Compliance Management Software

Struggling to keep up with compliance — and do it efficiently? Meet Ncomply, the all-in-one compliance management system for financial services companies. Streamline compliance research, implementation, and oversight in a single, centralized platform — eliminating silos, reducing manual effort, and ensuring your institution is on top of regulatory requirements.

Relied on by thousands of financial institutions nationwide

Essential Compliance Management Software

Ncomply takes the pain out of implementing compliance management. With powerful features designed to reduce complexity, improve efficiency, and eliminate manual tracking, it streamlines your processes, making compliance easier for your team.

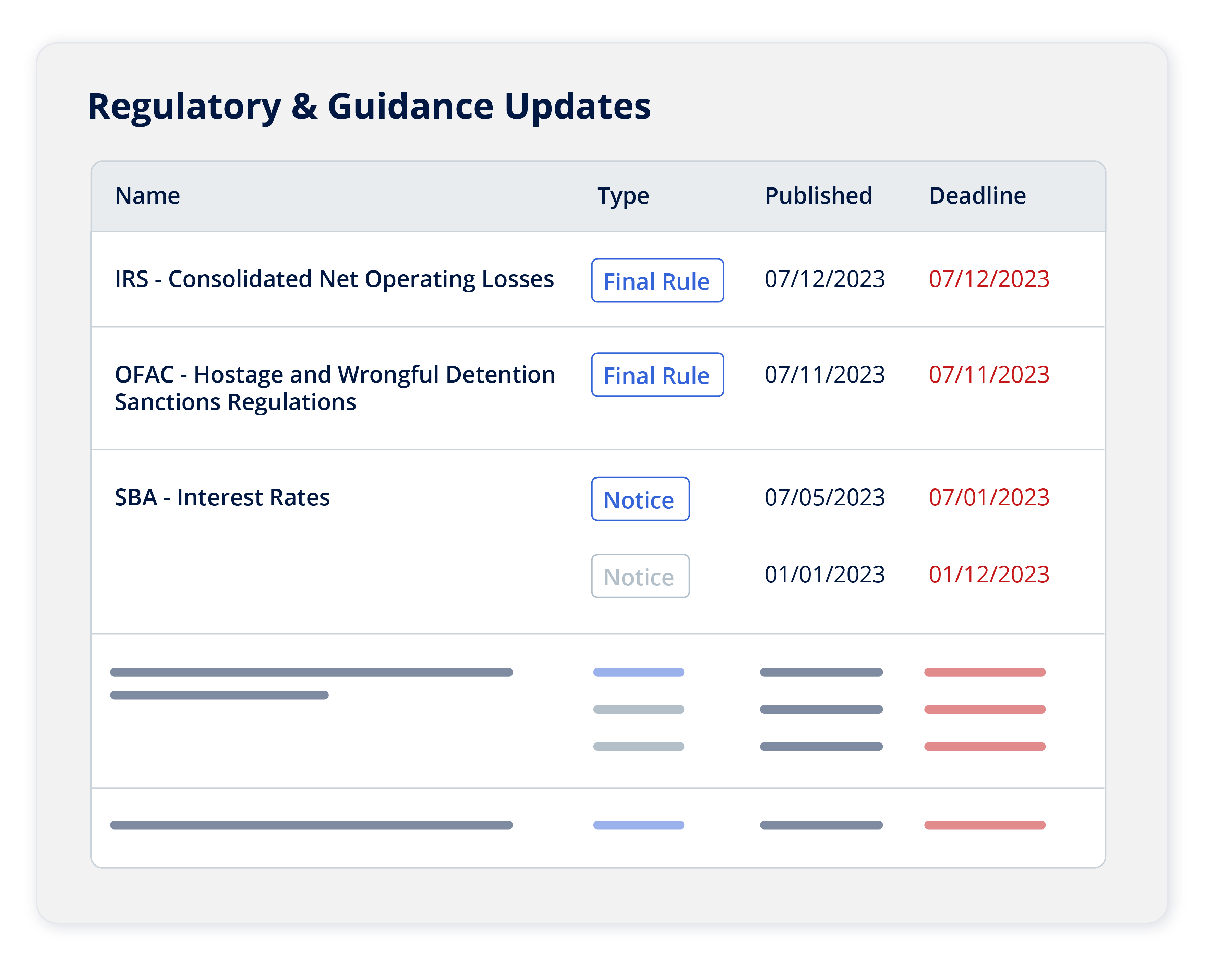

Tailored Regulatory Alerts

Receive instant notifications on regulatory changes — including links to Federal Register summaries, deadlines, and suggested action plans for implementation — based on your organization’s size, products, services, examiner, and geography.

