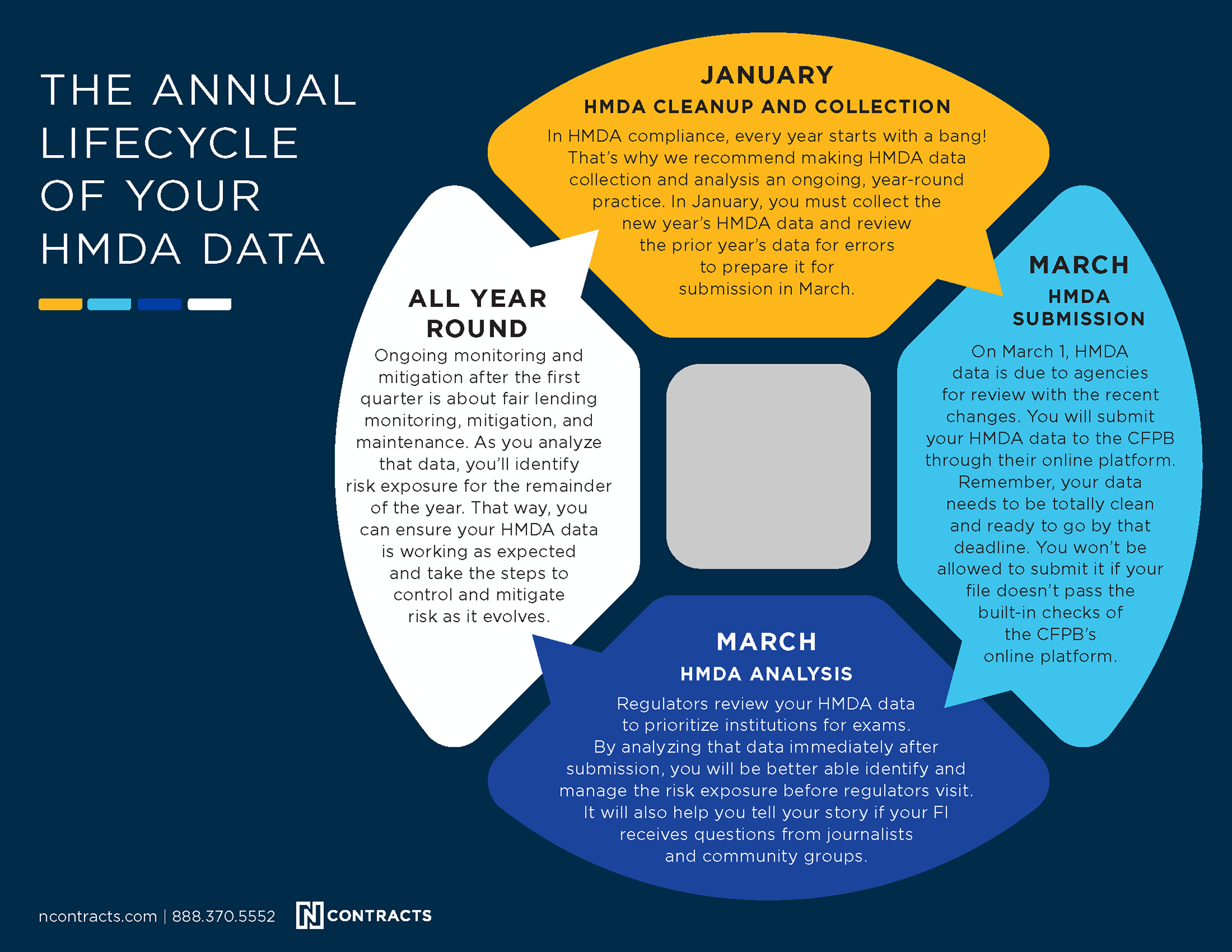

Learn the four phases that all HMDA data goes through in its yearly lifecycle, plus best practice strategies to make each stage a success. Print the HMDA lifecycle infographic and share with your team.

During this time of the year, one area of compliance stands out as a focal point: HMDA. HMDA, or the Home Mortgage Disclosure Act, is one of the key consumer compliance regulations for American financial institutions.

During this time of the year, one area of compliance stands out as a focal point: HMDA. HMDA, or the Home Mortgage Disclosure Act, is one of the key consumer compliance regulations for American financial institutions.

In recent years, this key legislation has undergone immense changes, from what HMDA data is collected to how you submit the final HMDA LAR.

It can be a real challenge for financial institutions to stay up-to-date and on schedule with all of these changes.

In this post, you'll see the basic lifecycle of your HMDA data, which should help you and your team frame and contextualize your HMDA efforts. In addition, you'll learn key strategies and best practices at each stage.

