Enterprise Risk Management Software

Ncontracts’ highly customizable ERM software empowers your financial institution to continuously evaluate, measure, and report on risk in real time. The cloud-based enterprise risk management software simplifies the ERM process – or makes your existing program more efficient. Skillfully govern your risk and control environment with real-time alerts on one centralized dashboard for a 360-degree view of risk.

ERM Program trusted by thousands of financial institutions across the country

.png?width=500&height=105&name=FNCB-Bank-Logo%20(3).png)

Enterprise Risk Management System Features

Your institution’s operational environment is defined by risk. Failing to manage risk – and monitor controls – is an existential threat. Excessive risk avoidance means missed opportunities. Our ERM software is a powerful tool that enables your institution to leverage risk to your strategic advantage.

Leading Risk Assessment Methodology

Harness the power of industry best practices with Ncontracts’ proven risk assessment methodology. Use as-is or customize it to your institution’s needs. Nrisk delivers pinpoint quantitative results that drive efficiency, seamlessly integrating with your institution’s ERM architecture.

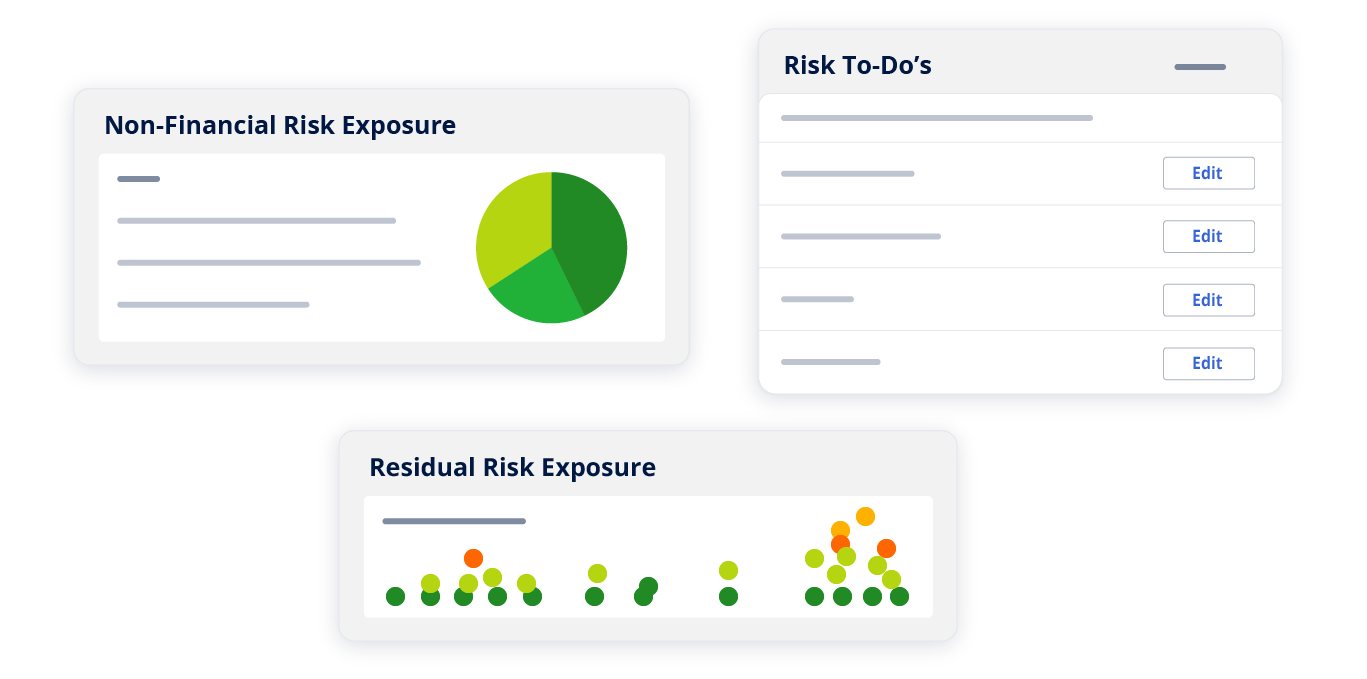

Instant Risk Analysis Tools

Key Risk Indicator (KRI) and Key Performance Indicator (KPI) tracking and dynamic risk heat maps allow for real-time risk monitoring and measuring. Make better business decisions with valuable risk insights that serve as early warnings and success metrics.

