I recently reviewed Paying More for the American Dream V that summarized mortgage lending in 2009. It was a collaborative effort between seven community based advocacy groups across the country. The report indicates a stark contrast in lending between minority neighborhoods and predominately white communities.

The "Paying More for the American Dream" report highlights lending disparities in minority communities. This report will add fuel to the fire and encourage the Department of Justice and the regulatory agencies to dig deeper into each banks loan data and increase data analysis. Given the authors of the report, it is no surprise that it highlights inequalities in the finance system and the impact on lower-income neighborhoods and high minority communities.

Conventional refinance loans to homeowners in predominantly white neighborhoods increased by an average of 129 percent. The report states loan originations in communities of color decreased by an average of 17 percent. Bank compliance officials know, this disparity will further increase Fair Lending and CRA (Community Reinvestment Act) scrutiny.

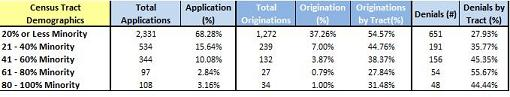

Compliance officers responsible for fair lending compliance should pay specific attention to denial rates in communities of color. Denial rates ranged from 29 percent to 60 percent in minority communities, as compared to 12 percent to 24 percent denial rates in predominantly white neighborhoods.

A number of our clients have experienced this type of review during their recent examinations. The question we get most often is, "so how should we prepare?"

A quick fair lending analysis similar to the following chart should be an excellent start:

As a community bank compliance official, you need to fully understand what your application, denial and fall out rates imply about your lending practices. And understanding what your loan data really says isn't as difficult as you might think...and the vast majority of our clients find it can actually put the bank in a very favorable light.