The CFPB is expected to release their HMDA data submission tool in the upcoming months. In this post, we'll discuss some key facts and features about the new HMDA Platform, and what it might mean for you.

Next year, the Consumer Financial Protection Bureau will take over the operational functions for HMDA data collection and reporting from the Federal Reserve Board. This applies to all HMDA data collected in 2017 that will be reported in 2018, and beyond.

Next year, the Consumer Financial Protection Bureau will take over the operational functions for HMDA data collection and reporting from the Federal Reserve Board. This applies to all HMDA data collected in 2017 that will be reported in 2018, and beyond.

The regulators will analyze this HMDA data to identify risks and prioritize institutions for exams in the upcoming year.

A few weeks ago, the Mortgage Bankers Association and the CFPB together hosted an informative webinar about the Bureau's soon-to-be-released Home Mortgage Disclosure Act data submission tool, called the HMDA Platform. During the webinar, two representatives from the CFPB explained the technology and process of data submission in the future.

Below are a few facts at a glance:

- The CFPB is launching the HMDA Platform to process data collected this year (2017) and beyond. It is an online data edit-check and submission tool that is designed to process the HMDA data.

- The HMDA Platform is only available online.

- The beta version HMDA Platform is expected to go live in Q3 2017. The complete version will be formally live on January 1, 2018.

Get Your Free HMDA Analysis Sample Report Today!

Learn how easy it is to analyze your HMDA data and prepare for regulatory scrutiny! Get a free sample report today:

According to the CFPB, they have reviewed the current HMDA reporting process, and are hoping to improve it with the new HMDA Platform. In particular, they intend this new process to improve the data collected and released, reduce the burden on financial institutions, and modernize and streamline the collection and reporting of HMDA data, possibly in preparation for HMDA Plus.

In general, here is how to use the CFPB's HMDA Platform:

- Format your HMDA LAR file properly for submission.

- Upload it into the HMDA Platform.

- Review and complete any necessary edits identified by the HMDA Platform.

- If edits are necessary, make them and resubmit the new HMDA LAR file. It will overwrite the existing file.

- When your LAR is edited and checked, click submit!

- You're all done.

We've included some additional details about how to use the new HMDA Platform and what it means for you after the following images below.

