Are You Prepared to Defend Your PPP Lending?

Regulators are examining PPP lending, be sure your financial institution is prepared to defend your loan decisioning.

.jpg)

Risk Culture vs. Compliance Culture: What’s the Difference?

Risk culture and culture of compliance are common buzzwords these days. What’s the difference and what does that mean for your institution?

Let Me Tell You a Story

Let us tell you a story about a bank that works hard to comply with fair lending laws to be there for the people of Far, Far Away.

Internal Audit Failures Costs JP Morgan $250 Million

JP Morgan failed to maintain adequate internal controls and internal audit over its fiduciary business and it cost them $250 million.

Lending Compliance: Building Up the Three Lines of Defense

A financial institution’s lending compliance management system must effectively guard the FI against unnecessary risk with these three lines of defense.

Weigh the Risk Before Cutting These Key Costs, OCC Says

OCC is warning banks to be careful when cutting funding for key control functions and processes.

New Redlining Suit: Are You Making the Same Mistake as Redfin?

Redlining made news again when the NFHA and other fair housing organizations filed a suit against Redfin, an online real estate service.

What Examiners are Looking for: Board Oversight

Examiners aren’t just looking to see what’s right with board management. They also want to uncover anything that’s gone wrong.

Ncontracts Launches New Podcast - The Ncast

The leader in integrated risk management solutions launches a new podcast focused on the people and issues on the front lines of risk and compliance

Ncast Podcast Launches with Remote Exam & Cyber Risk Discussion with ABA’s Paul Benda

Today we’re excited to announce the launch of our new weekly podcast, the Ncast! The Ncast Podcast launches with Remote Exam & Cyber Risk Discussion

What Went Wrong? CFPB Fines Bank $200,000 for HMDA Errors

This week we bring you a reminder that the CFPB could fine your bank $200,000 for HMDA data errors.

HMDA Data Scrubbing FAQ

Here are the answers to your most frequently asked questions about HMDA data scrubbing.

What does the 'M' in CAMELS stand for?

The M in CAMELS stands for management, who is responsible for setting and implementing the strategic decisions and plans that determine CAMELS rating.

Halloween Fun: Spook-tacular Risk, Compliance & Vendor Management Stories

We’ve put together a collection of our best Halloween-themed risk, compliance, and vendor management blog posts.

Inside USAA’s CRA Rating Downgrade and $85 Million Penalty

USAA’s CRA rating was downgraded after the OCC found llegal credit practices which cost USAA $85 million in penalties.

How Does Your Business Continuity Plan Measure Up?

Financial institutions must be resilient and ready for anything. How does your business continuity plan measure up?

6 Essentials for Flawless Policy Management

Flawless policy management is essential as regulations, the operational environment, and your financial institution’s priorities shift.

How to Manage Cyber Risk Like a Boss

October is National Cybersecurity Awareness Month and it’s an annual reminder of how financial institutions—need to do their part to manage cyber risk.

Citibank’s $400 Million ERM & Compliance Fine: 6 Lessons Learned

Not properly implementing enterprise risk management for financial institutions can result in unsound practices, penalities, and more.

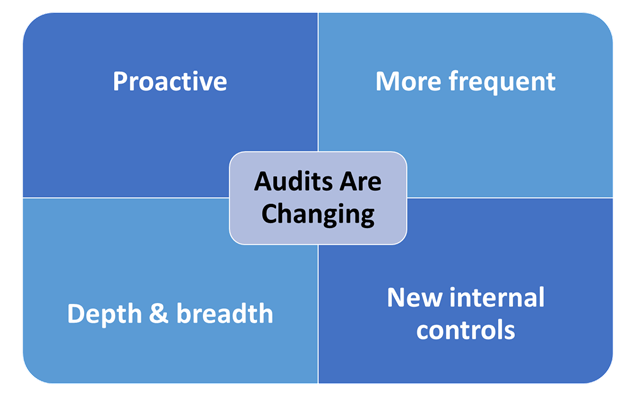

Audit Management Is Evolving. Are You Keeping Up?

Audit management programs have been predictable and formulaic for most of banking’s history. However, things are evolving, is your financial...

