Internal Audit Management Software

Empower your institution with our advanced auditing solution. Automate and integrate your audit process, ensuring strict compliance and identifying opportunities for optimization. Experience unmatched efficiency in risk reduction, time management, and cost savings with our internal audit management software. A game-changer for financial institutions.

Helping thousands of financial institutions across the country

Software for Internal Audit Management to Improve Productivity and Resource Use

With Nverify, you gain access to premium features and tools like:

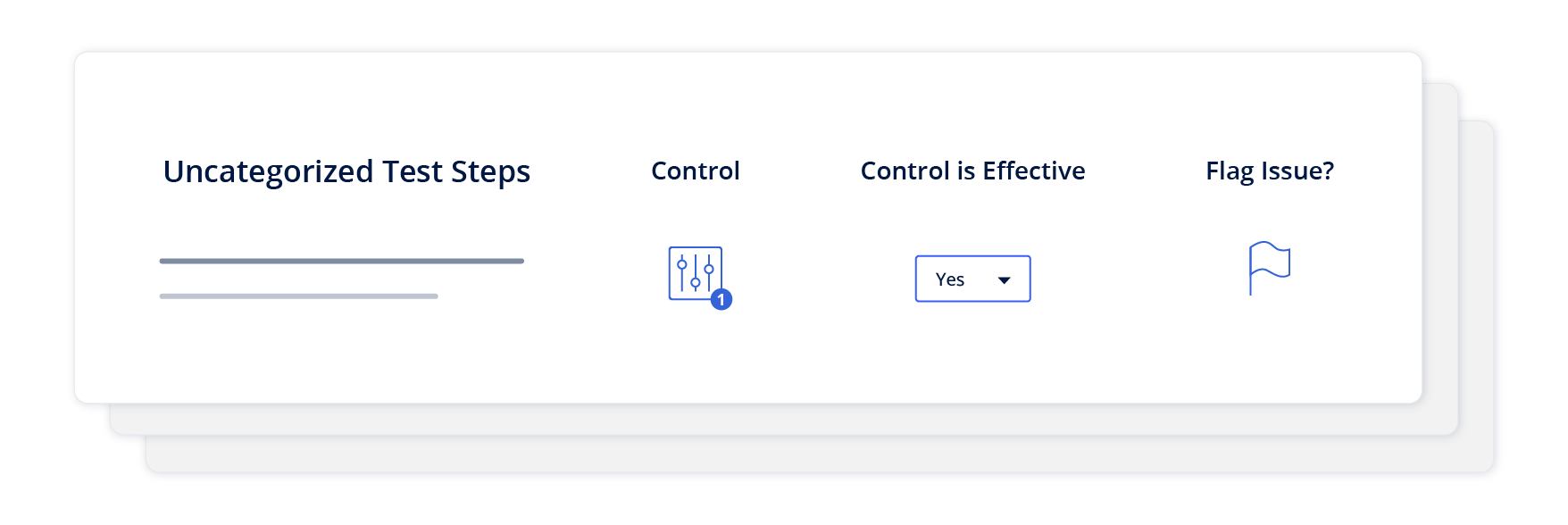

Unleash the Power of Digital Workpapers

Say goodbye to the daunting task of tracking, reviewing, and documenting crucial audit issues. Internal audit management software brings you digital workpapers, designed to convert complexity into simplicity. Organize your thoughts, maintain meticulous records, and streamline your internal audit testing in a breeze.