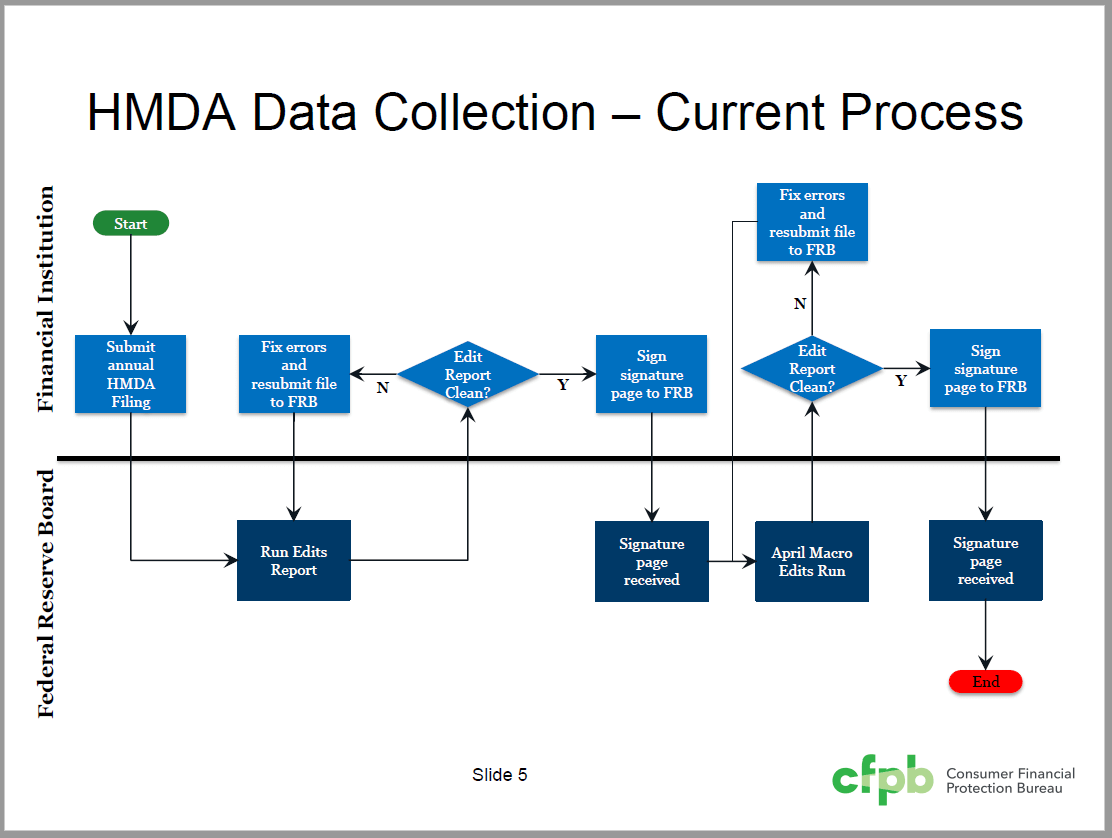

But first, here are two workflows outlined during the webinar that show how the new HMDA Platform will be used to improve the HMDA data editing, submission and transmittal process. Here is how the CFPB currently views the HMDA data process:

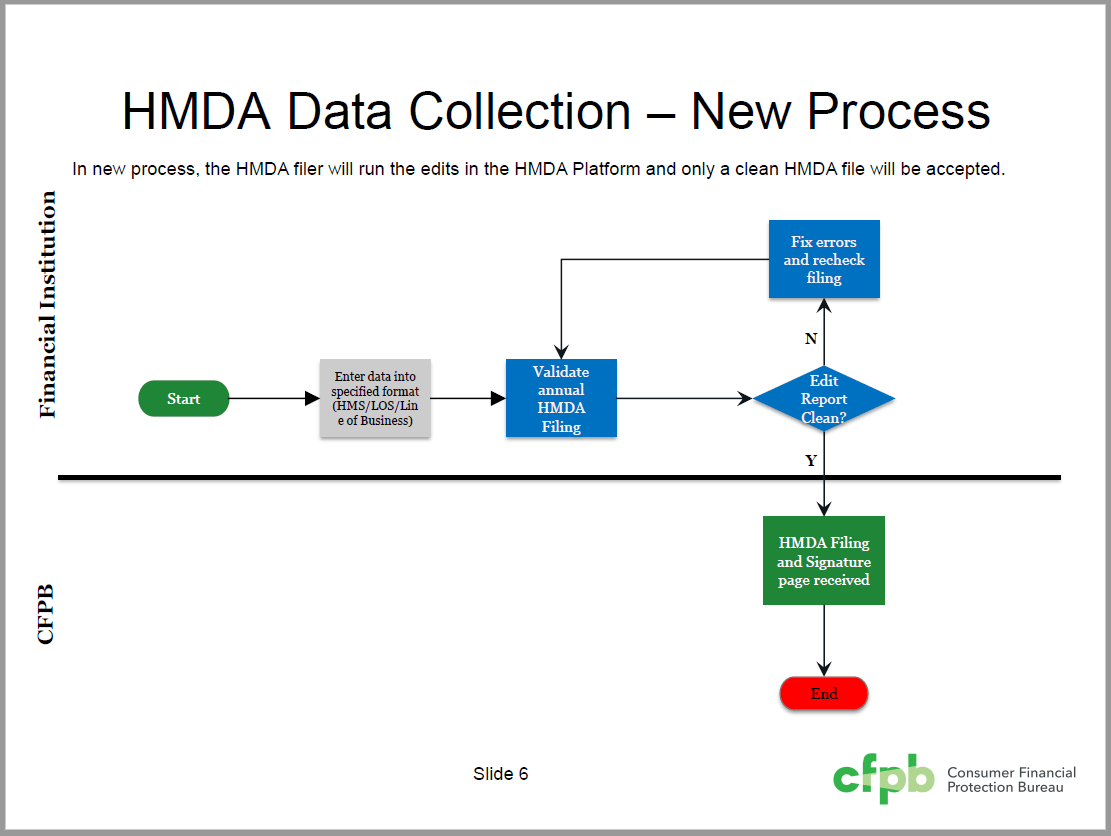

And here is how the CFPB visualizes the process with the new HMDA Platform:

The HMDA Platform will guide financial institutions through the entire filing process, including review of any edits, and certification of the HMDA LAR's accuracy and completeness. (For details about file format and other requirements, check out this Filing Instructions Guide.)