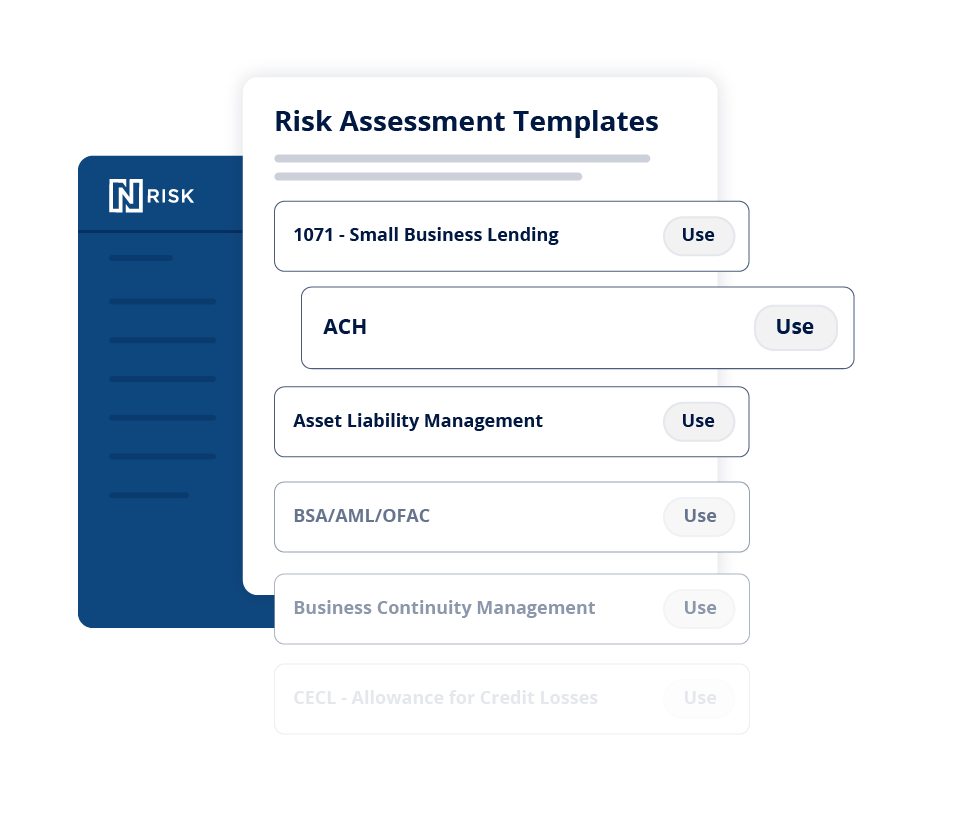

Unparalleled Model Content

Never stare at a blank page wondering where to begin. Ncontracts’ enterprise risk management software contains more than 50 pre-built, configurable model risk assessments and hundreds of risk controls created by our certified compliance and risk experts. Examples include BSA/AML/OFAC, Asset Liability Management, and Information Security/GLBA, plus many others.

Expert Service and Support

Enterprise risk management software from Ncontracts lets your institution weigh risks and address them with confidence. Our team is always here to support you – from full implementation to tailoring Nrisk’s dashboard to your institution’s unique needs.