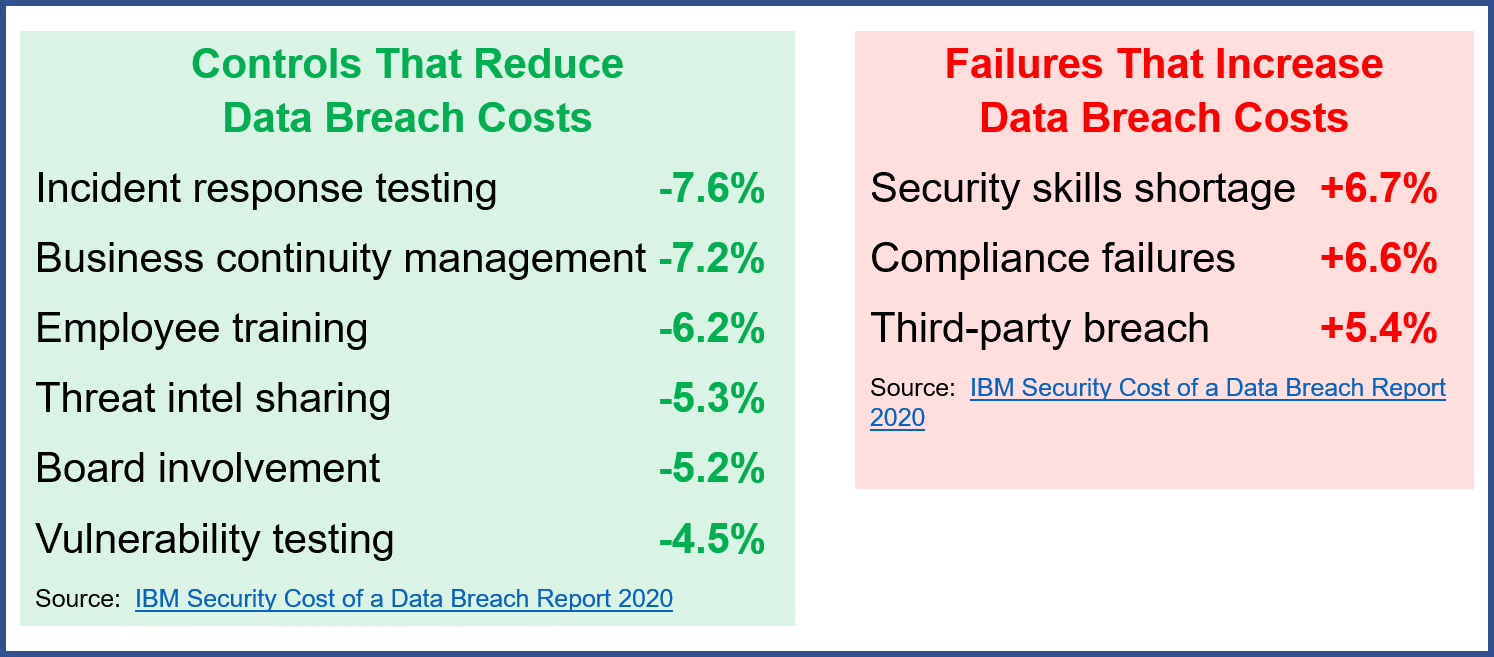

How to Reduce the Cost of a Data Security Breach at a Bank or Credit Union

Cyber risk management controls that reduce the risk of a data security breach occurring also reduce the cost of a data breach at banks and credit unions.

CFPB Proposals on Small Business Data Collection

Understanding how the CFPB may implement sec 1071 of Dodd-Frank can help your FI make strategic decisions when it comes to small business data collection.

10 Must-Have Elements to Include When Drafting Policies

When drafting policies, be sure to include these 10 must-have elements in each one to keep them effective.

11 Can’t-Miss Compliance Management Tips From Top Compliance Officers

11 can't miss compliance management tips from some top compliance officers. Some of the latest tips and tricks for making compliance more effective.

Fed Releases Community Reinvestment Act (CRA) Modernization Proposal

After a long deliberation, the Federal Reserve released its Advanced Notice of Proposed Rulemaking (ANPR) for the Community Reinvestment Act this week.

Is Your Vendor Prepared for Disaster?

Recent analysis conducted by the FDIC’s OIG finds that just half of vendor contracts it reviewed “explicitly included business continuity provisions.”

5 Ways to Show Your Files Some Love—and Better Manage Risk

In honor of National Love Your Files Week (September 21-25), we’re sharing our top five tips for making file management simpler and more efficient

7 Ways to Cut Compliance Costs & Still Stay Compliant

Many financial institutions are using creativity and practical thinking when looking for ways to cut compliance budgets and still remain compliant.

CFPB Sues Debt Collectors: Are You Making the Same Compliance Mistakes?

The CFPB sued debt collectors and debt buyers for making compliance mistakes that allegedly violated the CFPA and FDCPA.

How Have Critical Vendors Performed During the COVID-19 Pandemic?

The COVID-19 pandemic has been a trying time for everyone—including financial institutions working with third-party vendors.