Compliance Solutions

Designed by former compliance officers and supported by professionals with extensive industry experience, our compliance solutions were built with your organization’s needs in mind. Our integrated software and services help to ensure comprehensive, continuous exam readiness.

Consolidate your CMS functionality all under one roof

Our tools make it easy to organize and manage findings and documentation from internal to external to regulatory audits and exams.

Ncomply

Empower your compliance team and consolidate your compliance solution functionality under one roof.

Nlending

Easily identify trends in your lending patterns to proactively remediate potential fair lending issues.

Nverify

Streamline the audit process to accurately identify and reduce risk, which saves both time and money.

Nfindings

Automate the complex findings process and gain visibility into exam and audit findings, and address issues right away.

Nvendor

Gain a deeper understanding of your vendors in a configurable solution that fits the needs of your institution.

Ncontinuity

Manage and maintain business continuity before, during, and after a crisis so your institution can not only survive, but thrive.

Support your team with compliance solutions

Strengthen your risk and compliance culture for better exam results—and a stronger, more resilient institution.

Our integrated risk management suite

Ncontracts IRM Suite combines risk, vendor, compliance and findings management solutions to drive efficiency and help your institution make smarter decisions.

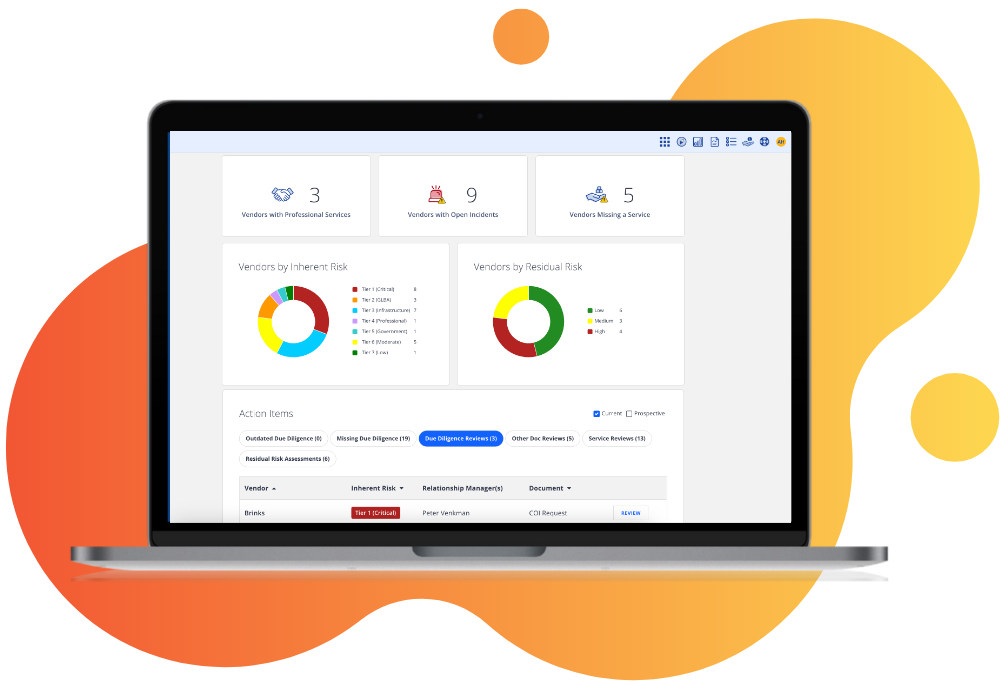

See the big picture of your third-party risk

Decrease risk exposure and increase exam readiness. With our user-friendly, customizable dashboards, your organization can store, track, and manage information throughout the lifecycle of each vendor.

Risk management software, simplified.

Still using fragmented manual processes for risk management? Switch to efficient, user-friendly risk management tools that offer institution-wide access.

.png?width=800&height=800&name=Cyber%20Monitoring%20(1).png)

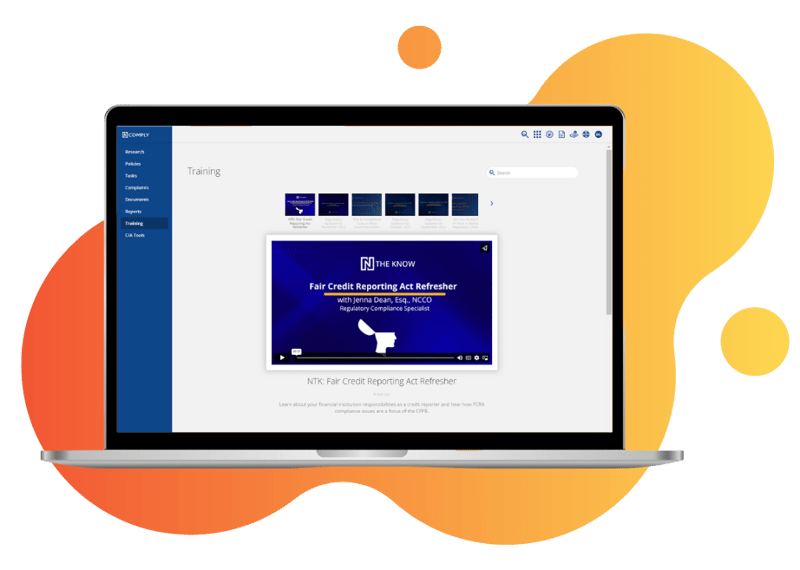

Keep up with all the applicable changes in regulations

Easily track applicable rule or regulation changes, confirm training, track consumer complaints, and assure your team of the adequacy of your compliance solutions.

Learn more about how our IRM software suite and services work together for integrated risk, compliance, and vendor management that allows you to do more with less.

How One Institution Cut its

Compliance Research Time in Half

“Trying to manage it becomes a series of spreadsheets and emails and text messages and hallway meetings, it was a complete and total frustration.”

Despite over 13 years of experience as a compliance professional, Devon Lyon was struggling to manage compliance at Direct Federal Credit Union using manual processes. Read about how Ncontracts turned this situation around.

Dive into the software with a Solution Advisor

Help your financial institution streamline all the aspects of compliance, risk, and vendor management with ease.

Latest articles

Thought leadership to guide you through compliance management

How to Effectively Communicate Policies at Your Financial Institution

Ransomware Risk Management: How to Defend Your FI Against Cyber Attacks