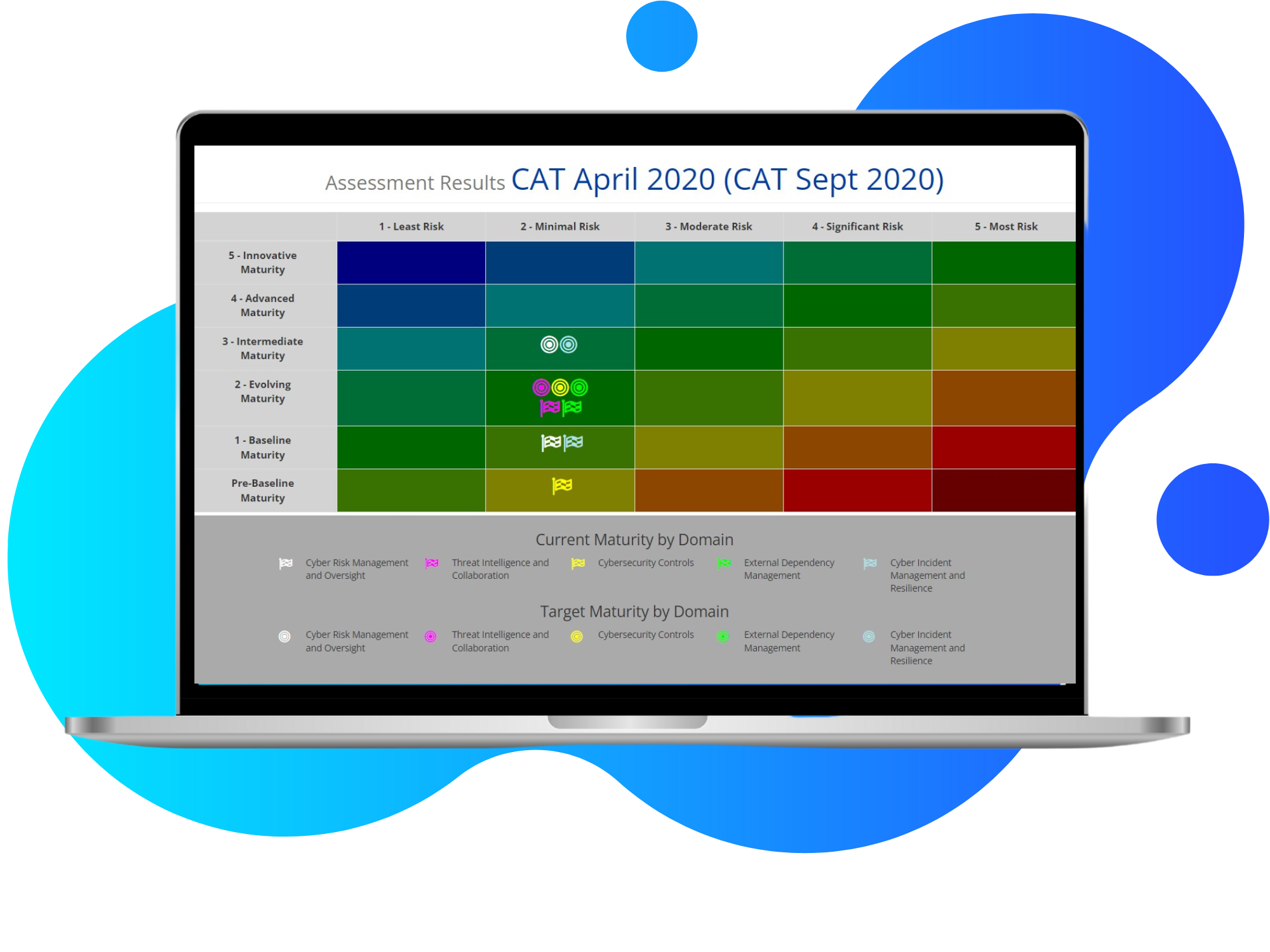

Robust Cybersecurity Assessments

Meet Ncyber, your personal cybersecurity assessment tool from Nrisk. Measure the resilience, maturity, and strength of your cybersecurity defenses, ensuring your institution's digital assets are always secure.

Perform advanced risk modeling to predict the likelihood of an adverse event

Generate comprehensive risk reports in a few keystrokes

Integrate Nrisk seamlessly with other products in the Ncontracts’ suite

Benefit from hands-on training by experts in the field

De-stress exam prep with read-only access for examiners

Maintain a single source of truth for unlimited users

Managed APIs to incorporate data from outside sources

ERM System Built by Experts

Discover the difference with Ncontracts - try the enterprise risk software solution offering real-time insights into risk management programs with advanced heat maps, robust analytics, easy-to-use reports, dashboards, and charts.

Unify Risk Data

Ensure everyone at your institutions speaks the same risk language and relies on the same models and data for an apples-to-apples approach to quantifying risk.

Assess Risk Continuously

Dive deep into Nrisk’s comprehensive risk library and controls and intuitive reporting and dashboards for relevant metrics that lets your team spot, assess, monitor, and evaluate risks collaboratively with real-time risk and control data. Know when to add more controls – or when to take more risk.