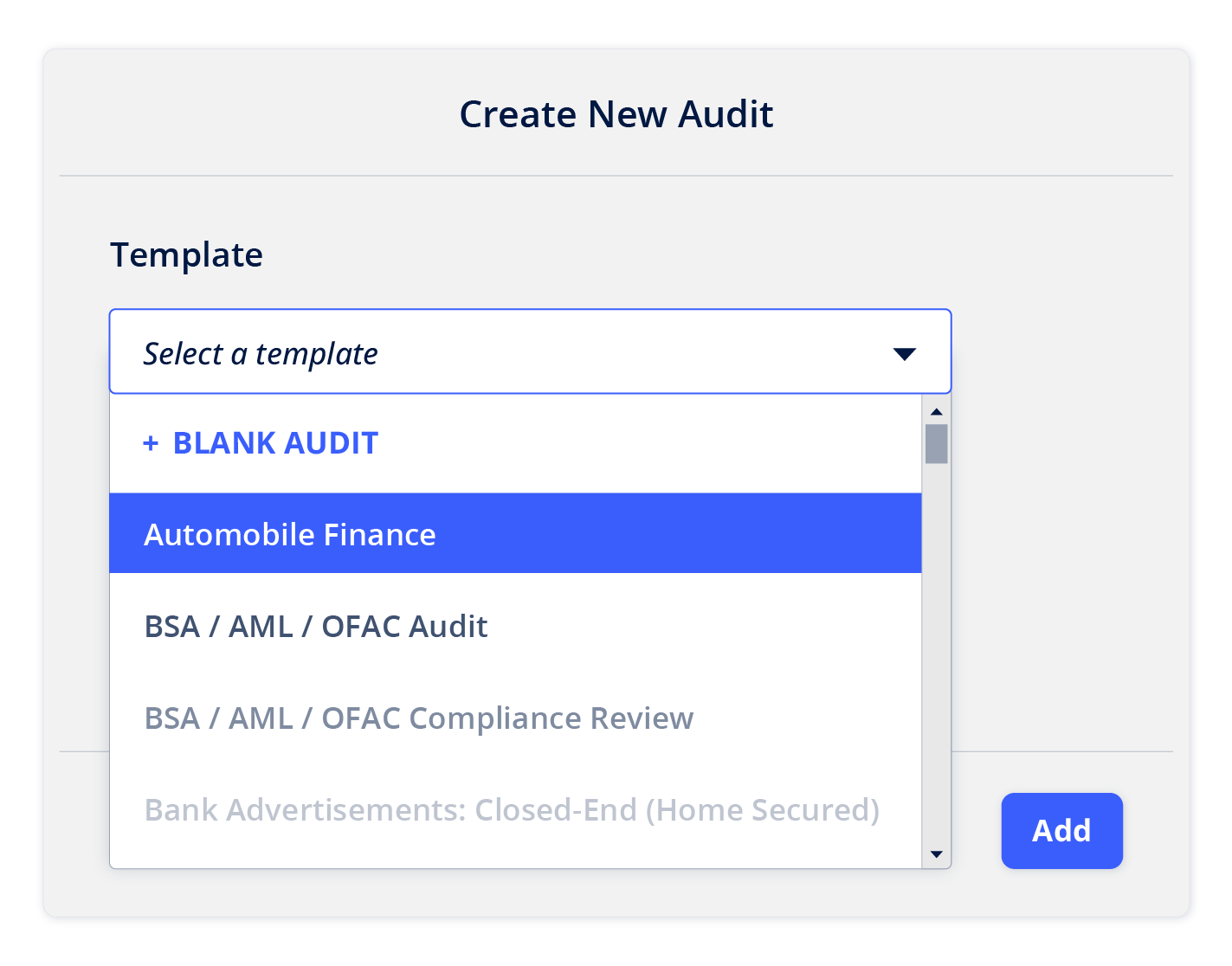

Versatile Audit and Compliance Templates

Configure your way to success with our comprehensive audit compliance software, featuring over 65 audit and compliance review templates. Supported by robust audit tracking solutions, these templates accommodate a variety of scenarios, ensuring you're prepared for audits of any complexity.

