If you're like many compliance professionals who have to comply with HMDA, you might be still coming to terms with the "new normal" of compliance today. That means changing data collection requirements, enhanced HMDA data analysis, new technologies, and updated processes that are designed to support the HMDA rule.

This post will summarize some of the most frequently asked questions about the Final HMDA Rule!

Let's get started:

1. What is the difference between an LEI and a ULI, and how can I get them?

An LEI is a single identifying number for your institution. LEI stands for Legal Entity Identifier. Your LEI is 20 digits long, and you’ll need to include it in your HMDA submission. You can get an LEI from one of the three companies listed here:

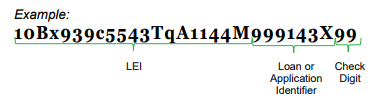

ULI stands for Universal Loan Identifier. A ULI is assigned to a specific loan and incorporates the LEI. This is a number that will follow the application or loan throughout the lending process. Your institution will create your ULIs internally, using this formula:

[20-digit LEI] + [Loan or Application Identifier] + [2-digit Check Digit] = ULI

2. What happens if I make a mistake?

The CFPB has shared a “good faith” provision, because they understand that they know that comply with the HMDA changes are challenging. Here is what they said:

“The Bureau recognizes the significant systems and operational challenges needed to meet the impending requirements under the rule. Accordingly, for HMDA data collected in 2018 and reported in 2019, the Bureau does not intend to require financial institutions to resubmit data unless data errors are material, or to pay penalties with respect to data errors.

Accordingly, collection and submission of the 2018 HMDA data will provide financial institutions an opportunity to focus on identifying any gaps in their implementation of the additional requirements and making improvements in their HMDA compliance management systems for future years. The Bureau expects that any supervisory examinations of 2018 HMDA data will be diagnostic, to help institutions identify compliance weaknesses, and will credit good-faith compliance efforts.”

3. What is a "material" error?

In their good faith provision statement, the CFPB references "material errors." As we researched, we haven't yet found a clear, concise definition, so we reached out to the CFPB for clarification.

That said, the statement references HMDA resubmission, so they may be referencing those requirements...here they are.

4. How does the new HMDA rule impact Community Reinvestment Act compliance?

In an effort to reduce the burden of compliance, the regulators have also released amendments to the Community Reinvestment Act. As we have written previously, these amendments are designed to align CRA requirements more closely with the HMDA requirements. The regulators also believe that these changes will make CRA Performance Evaluations less burdensome.

The most important CRA changes include:

- The term “Home Mortgage Loan” has been redefined.

- The term “Consumer Loan” has been redefined.

- Requirements regarding the content that needs to be in your Public File have changed.

The amendments also remove some now-obsolete cross—references and definitions from the Community Reinvestment Act.

5. I have HMDA data coming from two different loan operating systems (LOS). Am I able to submit these separately?

Unfortunately, you cannot submit multiple LAR files. The CFPB says: "This must be a single file that contains the entire LAR for the filer; the HMDA Platform will not allow users to combine multiple files."