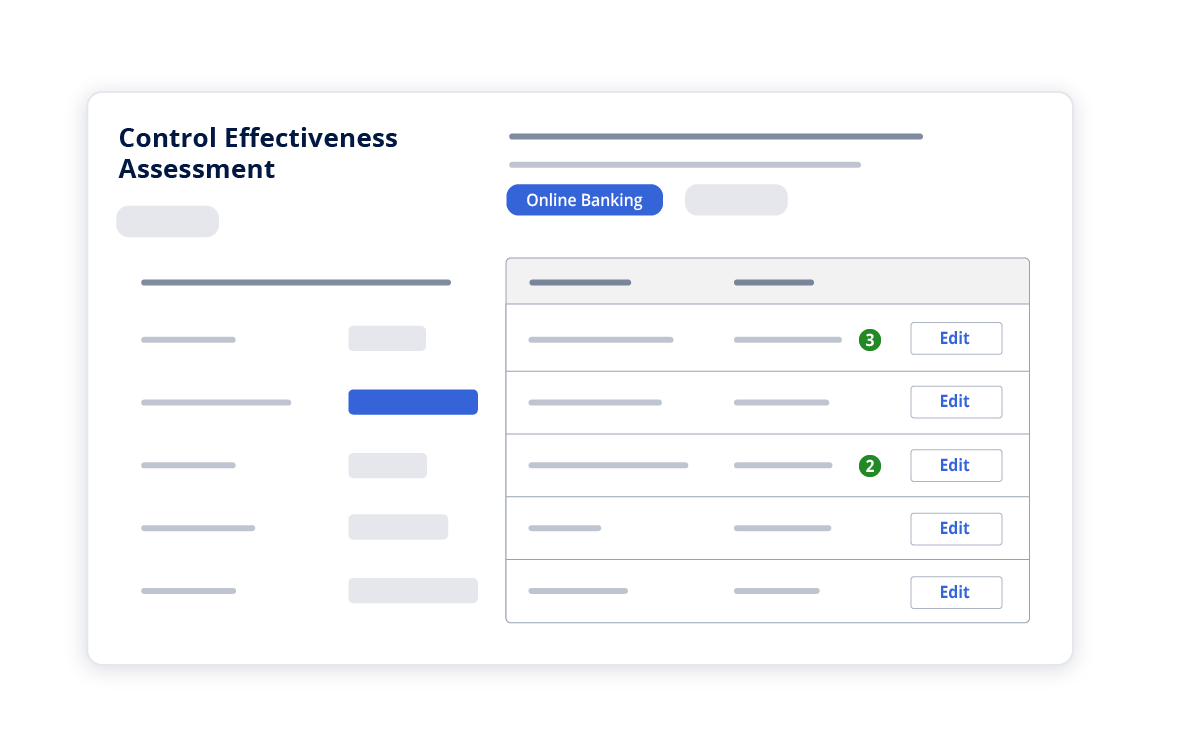

Reduce Regulatory Risk

With customizable risk ratings and reporting, our enterprise risk software provides full visibility into compliance controls giving you confidence at exam time.

Automate Risk Processes

Automating risk management saves time and money, helping your team work more efficiently while more effectively allocating resources to address your most urgent risks with our streamlined ERM system.

Work with Experts Focused on Financial Institutions

Benefit from Knowledge as a Service (KaaS) with a system developed for financial institutions by risk and compliance experts with real-world banking experience. No need to waste time with requirements aimed at other industries.

Understand Risk Holistically

Gain full insight into every risk category. Nrisk integrates seamlessly with other products in the Ncontracts’ suite, serving up a unified and coherent ERM tools.

Customer Success Story

The Fairfield National Bank successfully identifies and mitigates its most pressing compliance risks with our risk management software.

The Enterprise Risk Management Buyer’s Guide

Risks evolve quickly. Disruptive technologies, increased regulatory scrutiny, economic and workforce challenges, and the growing number of products and services make risk management a moving target.

Discover how centralizing and systematizing your risk management processes protects your institution from emerging threats.

%20(1).png?width=800&height=652&name=Copy%20of%20Various%20Clients%20%20Social%20Images%20(7)%20(1).png)

Why Nrisk Outperforms Traditional Risk Assessment Tools

Get a clear, side-by-side look at where traditional models fall short — and how Nrisk closes the gap.

Montecito Bank & Trust Case Study

This bank finds a risk management solution that bends to their needs in Nrisk. See what the Chief Risk Officer says about the Nrisk experience.

Risk Management Resources

Ncontracts compliance and enterprise risk management resources like whitepapers, ebooks, webinars and more.