Below are more detailed steps for how to use the new HMDA Platform:

- Every HMDA-filing financial institution will be required to register online for login credentials and an account when that process goes live in Q3 2017. An institution may have multiple authorized representatives, or users, in the HMDA Platform.

- If you've filed HMDA before, an authorized representative from your financial institution can do this online.

- If you're a new HMDA filer, you will be directed to HMDA Help to set up your account.

- An individual can be authorized by more than one HMDA-filing financial institution to submit HMDA data on their behalf. The user will indicate the institution(s) they are authorized to file for during registration.

- Before uploading your data into the HMDA Platform, you will need to format your LAR for submission into the HMDA Platform. To do this, you can use the FFIEC's LAR Formatting Tool, which is free to download.

- You don't need to use the LAR Formatting Tool if you format your data into a pipe delimited text file using either vendor HMDA software, your LOS, or a spreadsheet tool (like Excel) that can format it.

- You HMDA LAR should be a single file, as the HMDA Platform can't merge files.

- If you accidentally upload an incomplete LAR, you can re-upload a new file to replace your existing file at any time before submission.

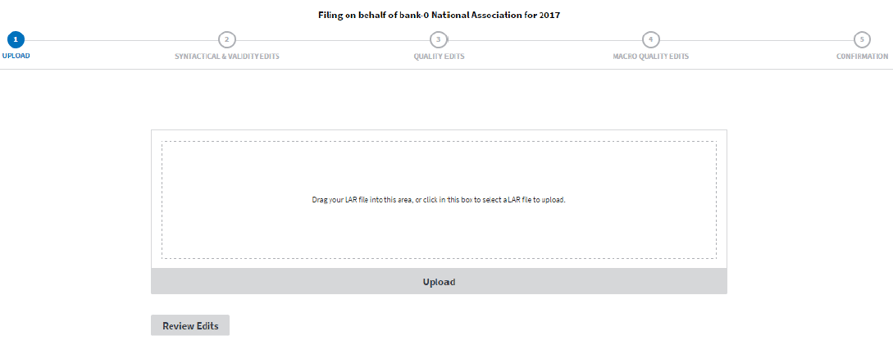

- Upload your data into the HMDA Platform. Here is an image of what that screen will look like:

- The HMDA Platform will help you edit your LAR, if needed, by flagging edits as you move through the system and asking you to review them. These edits will need to be addressed by the March 1 deadline.

- The HMDA Platform will identify any syntactical or validity edit, as well as any quality and/or macro quality edits.

- If edits are needed, the filer will need to correct the data, and refile the updated LAR to the HMDA Platform. The process will then repeat until the LAR is accurate and able to be filed.

- When the edits are complete, simply click submit!

Here are a few additional points to consider:

- If you need to refile before the HMDA submission deadline, you can do so via the platform. You will need to confirm that you'd like to refile, and go through the same edit-check process again.

- The FFIEC's Data Entry Software will no longer be available as a method of data entry or submission.

- You can't use a Apple Mac computer to file your HMDA LAR, because the HMDA Platform only works on Windows operating systems.

For more information about the HMDA Platform, visit the CFPB's overview page here. To learn more about technical requirements and troubleshooting, check out these FAQs.

This HMDA Platform has the potential to be a game-changer for HMDA data transmittal. In general, it seems like this process will be a little bit more straightforward than in the past.

While it seems that you may still opt to lean on vendors to help with transmitting your HMDA LAR to the government, it remains to be seen exactly how, and the ways that might impact the industry.

Ncontracts Viewpoint: If you're an Ncontracts customer, please know that we are working on ways to make your HMDA data analysis and transmittal easier.

We will be watching the CFPB's guidance, and getting you ready to submit in March. If you have questions, please get in touch with your Customer Success Manager!

We are already able to help analyze your HMDA Plus data, and will be focusing on how to improve your HMDA compliance with the imminent release of the public HMDA data.

If you're not yet an Ncontracts customer, but you want to learn more about how we can help you analyze your HMDA, non-HMDA, CRA and Redlining data with compliance software, please click the image below for sample reports: