Integrated Risk Management Software

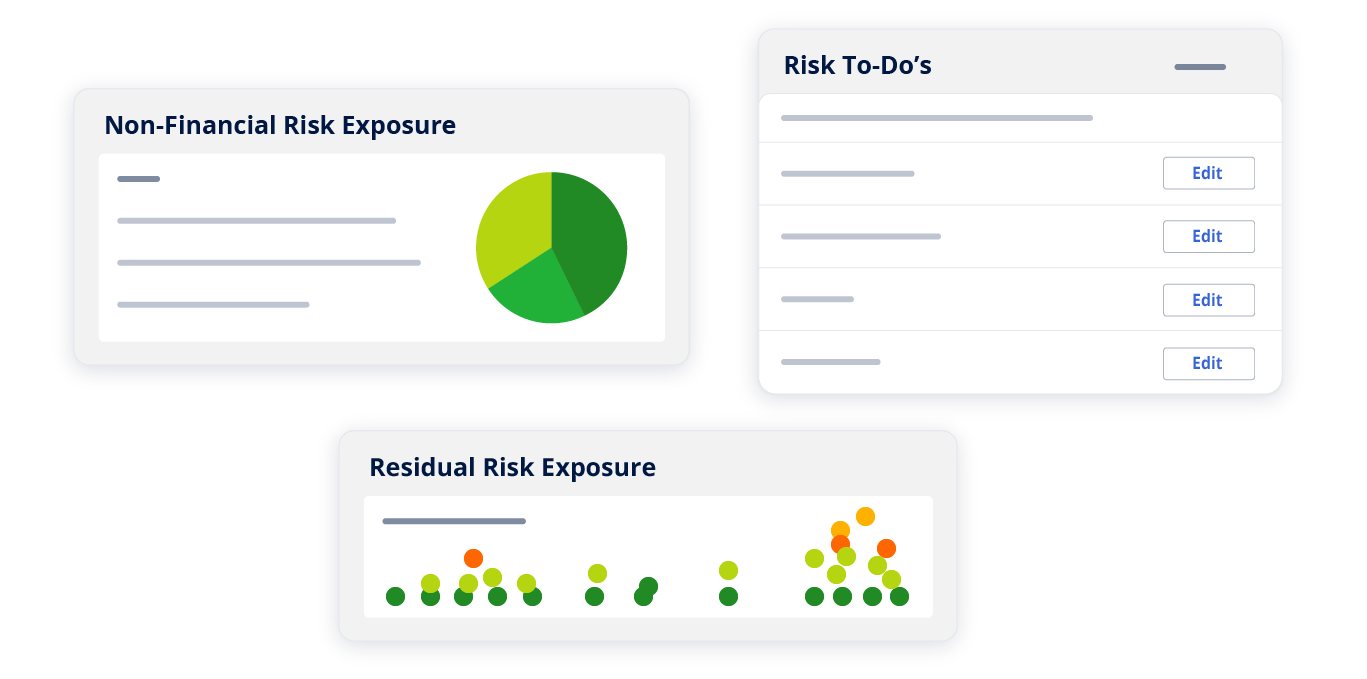

Take full control of your risk and compliance processes with Ncontracts’ integrated risk management (IRM) software. This powerful platform provides program-wide visibility, streamlines governance, and reduces inefficiencies. Harness advanced risk management tools and expert-driven solutions to foster a culture of compliance and risk awareness tailored to your institution's unique needs.

Integrated Risk Management Platform

Ncontracts brings everything under one roof — so you can stop managing risk in silos and start making better decisions with confidence. Our complete suite of integrated risk management solutions work together seamlessly to help you tackle enterprise risk, compliance, audits, vendor management, findings, and more.

Optimize with an Integrated Risk Management System

Ncontracts’ integrated risk management solutions empower financial institutions to simplify complex risk processes, unify teams, and proactively address challenges, ensuring resilience, efficiency, and confidence at every level.

Comprehensive Risk Visibility

Streamlined Decision-Making

Enhanced Collaboration Across Teams

Preparedness and Resilience

Customer Success Stories

"We can’t do the job that we do without the software and the professional services from Ncontracts. Hands down, it would not work."

Senior Vice President of Integrated Risk

$6B Credit Union

"Ncontracts' solutions make my job so much easier. The way Ncontracts' modules work together has been a tremendous benefit."

Christine M. Woodard

VP and Security Officer, Fahey Bank

"Ncontracts helps us to see the bigger risk. Whether it's in Nrisk, Nvendor, or Nfindings, we're able to get the information needed to create a holistic approach."

Beth Seals

Enterprise Risk Manager, Bankers’ Bank of Kansas

"Being able to create all the reporting with the same data across the different modules within the Ncontracts suite makes the whole experience so much easier for me to administer and present to the board and executive leadership team.”

VP of Enterprise Risk Management

CBC Federal Credit Union

Enforcement Action Tracker

Ncontracts' Enforcement Action Tracker is a free solution that keeps you in the know with the recent enforcement actions from the CFPB, FDIC, OCC, Federal Reserve, and other key regulators.

Case Studies

Discover how organizations like yours achieve success with our integrated risk and compliance management solutions. Explore real results, watch customer stories, and discover how we can help today!

Regulatory News & Updates

Join our expert compliance team as they breakdown the latest regulatory changes, news, and enforcement actions. Find out what they mean for your institution!

.webp?width=1200&height=627&name=Bankers%20Bank%20of%20Kansas%20(1).webp)