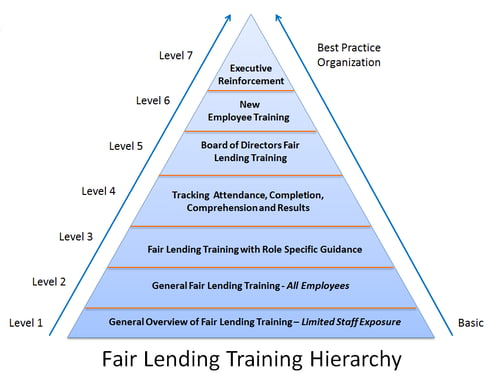

In our compliance consulting, we use a pyramid hierarchy to describe how successful financial institutions execute their fair lending training program. How does your institution compare to these best practices?

In general, compliance training is different from other types of training at financial institutions. For one thing, the stakes are generally higher, because failure to implement compliance policies can result in serious consequences. Given today’s regulatory environment, Fair lending training is a critical component of your compliance management system.

Ncontracts uses a simple Fair Lending Training Hierarchy to explain industry approaches and best practices. Below is a quick synopsis of the training hierarchy levels. We start with the most basic approach and move up to best practices.

Level 1: General Overview of Fair Lending Training Focused on Loan Officers, Underwriters and Operations Staff

We see many financial institutions provide generic fair lending training (i.e. the laws and regulations like ECOA or HMDA, outline of the prohibited basis groups, and the types of discrimination that may occur) to select groups of employees.

Take it to the Next Level: Even though certain key employees (e.g. loan officers) are the main point of contact most customers have with your institution, it is important to recognize that fair lending is about every aspect of the credit transaction (from cradle to grave). Therefore, it is important that everyone in the organization receive fair lending training including marketing, service team members, etc.

Level 2: General Overview of Fair Lending Training – All Employees

Generic training is a great start. However, we find that it is deficient in making the training relevant for specific employees.

Take it to the Next Level: Role-specific training that incorporates your financial institution’s policies, procedures, and expectations is extremely important. Lenders (e.g. I've given similar attention to the customer explaining product options), Underwriters (e.g. understanding what information can and cannot be considered when reviewing an application), Processors (e.g. understand how to administer adverse action notices), and Service Members (e.g. give similar levels of assistance) all must be able to translate the laws and regulations encompassing fair lending to their daily activities based on your specific institution’s policies and procedures.

Level 3: Fair Lending Training with Role Specific Guidance

When designing your fair lending training plan, you should make sure you detail what is permitted in your policies and procedures. If you have outsourced the training to a third party, evaluate the content for relevancy and how they can incorporate your specific policies and procedures.

We find that many “off the shelf” fair lending solutions do a good job of explaining the basics; however, these generic solutions tend to fall short on relating job expectations back to key employees (e.g. loan officer). If your chosen solution cannot be customized, look to complement the basic solution with department specific training guides and programs. Are you prepared to answer the examiner question: “Are all employees trained to understand how fair lending impacts their role? May we interview your employees?” It is especially important to have ample training in those key roles where employee discretion may exist.

Take it to the Next Level: Job aids (e.g. quick reference guides and checklists) that incorporate policies and procedures into the workflow which will help make sure that fair lending Compliance is a team sport and a shared responsibility.

Level 4: Tracking Attendance, Completion, Test Comprehension and Report Results

It is important to track and report compliance training attendance and comprehension. Are you prepared to answer the examiners' questions: “How do you know if everyone attended the training? How do you know if your team members comprehended the materials?”

Take it to the Next Level: It is one thing to track and report on attendance. Best practices hold management and employees accountable for completing the training and demonstrating their knowledge. What are the disciplinary consequences for not completing the fair lending training at your financial institution?

Level 5: Board of Directors Fair Lending Training

The board is responsible for aligning the financial institution’s strategies with the fair lending laws and regulations. The board may be involved with approving policies, reviewing exception reports, understanding complaint logs, reviewing compliance committee minutes and possibly approving large loans. This level of responsibility requires a working knowledge of fair lending laws and regulations and how it impacts their role as a board member.

Take it to the Next Level: Make sure the board minutes demonstrate the board members in attendance, what was covered in training, and any applicable discussion.

Level 6: New Employee Training

A solid fair lending training plan includes a discussion on how to manage new employees. Your institution cannot afford to have a new employee, with their individual systems and beliefs, to operate independent of your financial institution’s fair lending program. Too many organizations inadvertently take on risk by waiting and allowing new employees to be educated by the next “fair lending training wave.” What happens if this next training session does not occur for another 364 days?

Take it to the Next Level: Require managers to review the institution’s fair lending expectations in a 1:1 setting. Consider having new employees sign/acknowledge/attest to your firm’s fair lending statement. Consider requiring new employees to take some form of fair lending training within the first 30 days.

Level 7: Executive Reinforcement

Post-training reinforcement is an imperative component of any effective training program. Some studies imply that participants in training forget half of what is taught within five weeks. In comparison, when managers are used to reinforce training, retention increases by over 50%. Based on our travels and observations, the key to training success is the implementation of creative reinforcement techniques that deepen the learning for participants. Timely refreshers can keep the material front and center. Said in a different way, no matter how great your training program, it will not become an important part of your organization without reinforcement. Is fair lending an annual training event or part of your firm’s fabric?

Take it to the Next Level: Management must be proactive in facilitating the sharing of best practices. Consistently share best practices and success stories, which are important to ensure staff buy-in along with building confidence in the policies and procedures that have been set forth by your financial institution. Another best practice is to syndicate the reinforcement message by using various mediums (e.g. email, newsletters, team meetings, internal posters, homework case studies, etc.) to help make sure the message is heard.

Effective fair lending compliance requires that everyone, from the board to management to the front line, understand and embrace the organization’s approach to being fair and equitable. Financial institutions should regularly review and enhance their fair lending training programs by comparing their current training activities with the best practices associated with the training hierarchy described above.

How does your fair lending program compare to industry best practices?