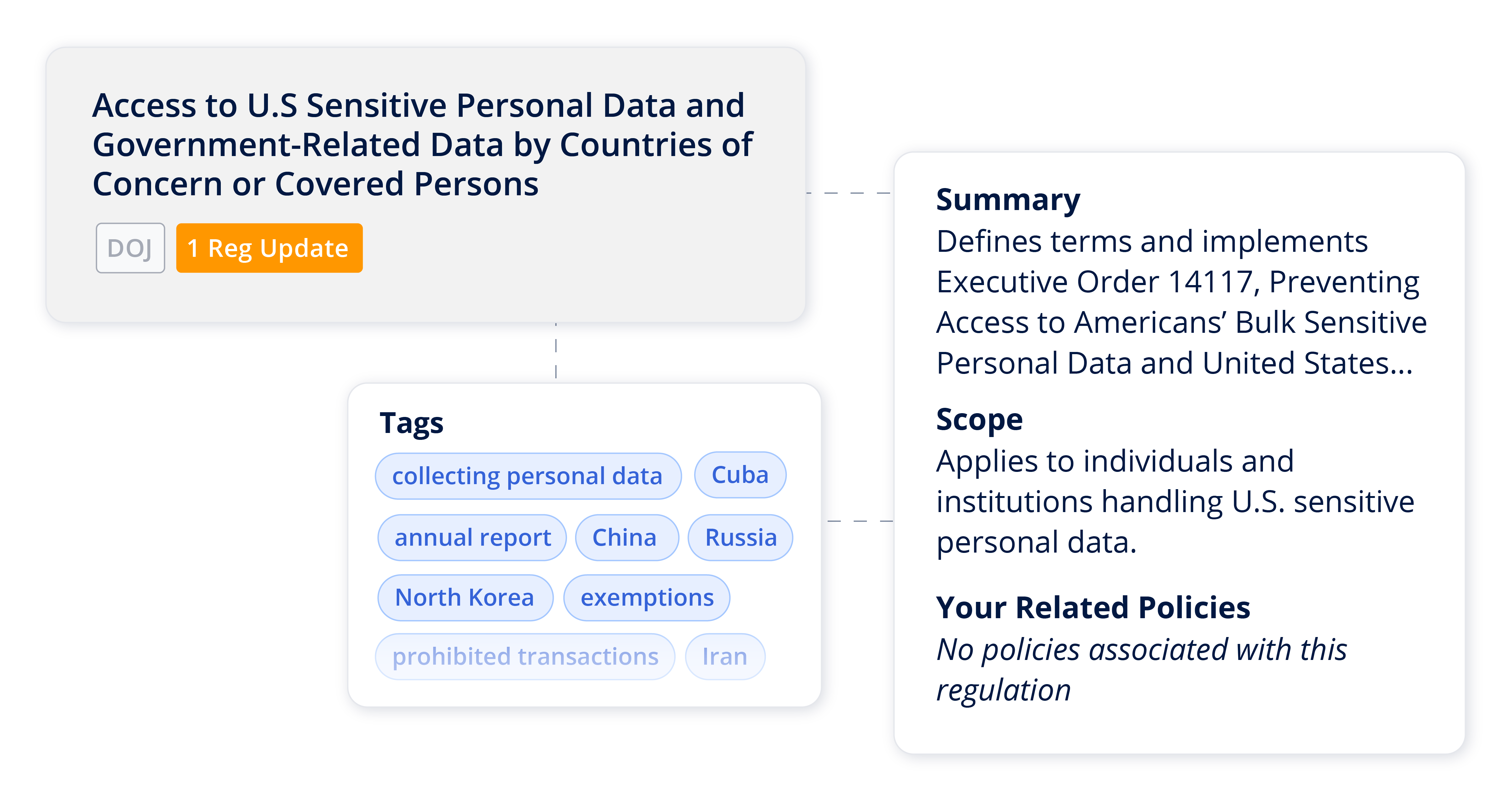

User-Friendly Regulatory Library

Access a real-time database of nearly 5,000 guidance documents, 6,000+ U.S. and state rules and laws, and 11,000+ industry news updates. Search and filtering tools make it easy to find relevant compliance information quickly.

