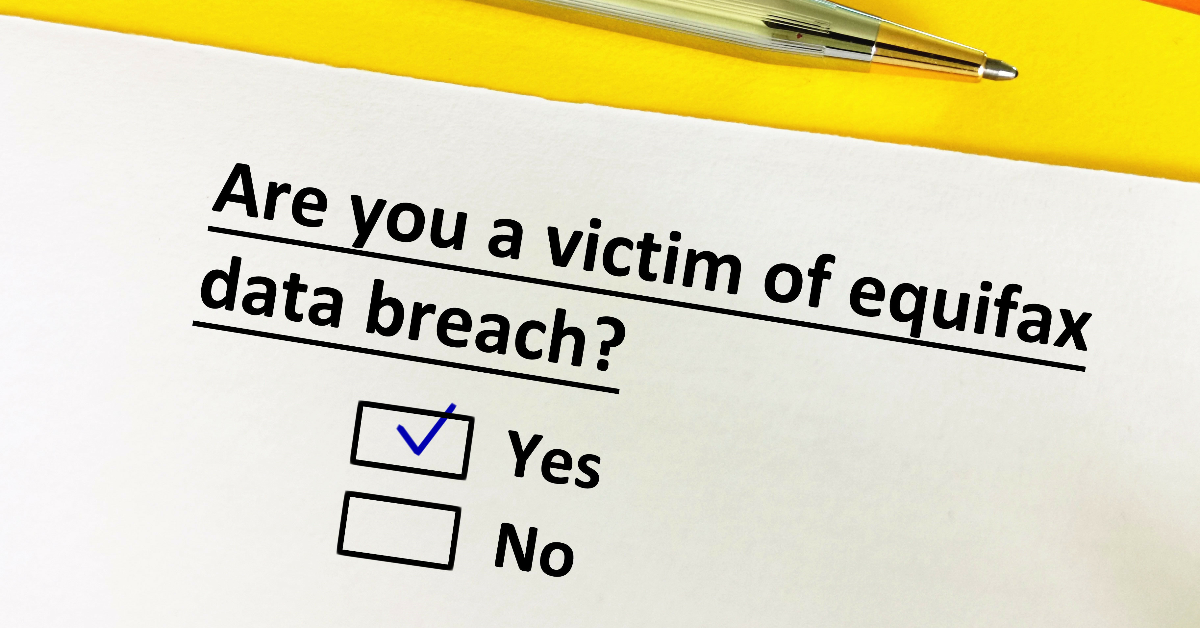

3 Tips for Avoiding an Equifax-Style Breach

When one of the nation’s largest credit reporting companies reports a breach involving the private financial data of over 145 million Americans, people

7 Risks that Third-Party Vendors Pose to Your Financial Institution

In 2019, vendor risk management remains a key concern for financial institutions in the US. There’s a good reason for that! Here are...

Why Vendor Cyber Monitoring Matters

No matter how strong a financial institution’s own cyber defenses are, it’s really only as strong as its weakest vendor.

How HMDA Plus Data is Changing Fair Lending Analytics

Since the Final HMDA Rule was released in 2015, the banking sector has undergone dramatic changes. In this article, you’ll learn how the extended...

The Future of Finance: 5 Banking Trends to Watch

We’re highlighting 5 new banking trends that we believe will shape the future of banking and finance sectors.

How to Discover Vendor Cybersecurity Flaws Before Data Thieves Exploit Them

How do you know if a cybersecurity rating is covering all the bases? Make sure it monitors these key areas...

What Should I Do After Submitting My HMDA Data?

Here are 10 steps you need to take after filing your HMDA LAR to strengthen your Fair Lending compliance program. Plus, get the post-HMDA filing checklist!

What is Fair Lending Discrimination?

What is Fair Lending discrimination? Learn how to define Fair Lending discrimination, and what it really means for you, with these five simple examples!