For those new to compliance, this can be a great training resource; however, even readers for whom HMDA is "old hat" will gain insights. Your institution's Board of Directors may benefit from this overview, particularly if the start of the year leaves you feeling overwhelmed with your HMDA responsibilities.

Here is the annual lifecycle of your HMDA data.

Without further ado, here is the annual lifecycle . Below it, you'll find even more detailed descriptions, with best practices and expert strategies. You can get a copy of the infographic just by clicking on it.

Stage 1: HMDA Data Collection and Clean-Up

The first stage of your HMDA data's lifecycle is both the first phase of the new year's HMDA data, and the last phase of the prior year's data.

In January, you begin collecting the new year's HMDA data. Given the changing HMDA reporting thresholds and the updated requirements, you may be collecting more than 40 new fields! Or, the HMDA data you collect may be very similar to years' past. (Mortgage companies are not depository institutions, so they must collect and report on all of the HMDA data fields, regardless of lending volume.)

Last year was the first year for many institutions to collect that extended HMDA Plus data, which surfaced some real challenges. If you're one of those institutions, your process this year may be slightly different to account for required policy and process changes.

At the same time, you will be reviewing the prior years' data for errors to prepare it for submission, sometimes called HMDA transmittal, in March. Getting that data ready for the March 1 deadline is no easy feat. Many, if not most, larger institutions will review that data and prepare it for submission on an ongoing quarterly basis to make it more manageable. Whatever your process, the start of the year can be a stressful time.

During this time, lending compliance professionals are juggling a lot; often, new responsibilities and strategies, enhanced risk management, coordinating training, preparing for the year ahead, and on top of all of that, HMDA data collection and preparation. Prepare accordingly, and don't be afraid to ask for help if you need it.

Related: A Deep Dive into HMDA Data Management

Stage 2: HMDA Data Submission

March 1 is the HMDA LAR submission deadline. This is a critically important date in the lifecycle of your HMDA data. This is the date when your previous year's HMDA lending data is submitted to the federal government for review.

They use this data to evaluate institution-specific and industry-wide disparities, prioritize institutions for Fair Lending exams, identify trends in the market, and prepare it for public release.

They use this data to evaluate institution-specific and industry-wide disparities, prioritize institutions for Fair Lending exams, identify trends in the market, and prepare it for public release.

This means submitting it to the CFPB through their online platform. But remember, your data needs to be perfectly clean and ready for submission by March 1. You won't be allowed to submit it if your file doesn't pass the built-in edit checks of the CFPB's online platform; if it doesn't, you could be looking at a late submission.

Stage 3: HMDA Data Analysis

The best time to analyze your HMDA data is immediately following your Final HMDA LAR submission. You'll know that the data you're reviewing is the exact same data the regulators are seeing.

Here are just a few ways that HMDA data will be used:

- Regulators will review that data for disparities, both at an institution and industry level.

- Regulators will also review the HMDA LAR to prioritize institutions for exams. Naturally, institutions with higher disparities will receive more attention.

- Regulators also prepare the HMDA data for public release. While the HMDA data was traditionally released in the fall, the updated process allowed the CFPB to release the data much earlier last year.

- Community groups and journalists have also expressed a lot of interest in the public HMDA data, using it in articles about Redlining and Fair Lending issues impacting their communities and readers. (Some of that interest has even led to settlements and other financial repercussions.)

In this environment, you need to be able to clearly tell your story to examiners, community groups, journalists, and even potential customers. HMDA analysis lets you do just that.

Remember, disparities do not always mean discrimination, but data analysis is the only way to know for sure!

Stage 4: Ongoing Monitoring & Mitigation

After you've analyzed your HMDA data, you'll identify areas of risk exposure. At this point, HMDA compliance really becomes about Fair Lending monitoring, mitigation, and maintenance. It's important to ensure your HMDA program is working as expected, and take steps to control and mitigate risk as it evolves.

In practical terms, this means ongoing HMDA analysis, risk assessments, training, policy and procedure improvements as necessary, solutions upgrades, and data maintenance.

Best practices recommend conducting a Fair Lending risk assessment annually. Many institutions will rely on the insights from the HMDA data to guide the direction of any reviews and risk assessments, and supplement the risk assessment's findings.

In addition, you'll want to make sure to analyze your data compared to peers and benchmarks, to ensure that you really understand how your performance compares to others in your area.

Finally, remember that Fair Lending and CRA compliance are intertwined. Keep this in mind as you analyze your HMDA and non-HMDA data, and your CRA data, for Redlining and other consumer compliance risks.