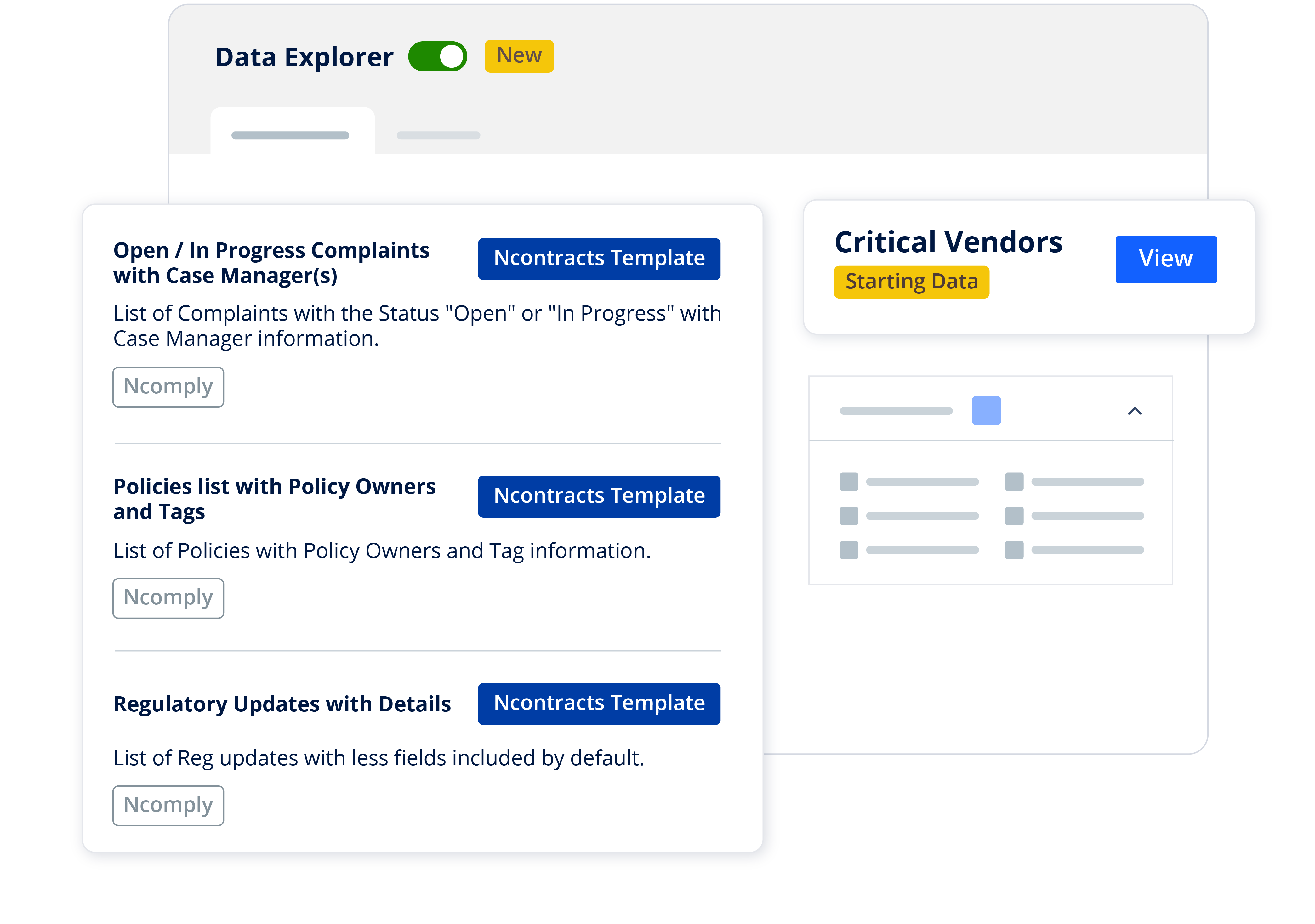

Robust Exam-Ready Reporting

Track cost breakdowns, regulatory changes, policy updates, and complaint management in one place. Generate detailed reports for stakeholders, management, and examiners to demonstrate compliance with ease.

