6 Silo-Busting ERM Tips

How do seasoned risk professionals fight risk management inertia? They find ways to dismantle silos and develop processes to spark discussion about risk

Ncontracts Recognized by Inc. Magazine as one of America’s Fastest Growing Companies

Ncontracts, the leading provider of integrated risk management solutions for financial institutions has joined the Inc. 5000, the magazine’s annual...

15 Key Insights from the CFPB’s 2018 Fair Lending Report [Part One]

The CFPB's released the 2018 Fair Lending Report to Congress in June. Here is the first of our 2-part blog about the regulatory insights you need to know.

CU Broadcast Interviews Stephanie Lyon on Compliance Management System for Financial Institutions

Our very own Director of Compliance, Stephanie Lyon, talks with Mike Lawson from CU Broadcast about the company's new CMS solution for FIs.

Bank Audit

A bank audit is a routine procedure designed to review the services of financial institutions to ensure they are in compliance with laws and industry

13 Movies and Shows Every Bank Compliance Nerd Needs to Watch

Here are a few banking compliance movies and TV shows for you to check out, and prove to your friends and family that compliance is entertaining!

Vendor Employees Gone Wild: Structuring Vendor Contracts to Guard Against Rogue Insiders & Cyber Threats

Capital One and its credit card applicants and customers are not having a good week.

Tips for Implementing 3 Lines of Defense in your CMS from a Compliance Pro

Learn tips for how to implement three lines of defense into your compliance management system from a compliance pro with more than 20 years of experience.

A Model CIO: Equifax CIO Keeps Showing Us How *Not* to Respond to a Breach

The big news out of Equifax this week is its $700 million settlement as a result of its 2017 data breach. It’s the most expensive breach settlement ever.

What are the Three Lines of Defense in a Compliance Management System?

Learn the essential definitions of a compliance management system (CMS), and what the three lines of defense really are.

The Risk Management/HR Connection

How often do you engage with human resources? Risk managers may not give a lot of thought to human resources, but they should.

Hate Illegal Telemarketing Calls? So Does the FDIC.

The good news is at least one agency is taking action to enforce telemarketing regulations. The bad news for one community bank is that it’s the FDIC.

2 Key Elements of a Successful Compliance Management System from the CFPB

Learn the two essential components of any successful Compliance Management System (CMS) to ensure that your financial institutions is in shape.

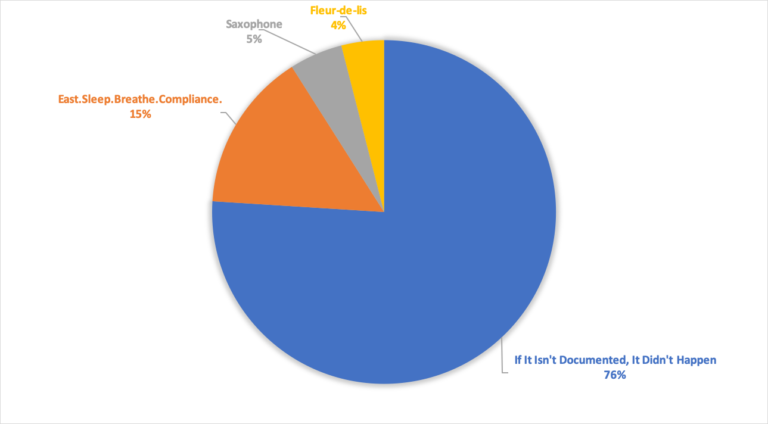

Are You Using a Data-Driven Approach to Compliance Risk?

Make sure that your risk management metrics are keeping up with the outside world, and help your institution separate fact from perception.

This $25M Settlement Highlights UDAAP Risk and FDCPA Changes

This recent $5M Civil Money Penalty from the CFPB against a debt collector highlights the importance of compliant debt collection practices. Learn more!

3 Elements of a Vendor Cyber Monitoring Program

An FI’s vendor management program is part of its enterprise risk management. Vendor management can’t be done in a vacuum.

Fair Lending Fireworks: 3 Trends in the Hottest Area of Compliance

In the spirit of July 4th, learn what's sparking fireworks in Fair Lending compliance. After the $1.75M consent order, this is news you'll want to know.

Another Vendor Behaving Badly: Failed Vendor Management Results in $236K+ Consent Order

Failing to engage in appropriate third-party vendor planning, due diligence, contract negotiations, and ongoing monitoring has bad results.

Frequently Asked Questions About Cyber Monitoring

Here are the most common questions we get asked about vendor cyber monitoring:

Does this $1.75M Fair Lending Consent Order Signal Changes in Compliance Enforcement?

Does this $1.75M Fair Lending consent order signal a change in regulatory enforcement? We're talking HMDA, Fair Lending, and what this means for you.

Ncontracts Announces Integration With Compliance Alliance

Ncontracts Announces Integration With Compliance Alliance

3 Lessons Learned from the ABA Regulatory Compliance Conference

In this post, you'll learn 3 essential insights gained from the ABA Regulatory Compliance Conference that every compliance pro needs to know!

Lessons Learned from Giving Away 1,100 T-Shirts at an ABA Conference

We handed out our full inventory of 1,100 free t-shirts at the ABA Compliance Conference earlier this month! Here's what we learned:

What to Do When You’re Worried About Your Vendor’s Finances

How do you know your vendor is in trouble and what can you do if it is? Read on to find out.

Ncontracts Launches New Compliance Management System (CMS), Ncomply

Ncontracts Launches New Compliance Management System (CMS), Ncomply

OCC: Operational Risk Remains Elevated

The only certainties in life are death and taxes, but I can think of one more thing: risk.

TRUPOINT Partners is Becoming NTRUPOINT - What That Means For You

There are big changes coming to TRUPOINT Partners over the next few weeks and months. Here’s what all those changes might mean for you.

Due Diligence 101: Are On-Site Visits Required?

Let’s start with guidance on the subject. There is very little guidance requiring on-site due diligence. It’s peppered with words like “may” or...

Creating Value with A Culture of Risk Management

Many bankers think the concept of a “risk management culture” is thought exercise. It’s the kind of psychobabble that takes up time that could be dedicate

Your Complete Guide to the ABA Regulatory Compliance Conference in New Orleans

Here is everything you need to know to prepare for the American Bankers Association Regulatory Compliance Conference from June 9-12 in New Orleans!