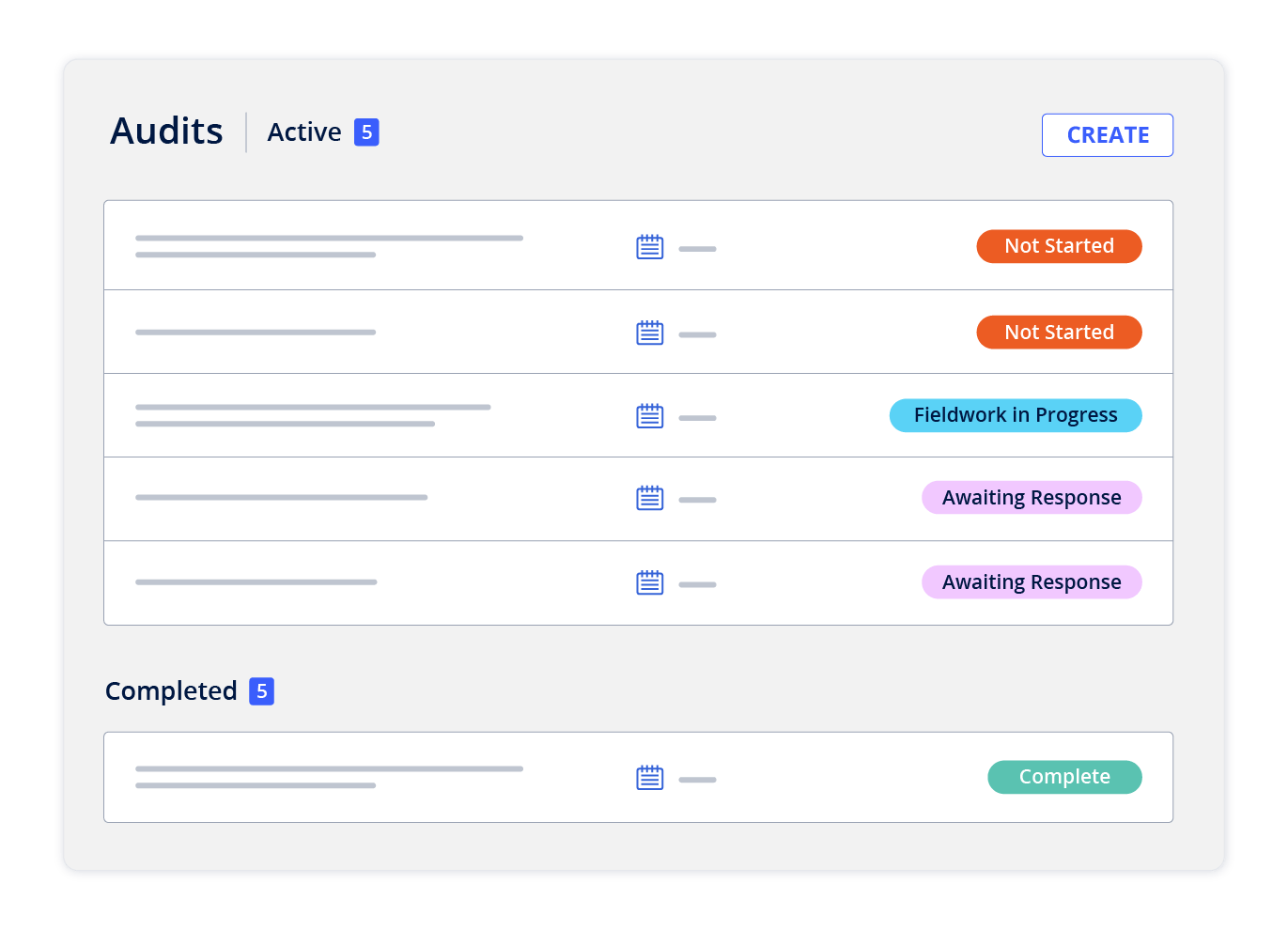

Automated Workflows at Your Fingertips

Propel your audit efficiency with our step-by-step automated workflows. From initial testing to quality review, maintain an eagle's eye over every stage of your audit process. Gain unmatched control and visibility, empowering you to deliver impeccable audit performance.