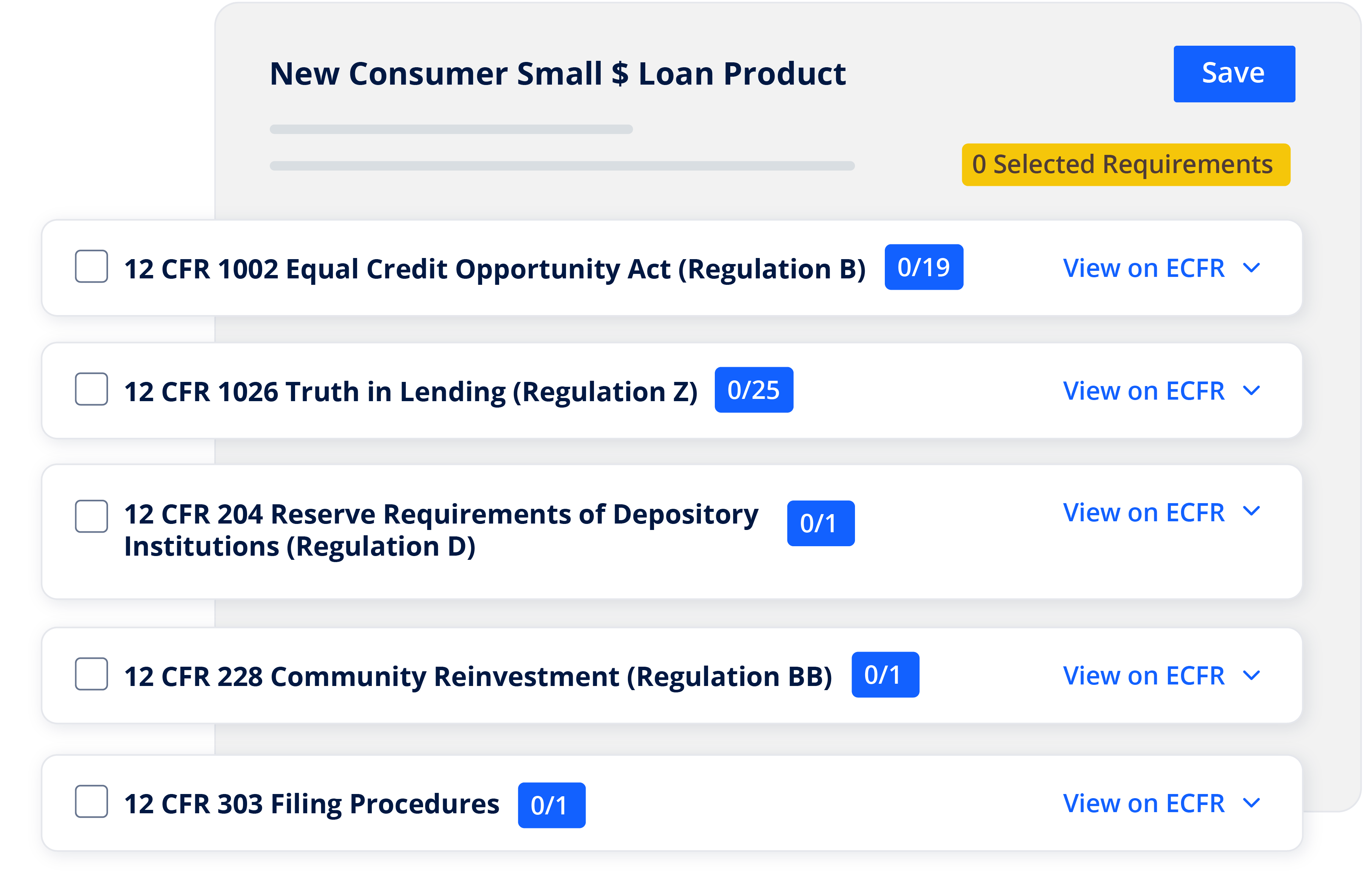

Simple Requirements Builder

Assess regulatory requirements for new products, services, or business expansions in minutes. Ncomply’s requirements builder tool enables compliance teams to provide insights that support smarter decision-making.

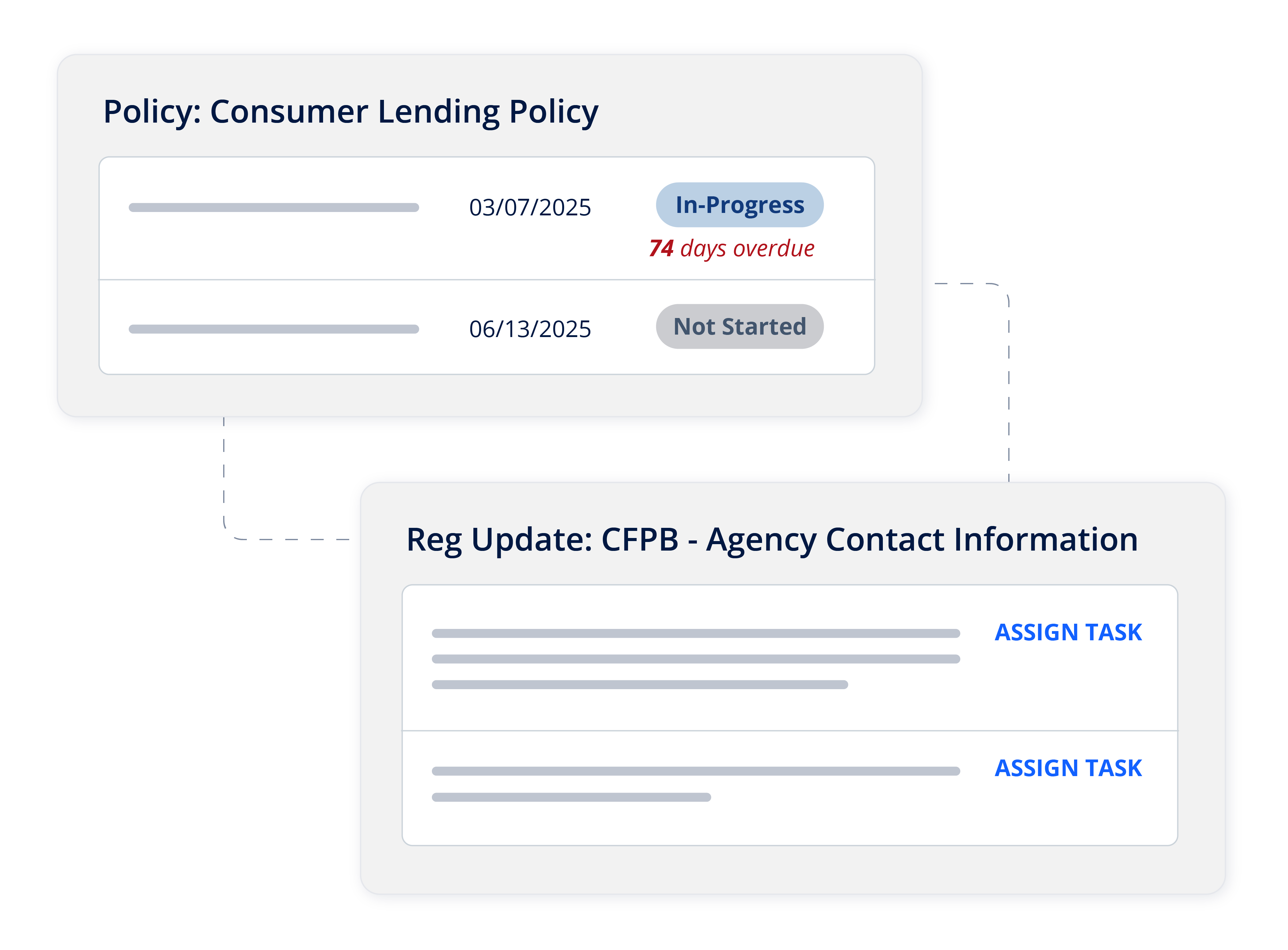

Dynamic Policy Management

Manage policies with version control, automated reminders, and board approval tracking. A centralized library ensures policies remain up to date and easily accessible for audits and internal reviews.

