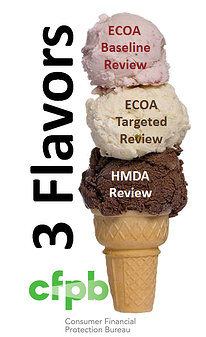

The Consumer Financial Protection Bureau quietly published its Baseline Review modules for examination of compliance with the Equal Credit Opportunity Act (ECOA). The new Baseline Reviews will be used in conjunction with fair lending statistical analysis to obtain a full picture of fair lending compliance and fair lending risks at the entity. The CFPB has now defined three unique types of fair lending reviews used to analyze fair lending compliance and fair lending risks. Which flavor of exam will your organization receive?

According to the recently published module, there are three types of fair lending reviews conducted by the CFPB:

- ECOA Baseline Reviews – Used to identify and analyze risks of ECOA violations, that facilitate the identification of certain types of ECOA and Regulation B violations, and to inform fair lending prioritization decisions for future CFPB reviews.

- ECOA Targeted Reviews – In-depth look at a specific area of fair lending risk, and is conducted using the ECOA Examination Procedures within the CFPB Supervision and Examination Manual.

- HMDA Reviews – Transactional testing for HMDA data accuracy, and is conducted using the HMDA Examination Procedures within the CFPB Supervision and Examination Manual.

Black Friday, Card Creepers, and Aluminum; Oh My!

Baseline Reviews are broken into modules. The completed modules will be utilized in conjunction with fair lending statistical analysis to obtain a full picture of fair lending compliance and the fair lending risks at the entity. These Baseline Review modules include the following:

- MODULE 1: Fair Lending Supervisory History - Is there a history of violations, areas of fair lending risks identified in prior exams, new risks that may have emerged since the last fair lending exam? What efforts have there been to address these conclusions or concerns?

- MODULE 2: Fair Lending Compliance Management System - Evaluation of the entity’s fair lending compliance program, including management participation, policies and procedures, training and internal controls and monitoring.

- MODULE 3: Risks Related to Mortgage Lending Policies and Procedures – Evaluation of the policies and procedures for underwriting, pricing, and other areas (e.g. marketing, third parties, CRA assessment areas, loan officer compensation).

- MODULE 4: Risks Related to Mortgage Servicing – Evaluation of mortgage servicing (and loss mitigation) policies and procedures.

- MODULE 5: Risks Related to Auto Lending – Evaluation of policies and procedures for pricing, underwriting, referrals, loan originator, dealer and other third party compensation for both direct and indirect auto lending.

- MODULE 6: Risks Related to Other Products – Identify types of products reviewed: Secured or Unsecured Consumer Lending, Credit Cards, Add-On Products, Private Student Lending, Payday Lending or Small Business Lending. Evaluation of policies and procedures for underwriting, pricing, referrals, compensation, marketing and other lending operations as they relate to fair lending risks.

Bottom Line: To no one’s surprise, Mortgage Servicing and Auto Lending (direct and indirect) have risen in prominence inside the new Fair Lending Baseline Review module. There is a consistent focus on policies and procedures that may have negative, unjustified impact on a prohibited basis group. There is also a consistent focus on employee discretion and exceptions.

What This Means to You: You can expect more scrutiny focused on Mortgage Servicing, Indirect Auto Lending, Policies & Procedures, Employee Discretion, Exceptions, and your numbers (fair lending statistical analysis) as regulators look to obtain a full picture of fair lending compliance and risks within your organization.

Ncontracts can help you prepare for your next exam.

Read More: