Apple Card’s Fair Lending Fiasco

While those tracking the mortgage industry have been digging through the new, expanded Home Mortgage Disclosure Act (HMDA) data, other types of Fair...

Risk Management Aids Prep for Risk-Focused Exams

Risk management helps financial institutions anticipate and guard against all kinds of risks. But did you know it can also help prepare for exams?

A Risk Assessor Origin Story Courtesy of Stephen King’s IT

Movies are chockfull of superhero origin stories, but what about us regular risk management folks?

All the Fair Lending News That’s Fit to Print

2019 has been a big year for Fair Lending news. We catch you up on the latest.

7 Features Every Compliance Management System (CMS) Needs

Compliance management is no joke. Look for a compliance management solution with these seven key features...

Can You Adopt an Agile Approach to Compliance?

One of the buzzwords in business these days is “agile.” If you’re looking to learn more about what an agile approach is, and how it can be used in...

3 Benefits of Analytics Software vs. Manual Analysis of Your HMDA Data

Are you still analyzing your Fair Lending data manually? If so, it’s time to consider a different approach. Here are the benefits of replacing a manual...

9 Reasons Why We Are Thankful For Compliance Officers

Here are 9 reasons we are thankful for compliance officers! Thank you, compliance officers, for everything you do.

Have You Prepared for Climate Change Risk?

What is your bank doing about climate risk and its potential impact on loans, investments, and operations?

Quiz Time! How Did You Get Your Start in Banking?

Risk management starts at the top, but bankers typically start at the bottom.

5 Fair Lending Lessons Learned in 2019

Now is perfect time to reflect on some of the lessons learned this year. In particular, we’ve seen lots of changes in Fair Lending compliance.

5 Fair Lending Lessons Learned in 2019

As Q4 approaches, it's time for compliance professionals to reflect on the changes we’ve seen so far. Here are 5 fair lending lessons learned this year.

What If a Cyber Attack Caused a Bank Failure?

There are more than just financial threats to industry stability. The FDIC is actively considering how it would handle an unprecedented scenario: a bank

Ignore KRIs & KPIs at Your Own Peril: Best Practices for Key Risk Indicators

Stop me if you’ve heard this story before. Significant management turnover at a $1B FI, and new management is eager to make an impact. The solution:

Summer Blockbusters Revisited: Assessing My Risk Assessments

When it can cost nearly $100 to take a family of four to the movies (including snacks, of course), you don’t want to risk wasting your cash on a so-so movi

Is Your Institution Prepared for These Emerging Risks?

Across the business world, businesses in all industries are worried about the pace of change...

PA Bankers Services Corporation Endorses Ncontracts’ Solution Suite

The PA Bankers Services Corporation (Services Corp.) and Ncontracts jointly announce the addition of Ncontracts into the corporation’s Select Vendor...

15 Key Insights from the CFPB Fair Lending Report [Part Two]

Check out the second half of our two-part series on the CFPB's 2018 Fair Lending Report. If you have to comply with Fair Lending, this post is for you.

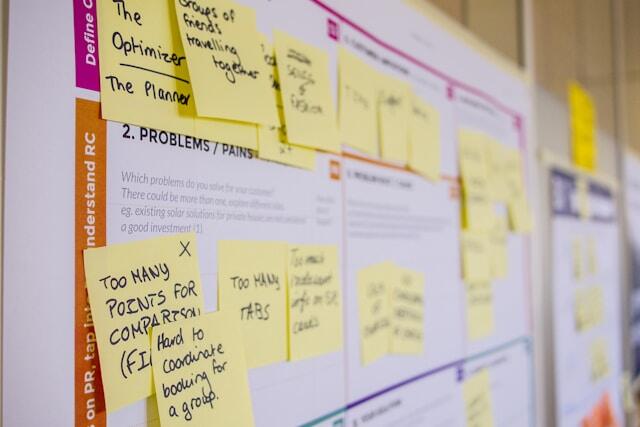

6 Silo-Busting ERM Tips

How do seasoned risk professionals fight risk management inertia? They find ways to dismantle silos and develop processes to spark discussion about risk

15 Key Insights from the CFPB’s 2018 Fair Lending Report [Part One]

The CFPB's released the 2018 Fair Lending Report to Congress in June. Here is the first of our 2-part blog about the regulatory insights you need to know.

CU Broadcast Interviews Stephanie Lyon on Compliance Management System for Financial Institutions

Our very own Director of Compliance, Stephanie Lyon, talks with Mike Lawson from CU Broadcast about the company's new CMS solution for FIs.

Bank Audit

A bank audit is a routine procedure designed to review the services of financial institutions to ensure they are in compliance with laws and industry

13 Movies and Shows Every Bank Compliance Nerd Needs to Watch

Here are a few banking compliance movies and TV shows for you to check out, and prove to your friends and family that compliance is entertaining!

Vendor Employees Gone Wild: Structuring Vendor Contracts to Guard Against Rogue Insiders & Cyber Threats

Capital One and its credit card applicants and customers are not having a good week.

Tips for Implementing 3 Lines of Defense in your CMS from a Compliance Pro

Learn tips for how to implement three lines of defense into your compliance management system from a compliance pro with more than 20 years of experience.

A Model CIO: Equifax CIO Keeps Showing Us How *Not* to Respond to a Breach

The big news out of Equifax this week is its $700 million settlement as a result of its 2017 data breach. It’s the most expensive breach settlement ever.

What are the Three Lines of Defense in a Compliance Management System?

Learn the essential definitions of a compliance management system (CMS), and what the three lines of defense really are.

The Risk Management/HR Connection

How often do you engage with human resources? Risk managers may not give a lot of thought to human resources, but they should.

2 Key Elements of a Successful Compliance Management System from the CFPB

Learn the two essential components of any successful Compliance Management System (CMS) to ensure that your financial institutions is in shape.

Are You Using a Data-Driven Approach to Compliance Risk?

Make sure that your risk management metrics are keeping up with the outside world, and help your institution separate fact from perception.