Customizable Policy Templates

Get a head start on policy writing with a library of policy templates drafted and regularly updated by financial institution compliance experts to align with evolving regulatory requirements and best practices. Customizable to fit your institution’s specific needs.

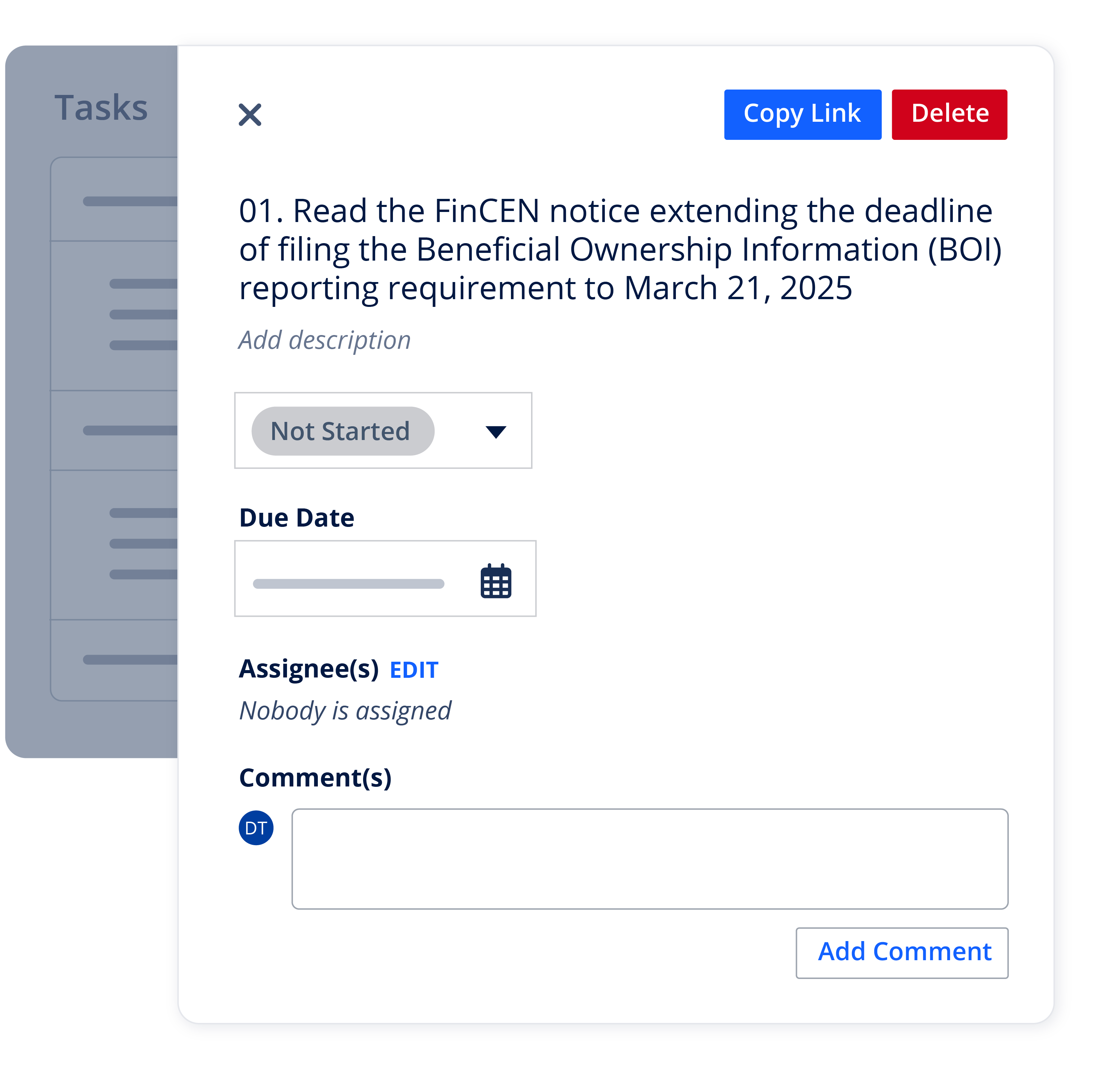

Interdepartmental Collaboration Tools

Our compliance management solution breaks down departmental silos. With automated task reminders, progress tracking, and assignments, Ncomply creates accountability and promotes a compliance culture across the institution.

