Coming to a GSE Near You: Better Third-Party Risk Management via FHFA Guidance

If you’ve been holding off on formalizing your approach to vendor management, this is another sign that you need to get on board.

Sharing BSA Resources with Another Institution? Third-Party Vendor Management Rules Apply

Regulators have given financial institutions a green light for sharing BSA resources in some situations, but proper third-party vendor management practices

Monkey Business: What Two Gambling Monkeys Can Teach Us About Risk

Did you hear about the monkey gambling for drops of juice in a casino? It’s an actual experiment that gives us insights into risk and decision making...

Ammo for the Budget Battle: How Risk Management Delivers ROI

Need help communicating return on investment (ROI) for risk management software? Here are arguments to help make the case to management and the board

OCC: Cybersecurity, Commercial/Retail Credit & BSA Will Be 2019’s Top Supervisory Priorities

Risk and cybersecurity remain top supervisory priorities at the OCC for a second year in a row, the agency reports in its latest supervision operating plan

7 Things You Need to Know Before Buying Cybersecurity Insurance

Cybersecurity insurance doesn’t always cover your institution the way you expect. Consider these 7 things before you buy...

FDIC Proposes Retiring Half Its Risk Management FILs—But Don’t Get Too Excited

It sounds like every banker’s dream come true. The FDIC has proposed retiring 374 of the 664 risk management supervision-related Financial Institution

Free Your Inner Luddite & Find Risk Management Peace

If you think of yourself as a risk management Luddite, consider this fresh perspective. It will make your job easier if you’ll let it.

Discovering a Vendor Data Mistake: A Lesson from the Fiserv Flaw

Have you ever swapped out a number or letter in a URL to skip to another page? Cybersecurity researcher and ethical hacker, Kristian Erik

Poor Vendor Risk Management Costs Bank $4.75 Million

Compared to other agencies, the Fed hasn’t handed down very many enforcement actions for unfair and deceptive practices violating the FTC Act. Why then is

How to Set Up a Risk Committee

The risk committee helps ensure that management and the board understand each other. Here're tips on setting up a risk management committee.

5 Lessons from HUD's "Digital Redlining" Complaint Against Facebook

Last week, the Department of Housing and Urban Development announced a formal complaint against Facebook for alleged digital...

Risk Assessments 101: The Role of Probability & Impact in Measuring Risk

Risk assessment methodology for banks aren’t nearly as subjective as they may seem. Here, we walk you through exactly what you need to evaluate.

5 Features Every Vendor Management Software Solution Should Have

Here are the top five features to look for when selecting a vendor management software solution...

FS-ISAC Offers Free Cyberattack Exercise

When was the last time your incident response team practiced its response to a cyberattack? If it’s been awhile, you may want to look into the CAPS

Is Your Third-Party Vendor Contract Specific Enough When It Comes to Cybersecurity?

If you’re assuming your third-party service provider is following cybersecurity best practices because it’s smart business, think again...

Is Your Compliance Program Reactionary or Proactive?

Is your compliance management program reactionary, or is it proactive? In this post, you'll learn why compliance is still critically important, and...

How Confident Is Your CFO When It Comes to Managing Risk?

When it comes to managing risk, many CFOs are not highly confident in their abilities to get the job done well. Here's 3 reasons why:

Examining the Examiner: What the OIG Has to Say About the FDIC

Your regulator may seem like an all-powerful force, but everyone answers to somebody. In the case of the FDIC it’s the (OIG)

Risk & Vendor Management: The Role of Committees vs. Departments

When it comes to risk and vendor management, both the board and management have specific roles to play, but where do committees and departments fit in?

Should Vendor Management Report to Compliance or IT?

What’s best for one financial institution isn’t necessarily best for another. One common question: Should vendor management report to compliance or IT?

Vendor Consolidation: What It Means for Vendor Management and Due Diligence

Many financial institutions are choosing to consolidate vendors. It’s a move that makes sense from a business and management perspective, but how does

How Well is Your Board Managing Risk?

How Well is Your Board Managing Risk? - The Federal Reserve has proposed guidance that would require the largest bank boards to conduct self-assessments.

How Not to Use Test Results: A $613 Million Enforcement Action Story

How Not to Use Test Results: A $613 Million Enforcement Action Story - Financial institutions rely on caps and limits. There are minimum deposits

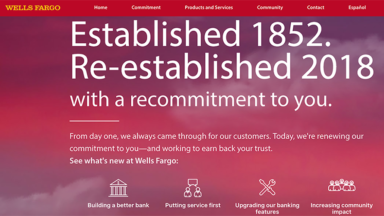

Wells Fargo Scandals: Re-Established 2018

Wells Fargo Scandals: Re-Established 2018 - Barely a month after launching its “Re-Established” ad campaign with ads about “Earning Back Your Trust”,

Should You Outsource Vendor Management?

For years, financial institutions have outsourced a variety of activities to third-party vendors creating a new conundrum: Should vendor management be

Mythbusting 5 Rumors About the Dodd-Frank Rollback

In this piece, we’ll take a look at five “myths” about the so-called HMDA rollback that we’ve heard circulating amongst our friends, colleagues, customers,…

Two Shocking Contract Management Mistakes That Cost Bankers Their Jobs

You probably think of vendor contract management as something that protects your institution. That’s true, but it does much more than that.

FS-ISAC: Third Parties “Still a Big Risk”

Financial institutions need to continue to pay close attention to third-party access points, control objectives, reporting, monitoring, and gap analysis

Are Silos Stunting Your Risk Management Efforts?

In risk management, there’s a big difference between thorough and redundant. Thorough is a unified, top-down approach with all decisions and discoveries