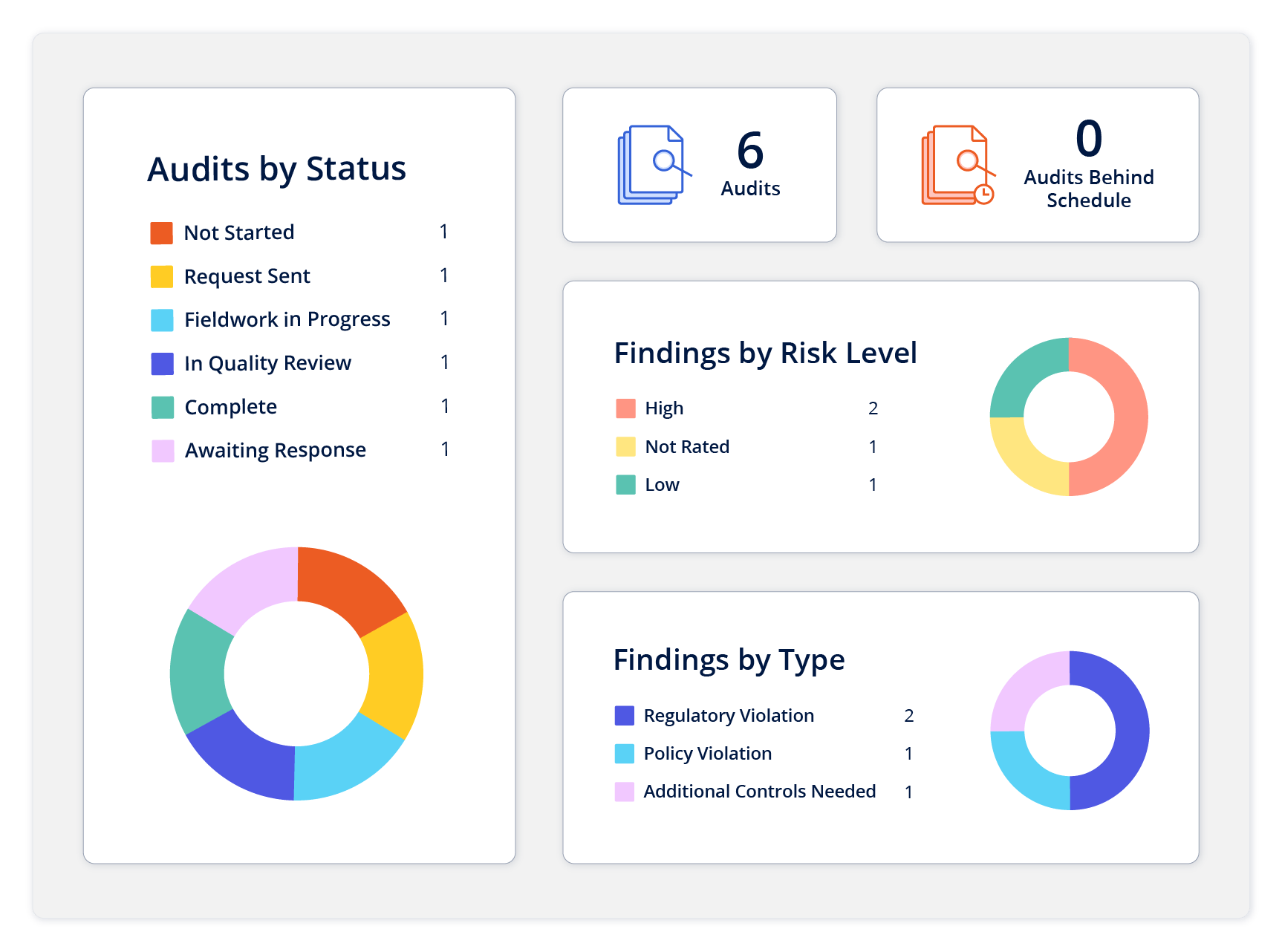

Flexible Reporting on Test Results

Communication is key, and that's why our internal auditing software offers flexible reporting on testing results. Keep your stakeholders informed with clear, concise reports, enhancing trust and facilitating seamless decision making.

Seamless Integration with Nrisk

Robust Connection with Nfindings

Internal Audit Software to Empower Your People

Nverify is a powerful, efficient internal audit solution designed to help your financial institution:

Accelerate Audit Efficiency

Leverage Nverify's cutting-edge, risk-based audit templates to expedite your audit process, optimizing efficiency like never before.

Empower Quality and Transparency

Navigate audit quality reviews with ease and foster unwavering transparency throughout the audit process.

Streamline Operations

Harness the power of our internal audit management software to eliminate operational redundancies, creating a smoother, more efficient auditing process.

Reinforce Your Defences

Maintain crystal clear separations within your lines of defense, fortifying your institution's integrity and resilience with our audit software solution.

Set Your Institution Apart

Elevate your institution and pioneer a new standard in audit processes that distinguishes you from the competition.

Customer Success Story

Country Club Bank finds a vendor management partner to grow with!

With regulatory expectations constantly evolving, this Bank needed a responsive partner to help it keep pace while working with its existing internal processes, approaches, and preferences.

Best Practices for Tracking Audit & Exam Findings

No matter what you call them, findings are the culmination of the audit and exam processes. They uncover risk—exposing deficient policies, procedures, and other controls so that they can be promptly remediated.

.png?width=800&height=655&name=NCO%20EBOOKS%20(3).png)

3 Ways Automation Can Streamline Audit Management Programs

It might be hard for auditors to sit down and focus on the task at hand without something else coming up. Here’s how automation can help.

The Audit Management Software Buyer’s Guide

- Why now is the time to modernize your internal audit program

- What to look for when selecting an audit management system

- Industry-specific, expert advice around audit management software

5 Must-Have Elements of an Effective Audit Program

Is your defense strong enough? Regardless of whether your FI has an internal audit function or uses an audit firm, an audit program needs these key elements.