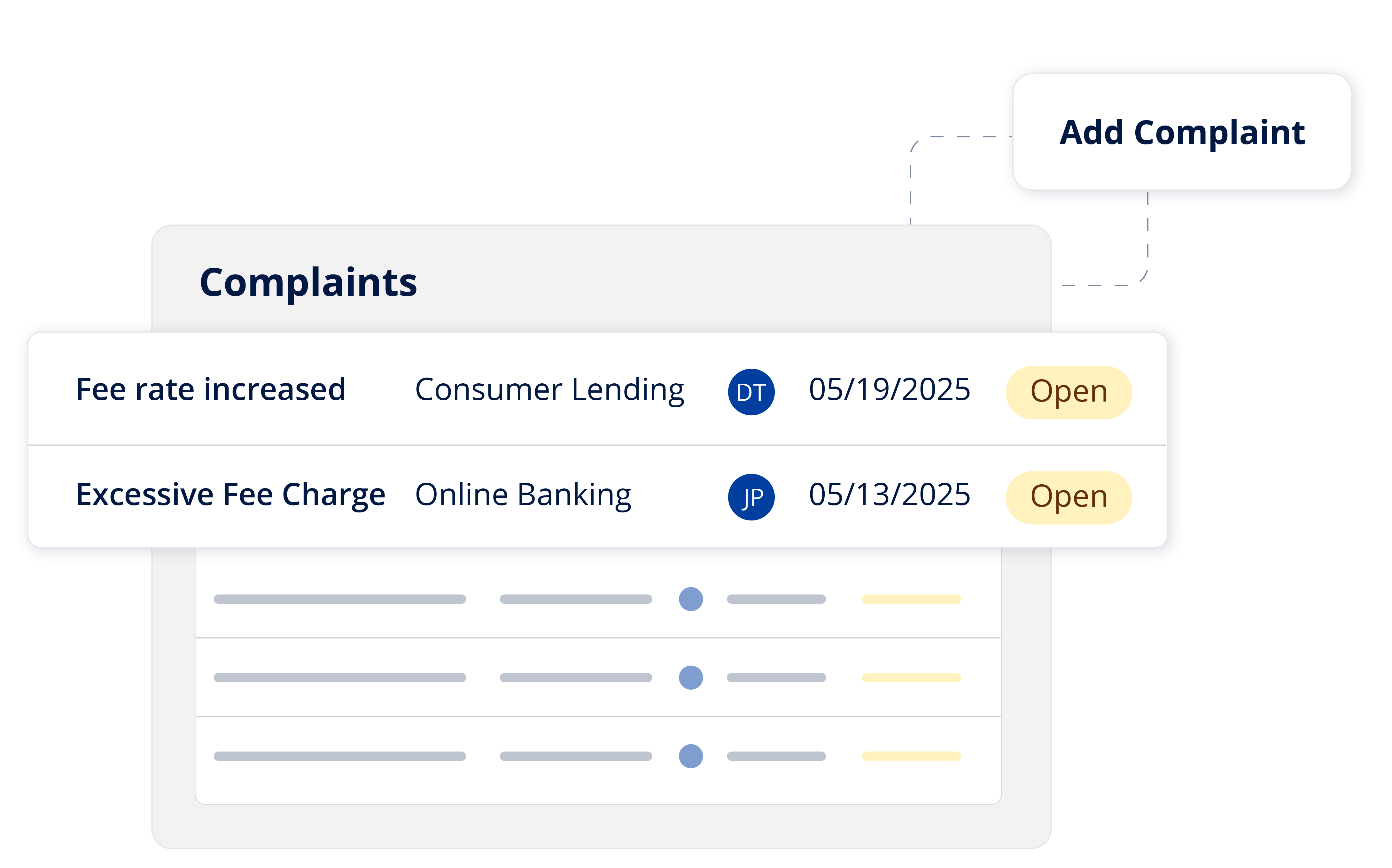

Ntelligent Complaint Management

Log, investigate, and resolve complaints efficiently with Ncontracts' complaint management software — now powered by Complaint Ntelligence. Automatically classify complaint types with clear confidence levels, extract key details for faster investigation, and enable efficient root cause analysis. Transform reactive complaint handling into proactive risk management with 90%+ accuracy in complaint cataloging and classification.

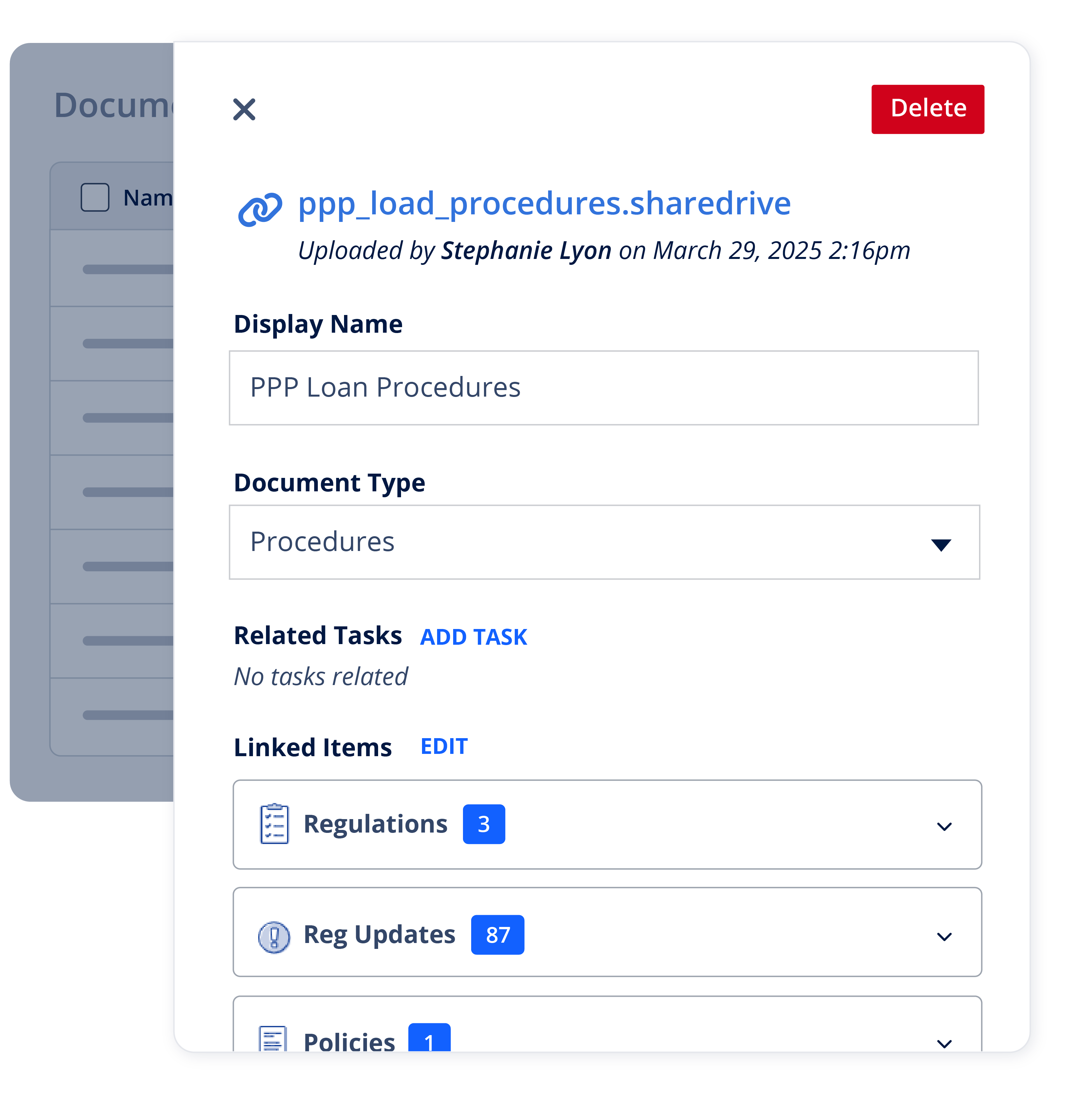

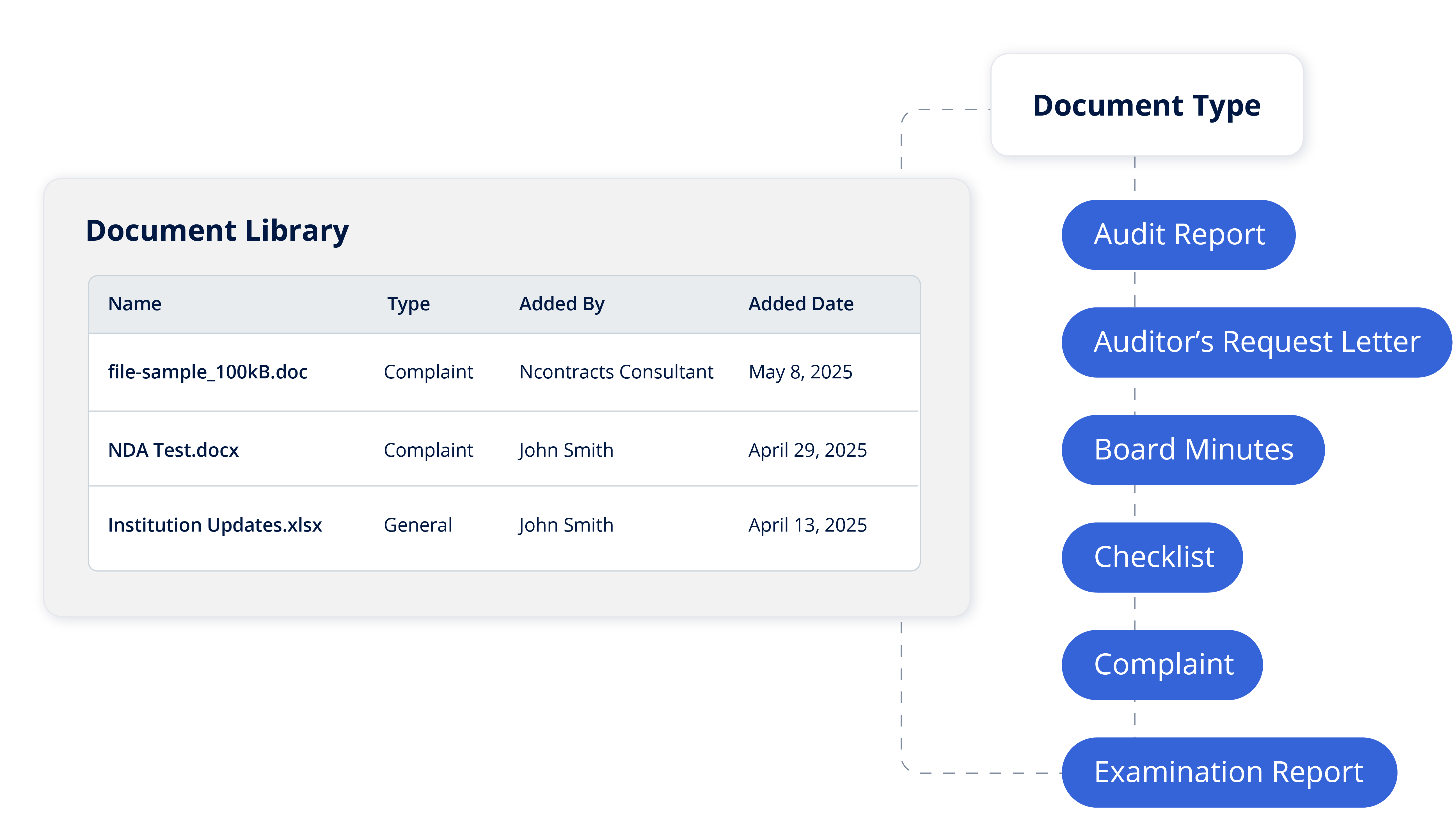

Unlimited Document Management

Store, organize, and retrieve compliance documents in a centralized repository. Advanced search and filtering features keep everything accessible and exam-ready.

Expert implementation services and support

Task management

Knowledge base with 100+ compliance training videos

Continuous updates

Due date and deadline monitoring

Customer Success Story

"Without Ncomply, I’d still be dealing with meetings on a regular basis".

When Langley Federal Credit Union needed a compliance solution, it turned to Ncomply. With our cost-effective software, Langley lowered its compliance workload by 33%.

Compliance Management, Simplified

Managing compliance is complex, but it doesn’t have to be. Ncomply is the compliance management solution that streamlines oversight, automates tasks, and keeps your team informed, so you can stay organized and navigate compliance requirements with confidence.

Eased Workload, Increased Confidence

Reduce compliance headaches with research tools, industry expert guidance, automation, centralized data, and detailed tracking. Spend less time on manual tasks and more on strategy, knowing your compliance program is organized and up to date.

Streamlined Compliance Oversight

No more scattered, manual tracking — Ncomply centralizes compliance processes, improving efficiency, ensuring consistency, and giving compliance teams a clear, current view of activities across departments.

Faster, More Informed Decision-Making

Real-time regulatory updates and automated alerts keep your team informed, allowing compliance to quickly assess compliance issues and risks, track and implement changes, and provide clear guidance for confident, proactive decision-making.

Enhanced Exam Readiness

Robust reporting, centralized documentation, and clear audit trails give compliance teams the visibility to stay prepared, streamline exam prep, and easily demonstrate compliance to examiners and internal audit with well-documented records.

Faster Compliance Onboarding

Quickly onboard new staff and bridge knowledge gaps left by departing employees, ensuring smooth transitions and uninterrupted operations with minimal downtime.

Expert Support, Continuous Improvement

Built by compliance experts, Ncomply offers industry-leading support, seamless implementation, and ongoing enhancements, ensuring your team has the knowledge and tools to stay ahead of regulatory changes and legal requirements.

Compliance Management Buyer’s Guide

Discover the advantages of compliance management software for streamlining processes, boosting performance, and achieving complete exam readiness. Minimize the time your team spends tracking down regulatory documents.

.png?width=1150&height=924&name=Copy%20of%20Various%20Clients%20%20Social%20Images%20(1).png)

Frequently Asked Questions

Relied on by financial institutions nationwide, Ncomply drives reliable, efficient compliance for confident results.

A compliance management system (CMS) is a framework financial institutions use to efficiently navigate and manage compliance obligations, ensuring operations always comply with regulatory requirements, industry standards, and internal policies. It is also a regulatory requirement. Many financial institutions use software to streamline and organize their compliance program.

Compliance management solutions like Ncomply centralize key compliance functions, providing a single source of truth and a hub for compliance processes and communication. They promote effective compliance with tools for:

- researching, tracking, and interpreting regulations;

- streamlining policy, complaint, document and task management; and

- fostering a culture of compliance and enhancing communication and across the organization.

Yes, compliance software includes reporting features that help report on compliance risks – both in the industry (new regulations, enforcement actions and other regulatory news and updates) and at your institution.

Compliance monitoring software automates and streamlines the tracking of regulatory changes, ensuring ongoing adherence to policies and procedures. It provides real-time updates on regulatory changes, enabling compliance teams to quickly assess their impact and take necessary actions. With features like automated task reminders, audit trails, and reporting tools, such software helps organizations monitor compliance status, track progress, and maintain detailed records for audits or exams. This continuous monitoring reduces manual effort, mitigates risks, and ensures consistent compliance implementation across the organization.

Banks, credit unions, mortgage companies, fintechs, wealth management firms, broker-dealers, insurance companies and other companies benefit from enhanced operational efficiency and better compliance risk management when they adopt a regulatory compliance platform.

Enforcement Action Tracker

Our Enforcement Action Tracker keeps you in the know with timely, plain-language summaries of recent enforcement actions from the CFPB, FDIC, OCC, Federal Reserve, and other key regulators.

Regulatory Compliance Updates

Join our team of regulatory compliance experts to know more about latest regulatory changes, news, and enforcement actions – and what they mean for your institution.

Compliance Management Buyer’s Guide

Learn how compliance management software can help you streamline your compliance processes, improve performance, and keep your organization exam-ready.

Compliance Risk Management Explained

Managing compliance risk is essential to enterprise risk management (ERM), the framework a financial institution uses to holistically manage risk throughout the organization. Here's more.

Navigating Change

A Comprehensive Guide to Effective Change Management in Financial Institutions

Langley FCU Cut Compliance Workload by a Third with Ncomply

VP of ERM and Internal Audit Mark Hutchinson realised that Langley FCU could now address faulty processes, not just individual complaints, thanks to Ncontracts' Ncomply.